- United States

- /

- Renewable Energy

- /

- NYSE:CWEN.A

Clearway Energy (CWEN.A): Taking Stock of Its Valuation After a Strong 1-Year Shareholder Return

Reviewed by Simply Wall St

Clearway Energy (CWEN.A) has quietly built a sizable clean power portfolio, and the stock’s recent climb is starting to catch income focused investors’ attention as they weigh its long term growth and payout profile.

See our latest analysis for Clearway Energy.

The stock has cooled off slightly in the past week with a 7 day share price return of negative 5.76 percent. However, that follows a strong 90 day share price return of 17.58 percent and a 1 year total shareholder return of 26.18 percent, which together suggest momentum is still building rather than fading.

If Clearway’s mix of yield and growth appeals to you, this is a good moment to broaden your watchlist and discover fast growing stocks with high insider ownership.

With shares still trading below analyst targets but the valuation already reflecting steady revenue growth, investors now face a key question: Is Clearway Energy a mispriced clean power income play, or is future upside already baked in?

Most Popular Narrative: 13.5% Undervalued

With Clearway Energy’s fair value pinned at $36.90 against a last close of $31.91, the most followed narrative sees meaningful upside still on the table.

The analysts have a consensus price target of $36.111 for Clearway Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $34.0.

What kind of growth story justifies this higher valuation for a regulated utility like business, especially with future margins and earnings doing the heavy lifting? The narrative leans on accelerating revenue, expanding profitability and a richer earnings multiple that looks more like a growth stock playbook than a sleepy yield vehicle. Curious which assumptions really drive that upside gap, and how confident the market is in those numbers?

Result: Fair Value of $36.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk around debt financed growth and shifting power contract economics could quickly erode margin expansion and challenge the implied premium valuation.

Find out about the key risks to this Clearway Energy narrative.

Another View: Ratio Signals Look Less Excited

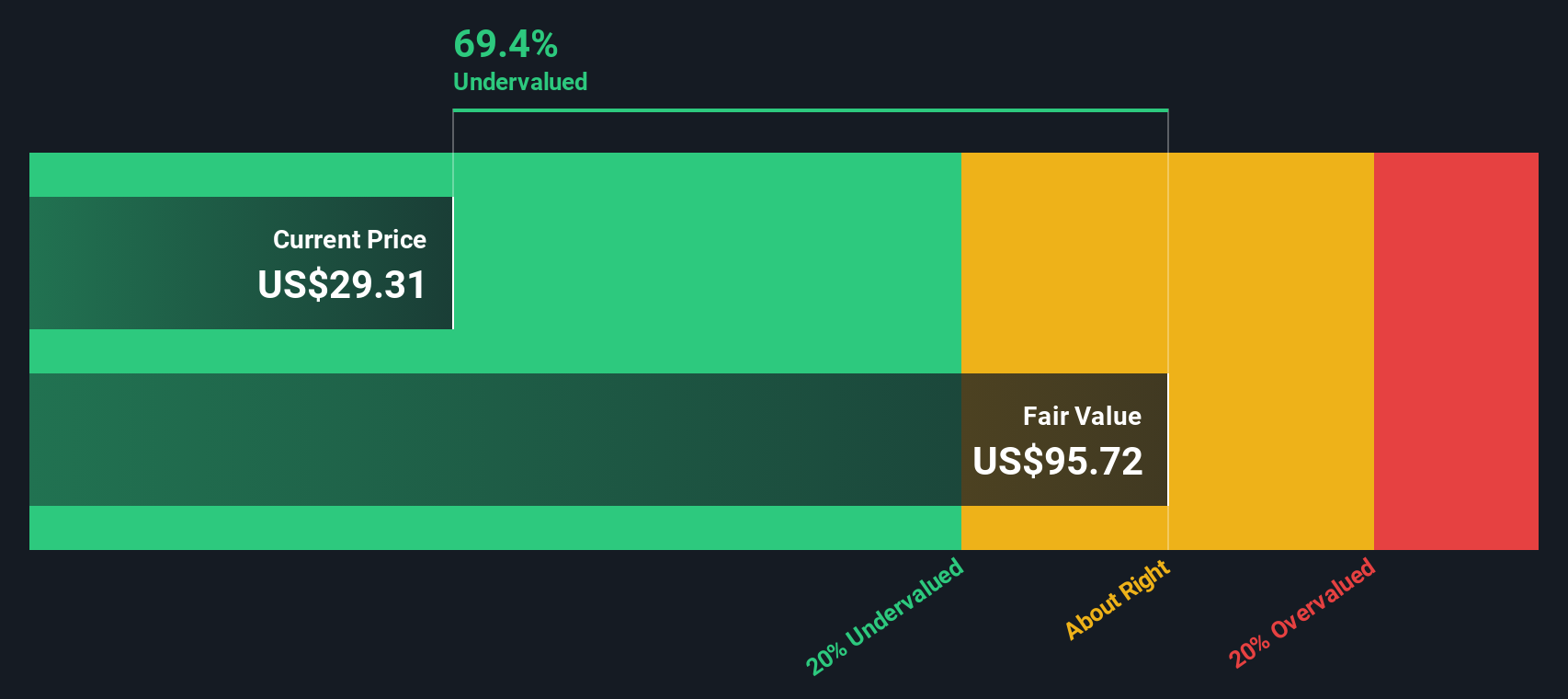

Analysts see upside to $36.90, but our SWS DCF model points the other way, with a fair value of just $14.21. This implies the shares are trading well above intrinsic value and could be overvalued. Which story do you trust when growth wobbles or rates move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Clearway Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Clearway Energy Narrative

If you see the story playing out differently or want to stress test the numbers yourself, you can build a fresh view in minutes using Do it your way.

A great starting point for your Clearway Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before Clearway’s story fully plays out, consider identifying your next opportunities now with targeted screeners that highlight income, growth characteristics and market themes.

- Explore potential sources of cash flow by reviewing these 15 dividend stocks with yields > 3% that may strengthen your portfolio’s income stream while still leaving room for upside.

- Consider positioning for innovation by examining these 27 quantum computing stocks that are involved in computing, security and problem solving.

- Evaluate digital trends by looking at these 81 cryptocurrency and blockchain stocks associated with businesses that use blockchain, payments and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWEN.A

Clearway Energy

Operates in the clean energy generation assets business in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026