- United States

- /

- Other Utilities

- /

- NYSE:D

Dominion Energy (NYSE:D) Confirms 2025 Earnings Guidance and Reports Q1 Financial Growth

Reviewed by Simply Wall St

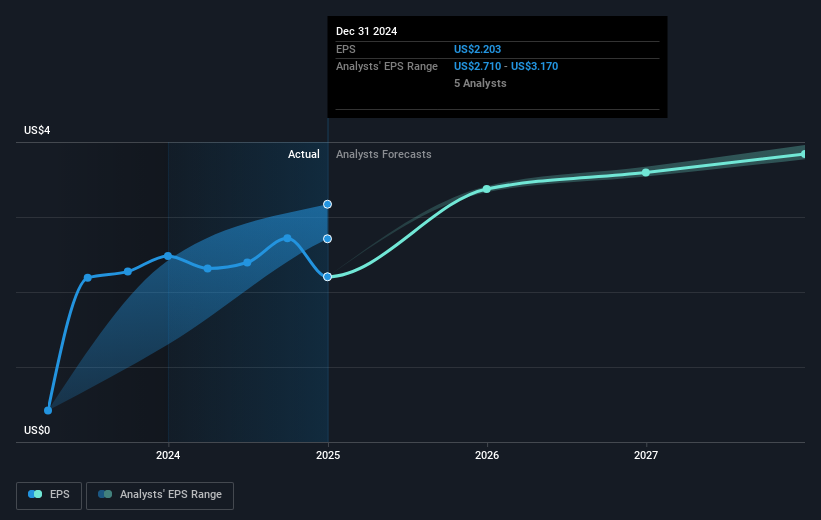

Dominion Energy (NYSE:D) recently announced its first-quarter earnings for 2025, reporting an increase in sales and net income. The company affirmed its operating earnings guidance, maintaining a positive outlook. Over the past week, Dominion's share price experienced a 1.97% increase, a move that parallels the broader market's upward trend. While the company's solid earnings and positive guidance might have provided additional support, the market's overall positive momentum, buoyed by strong performances from major tech companies, likely played a significant role in this gain. The market rose 2.7% in the same timeframe, reflecting a broader positive sentiment.

Every company has risks, and we've spotted 2 risks for Dominion Energy you should know about.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

The recent increase in Dominion Energy's share price aligns with the company's positive earnings report and the broader market trend. This news adds context to the projected 7.3% annual revenue growth and operating earnings growth of 5% to 7% through 2029. These factors, alongside the anticipated benefits from projects like the Coastal Virginia Offshore Wind, may support future earnings and bolster Dominion's capital investment strategy. However, challenges remain, such as regulatory hurdles and increased project costs, which could impact the company's ability to meet these expectations.

Over the past year, the company's total shareholder return, including dividends, was 11.50%. This return is less favorable compared to the US Integrated Utilities industry, which gained 17.8% over the same period, and the broader US market, which returned 9.6%. Despite a 1% increase in stock price last week, Dominion's shares still trade at an 8.03% discount to the consensus analyst price target of US$58.74, reflecting possible undervaluation or varying growth assumptions. Investors should consider how the company's recent developments may influence long-term revenue and earnings forecasts and whether current price levels represent fair value in light of analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives