- United States

- /

- Other Utilities

- /

- NYSE:D

Dominion Energy (NYSE:D) Confirms Quarterly Dividend of US$0.67 Per Share

Reviewed by Simply Wall St

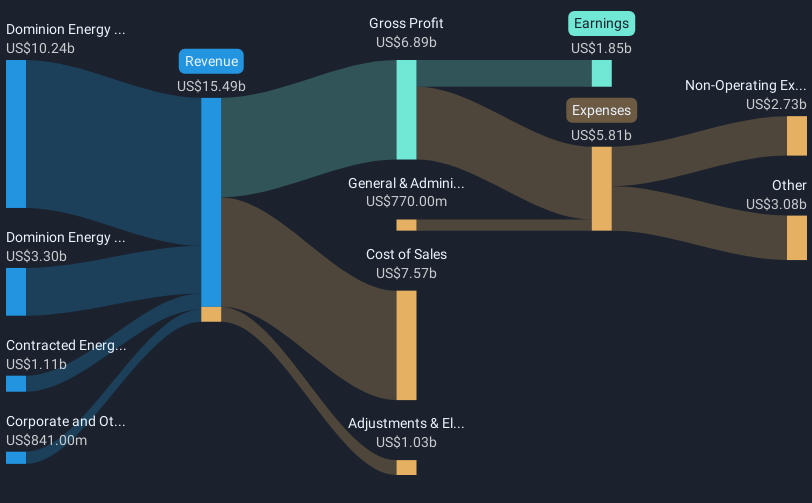

Dominion Energy (NYSE:D) recently affirmed a quarterly dividend of 67 cents per share, payable in June, as well as a positive earnings report with significant increases in both sales and net income compared to the previous year. Additionally, the company confirmed its full-year operating earnings guidance, contributing to investor confidence. These developments come amid a backdrop of robust market activity, notably the Dow Jones and S&P 500 surging following a trade deal between the U.S. and U.K. The alignment of Dominion's strong performance metrics with the market's positive trend likely supported its 9% price climb over the last month.

Dominion Energy has 2 possible red flags we think you should know about.

The recent affirmation of Dominion Energy's quarterly dividend, along with its strong earnings report, could positively influence future sentiment. As the company further progresses on significant projects like the Coastal Virginia Offshore Wind initiative and pursues regulatory enhancements, these developments might solidify its revenue and earnings forecasts. Dominion's proactive strategy, including its creation of a new rate class for high-energy users, positions it well to potentially enhance long-term revenue streams.

Over the last year, Dominion Energy achieved a total return of 10.91%, including share price adjustments and dividends. However, over the past year, its performance fell short compared to the US Integrated Utilities industry, which returned 15.4%. The recent month-long 9% share price climb highlights investor confidence, yet the company's current share price of US$54.68 reflects a 7.5% discount to the analyst consensus price target of US$59.12.

The company's progress in key projects and its strategic initiatives suggest a potential positive impact on future earnings, with analysts forecasting a 9.87% annual earnings growth. Dominion's ability to meet these forecasts could influence its valuation, potentially closing the gap between its current share price and the consensus price target. Investors should stay informed and consider how these developments may sway Dominion's financial trajectory and valuation metrics.

Evaluate Dominion Energy's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives