- United States

- /

- Renewable Energy

- /

- NYSE:CWEN.A

Clearway Energy (CWEN.A): Is There More Value Left After Recent Share Price Momentum?

Reviewed by Kshitija Bhandaru

Clearway Energy (CWEN.A) shares have nudged higher over the past week, up about 5%, continuing a steady climb since the start of the year. Investors are evaluating what is driving the momentum and where value could emerge next.

See our latest analysis for Clearway Energy.

Clearway Energy’s share price momentum has been picking up, as evidenced by a strong year-to-date return, with the 1-year total shareholder return also positive. This suggests investors are growing more optimistic about the company’s growth prospects and perhaps reassessing its risk profile.

If recent gains have you thinking about what else could be on the move, now is a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trending upward, the key question is whether Clearway Energy remains undervalued at current levels or if recent optimism means the market is already factoring in its growth prospects. This could leave little room for new buyers.

Most Popular Narrative: 21.5% Undervalued

With Clearway Energy’s last close at $28.33 and the most widely followed narrative assigning fair value at $36.11, there is a sizable valuation gap that has caught the market’s attention. The narrative focuses on factors that could fuel continued growth and support further upside.

Clearway's significant pipeline of renewable and battery storage projects, much of which already qualifies for tax credits through 2029, positions the company to benefit directly from increasing demand for decarbonized energy as electrification and clean energy mandates accelerate. This supports sustained revenue and CAFD growth.

Curious what’s powering that bullish outlook? The narrative’s fair value relies on bold growth forecasts, ambitious margin expansion, and future profit levels that rival much larger industry players. Want to see the underlying projections and the assumptions behind that premium price? The details will surprise you.

Result: Fair Value of $36.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as higher financing costs or changes in government incentives. Both of these factors could challenge the bullish outlook for Clearway Energy.

Find out about the key risks to this Clearway Energy narrative.

Another View: What Do the Multiples Say?

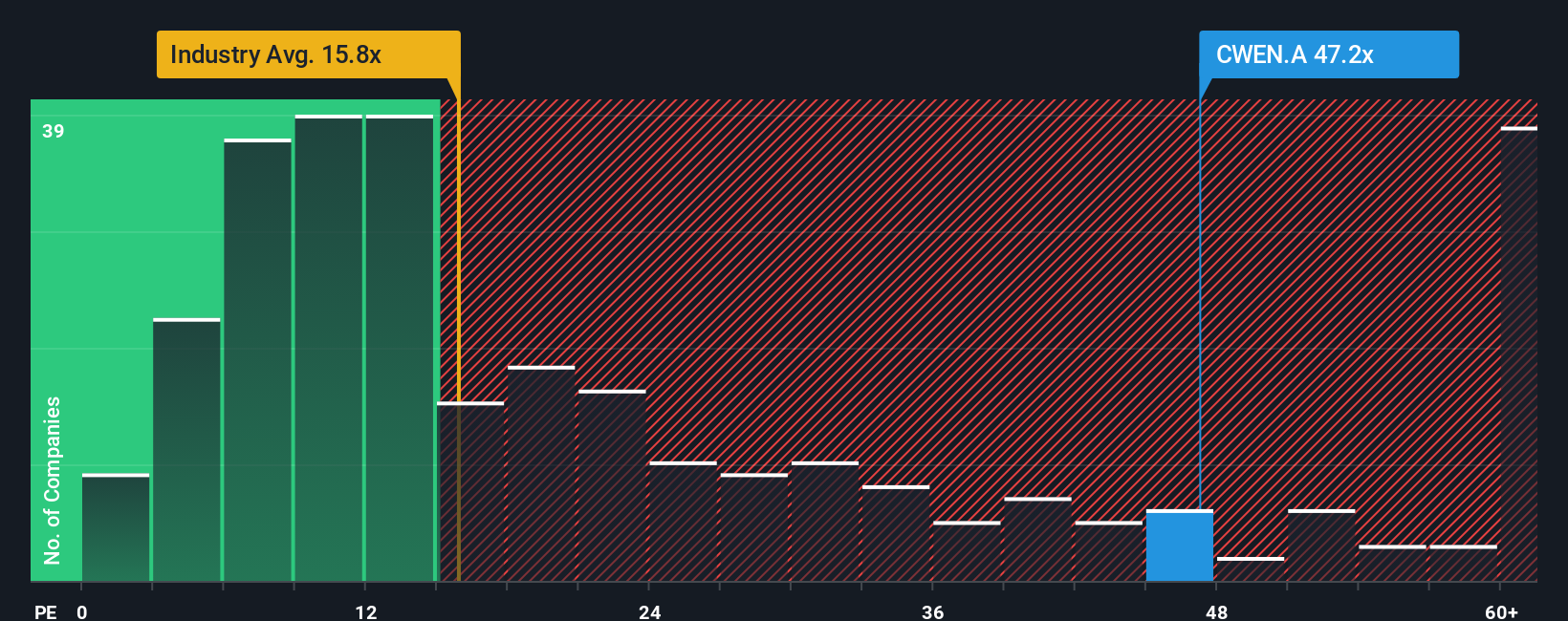

Looking beyond the bullish fair value estimate, the current price-to-earnings ratio stands out at 43.9x. This is significantly higher than the global renewable energy industry’s average of 15.9x, its peer group's 48.9x, and the suggested fair ratio of 30.3x. Such a premium raises key questions. Does this reflect sustainable growth or introduce valuation risk for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clearway Energy Narrative

If you see things differently or want to dig into the data yourself, it’s easy to craft your own view of Clearway Energy in just a few minutes. Do it your way

A great starting point for your Clearway Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let fresh opportunities pass you by. The market is full of potential, and the right screener could unveil the next winner in your portfolio.

- Boost your income stream with high-yield opportunities by checking out these 19 dividend stocks with yields > 3% that consistently deliver impressive returns.

- Capitalize on market mispricings and uncover value by exploring these 910 undervalued stocks based on cash flows based on strong underlying cash flows.

- Ride the momentum in disruptive tech and innovation by finding these 24 AI penny stocks positioned at the heart of the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWEN.A

Clearway Energy

Operates in the clean energy generation assets business in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives