- United States

- /

- Renewable Energy

- /

- NYSE:CWEN.A

Should You Reassess Clearway Energy After Its 19% Price Jump in 2025?

Reviewed by Bailey Pemberton

If you own shares of Clearway Energy or are thinking about jumping in, you’re probably wondering what to make of its latest moves. The past week saw the stock pop up 5.0%, and over the last month, it’s added another 4.3%. Year to date, the performance is even stronger, with a 14.3% gain that outpaces many of its peers in the energy sector. Those kinds of returns catch the eye, especially after a solid 2023 that brought Clearway’s one year gain to 11.2%, and its five year total return to a hefty 32.4%. These gains haven’t come out of nowhere, as investors are starting to view renewable-focused utilities like Clearway as less risky and more crucial in a shifting energy landscape.

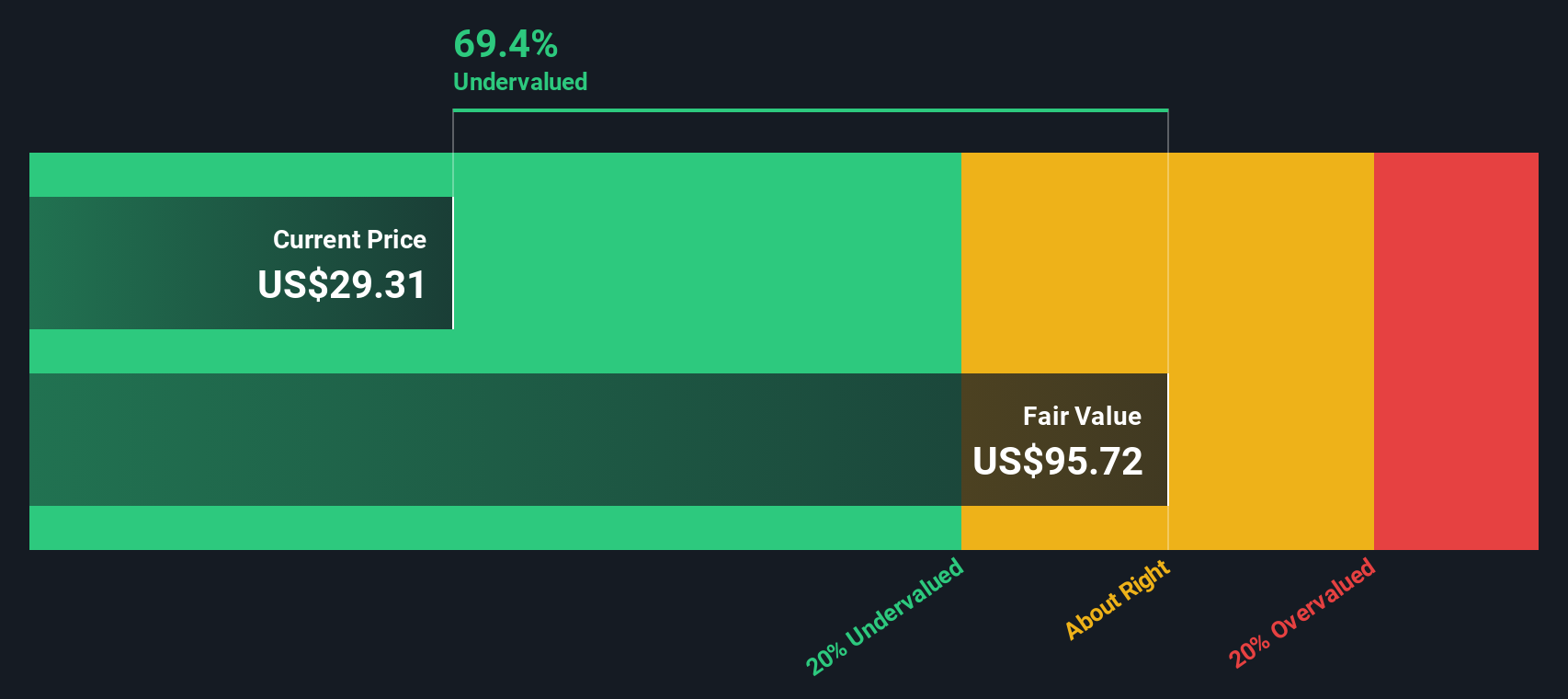

So, does this recent momentum mean it’s time to buy, or should you tread carefully? A quick look at the numbers gives us some clues. Clearway Energy’s value score sits at just 2 out of 6, based on widely used valuation checks. That suggests it only passes two of the six measures we use to spot an undervalued stock. In other words, it’s not screamingly cheap, but there could still be opportunities you might miss at first glance.

To really get a handle on whether Clearway is undervalued, fairly priced, or riding a hype wave, it’s helpful to dig into how it stacks up across various valuation methods. After that, we’ll look at how some investors are thinking about valuation in ways that go beyond just the numbers.

Clearway Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Clearway Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a straightforward method that estimates a company's fair value by projecting future dividend payments and discounting them back to today's dollar value. The idea is simple: if you think of owning a stock as owning a stream of future dividends, you can calculate what that stream is worth now.

For Clearway Energy, the most recent annual dividend per share is $1.92. According to current estimates, the payout ratio stands at a steep 210.64%, meaning the company is distributing more cash to shareholders than it earns, raising questions about dividend sustainability in the long term. Even so, the DDM model applies a modest expected annual dividend growth rate of 0.34%, calculated based on the company's negative return on equity and high payout level.

After running these projections, the DDM model arrives at an estimated intrinsic value of $23.76 per share. With the stock currently trading 19.2% above this value, Clearway Energy appears to be overvalued by this metric. Unless the company can support such generous dividend payouts with lasting cash flow improvements, the current price may be ahead of fundamentals.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Clearway Energy may be overvalued by 19.2%. Find undervalued stocks or create your own screener to find better value opportunities.

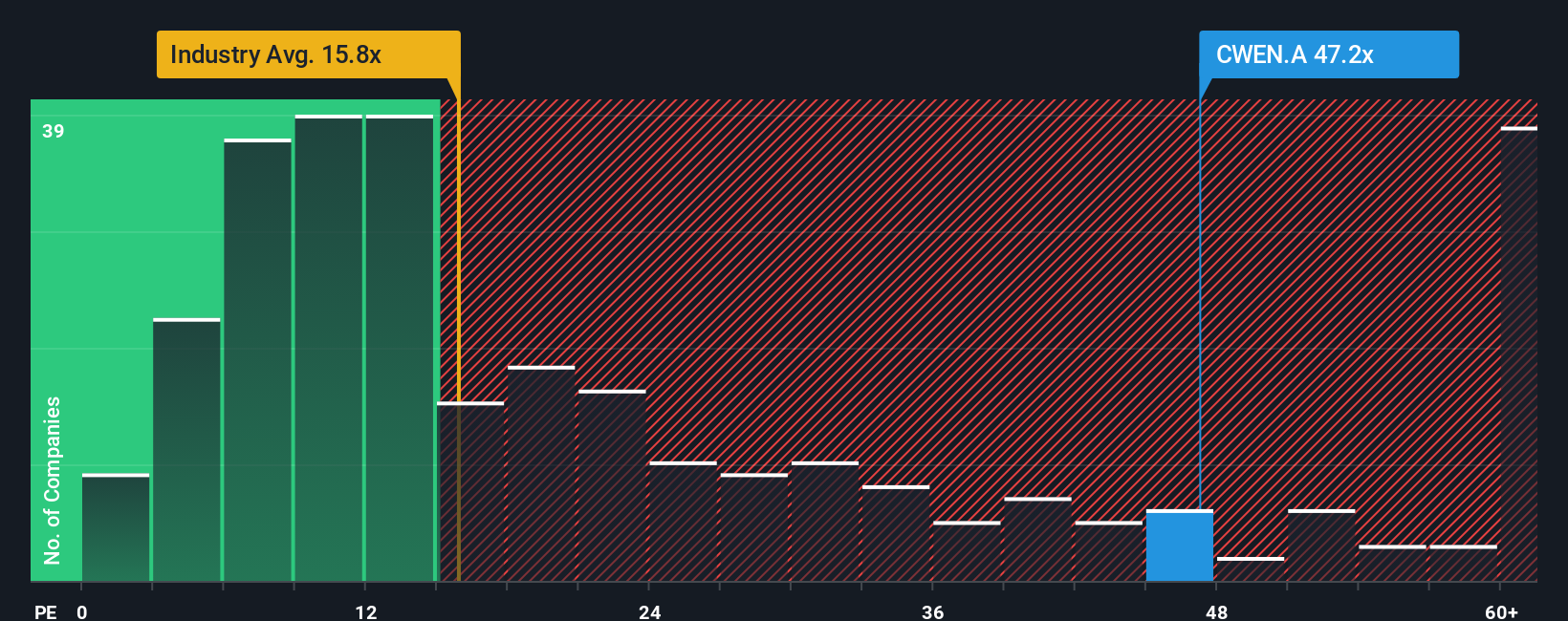

Approach 2: Clearway Energy Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies because it directly ties a company's market price to its earnings power. Investors rely on the PE ratio as a quick snapshot of whether a stock looks expensive or cheap relative to its profits. However, what qualifies as a "fair" PE ratio varies widely depending on expectations for future earnings growth and the risks facing a company. Stocks with higher growth prospects or lower risk tend to justify higher PE ratios, while slower-growth businesses or those facing headwinds typically warrant lower multiples.

Currently, Clearway Energy is trading at a PE ratio of 43.9x. To put this in perspective, the renewable energy industry average sits at just 16.0x, and the average for Clearway’s direct peers is 48.9x. So, the company’s valuation is above the broader sector, but just below the peer group average. While these benchmarks provide context, they don’t account for Clearway’s unique mix of growth, profitability, and risk.

This is where Simply Wall St’s "Fair Ratio" steps in. The Fair Ratio calculates what a company’s PE should be after factoring in not just industry trends and macro forces, but also its specific growth prospects, margins, market size, and risk profile. For Clearway, the Fair Ratio comes in at 30.3x, which is notably below the current PE and both key benchmarks. Because the company’s actual PE is materially higher than its Fair Ratio, it suggests that the stock is trading at a premium to what its fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Clearway Energy Narrative

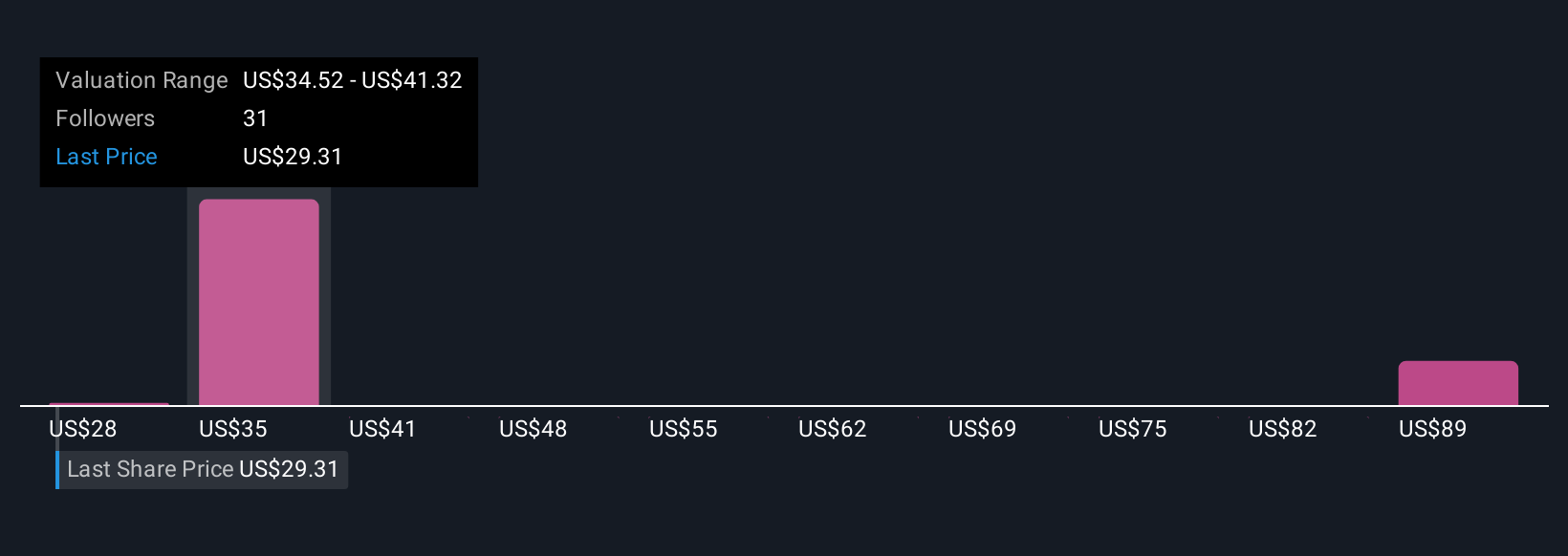

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story about a company. It connects your view of Clearway’s opportunities and risks to your own forecast of future revenue, earnings, and margins, then ties all that to what you think the stock is really worth.

Instead of relying only on static ratios or past numbers, Narratives help you invest with purpose by turning your perspective about where the business is headed into a clear, data-driven fair value. On Simply Wall St’s Community page, millions of investors use Narratives as an easy and accessible tool to organize their thinking, compare fair value to today’s price, and decide if, when, and why to buy or sell. Narratives are not set in stone. Whenever news drops or earnings reports come in, the numbers and fair value in your Narrative update automatically, so you always have a current, personalized outlook.

For example, one investor’s Narrative for Clearway might be optimistic, backing the company’s expansion in renewables and seeing a fair value above $40. Another, more cautious about policy risks and margin pressure, sets fair value closer to $34. Narratives make it easy to bridge the gap between the story you believe and the action you take.

Do you think there's more to the story for Clearway Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWEN.A

Clearway Energy

Operates in the clean energy generation assets business in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives