- United States

- /

- Water Utilities

- /

- NYSE:CWT

California Water Service Group (CWT): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

California Water Service Group (CWT) stock has recently caught some attention, showing an 8% gain over the past month and more than 10% over the past 3 months. Investors might be weighing these moves against the company’s steady revenue and income growth rates.

See our latest analysis for California Water Service Group.

While California Water Service Group’s recent 8% share price return over the past month signals a resurgence in momentum, it is worth noting that the one-year total shareholder return is still slightly negative. The company’s bounce suggests shifting investor sentiment, perhaps reflecting optimism around its steady fundamentals, even as long-term returns have lagged the index.

If you are interested in seeing what else is capturing investor attention lately, now is a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With steady growth and the recent run-up in share price, is California Water Service Group still undervalued? Or are investors already factoring in its future prospects, leaving little room for a bargain purchase?

Most Popular Narrative: 10.7% Undervalued

California Water Service Group’s most popular narrative assigns a fair value of $55.50, which is well above the last closing price of $49.58. This highlights analysts’ belief that current shares may not reflect the company’s future growth trajectory and margin outlook.

Accelerating capital investment in water infrastructure and modernization, driven by increasing water scarcity, climate adaptation needs, and urban population growth, positions Cal Water to expand its regulated rate base by a projected ~12% CAGR. This supports sustained long-term revenue and cash flow growth. Expansion into high-growth areas such as Texas and the development of large-scale reuse projects like Silverwood create a pathway for customer base expansion and incremental capital deployment, which is expected to drive future top-line and earnings growth.

Curious what earnings leaps and margin shifts the narrative relies on? The secret sauce could be bold growth in new markets and steady profit improvement. Want to know what’s driving this target? The real answer is buried in the growth assumptions and how they shape future value.

Result: Fair Value of $55.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including regulatory delays in California and higher costs from evolving water quality standards. These factors could limit expected growth.

Find out about the key risks to this California Water Service Group narrative.

Another View: What Do Earnings Ratios Say?

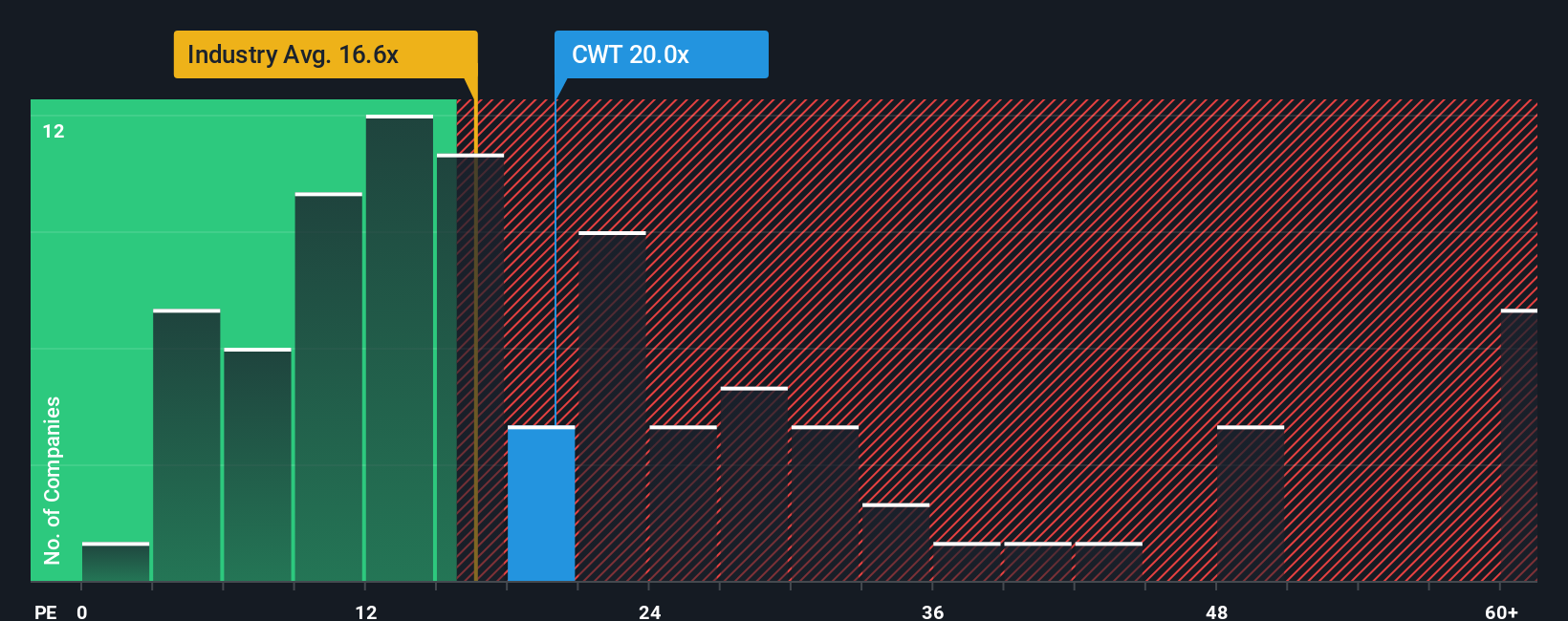

Looking beyond the fair value estimate, the company’s price-to-earnings ratio stands at 21.7x, which is higher than both the global Water Utilities industry average of 16.8x and its direct peer average of 21x. It also sits above the fair ratio of 19.5x, suggesting investors are paying a premium for California Water Service Group compared to peers. Is this premium justified, or does it introduce more downside risk than upside opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own California Water Service Group Narrative

If you think the story looks different from another angle or want to dive deeper into the numbers yourself, you can craft your own narrative in just a few minutes, and get started with Do it your way

A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let exceptional investment opportunities pass you by when the next market favorite could be just one strategic move away. Power up your portfolio and get ahead now.

- Maximize your income potential by tapping into these 17 dividend stocks with yields > 3% offering strong yields for reliable returns.

- Jump into tomorrow’s innovation with these 27 AI penny stocks that are pushing the limits of what AI can accomplish.

- Capitalize on market mispricing by acting early with these 872 undervalued stocks based on cash flows that could offer standout value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWT

California Water Service Group

Through its subsidiaries, provides water utility and other related services in California, Washington, New Mexico, Hawaii, and Texas.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives