- United States

- /

- Other Utilities

- /

- NYSE:CNP

CenterPoint Energy (CNP) Margin Decline Undercuts Bullish Growth Narrative Despite Premium Valuation

Reviewed by Simply Wall St

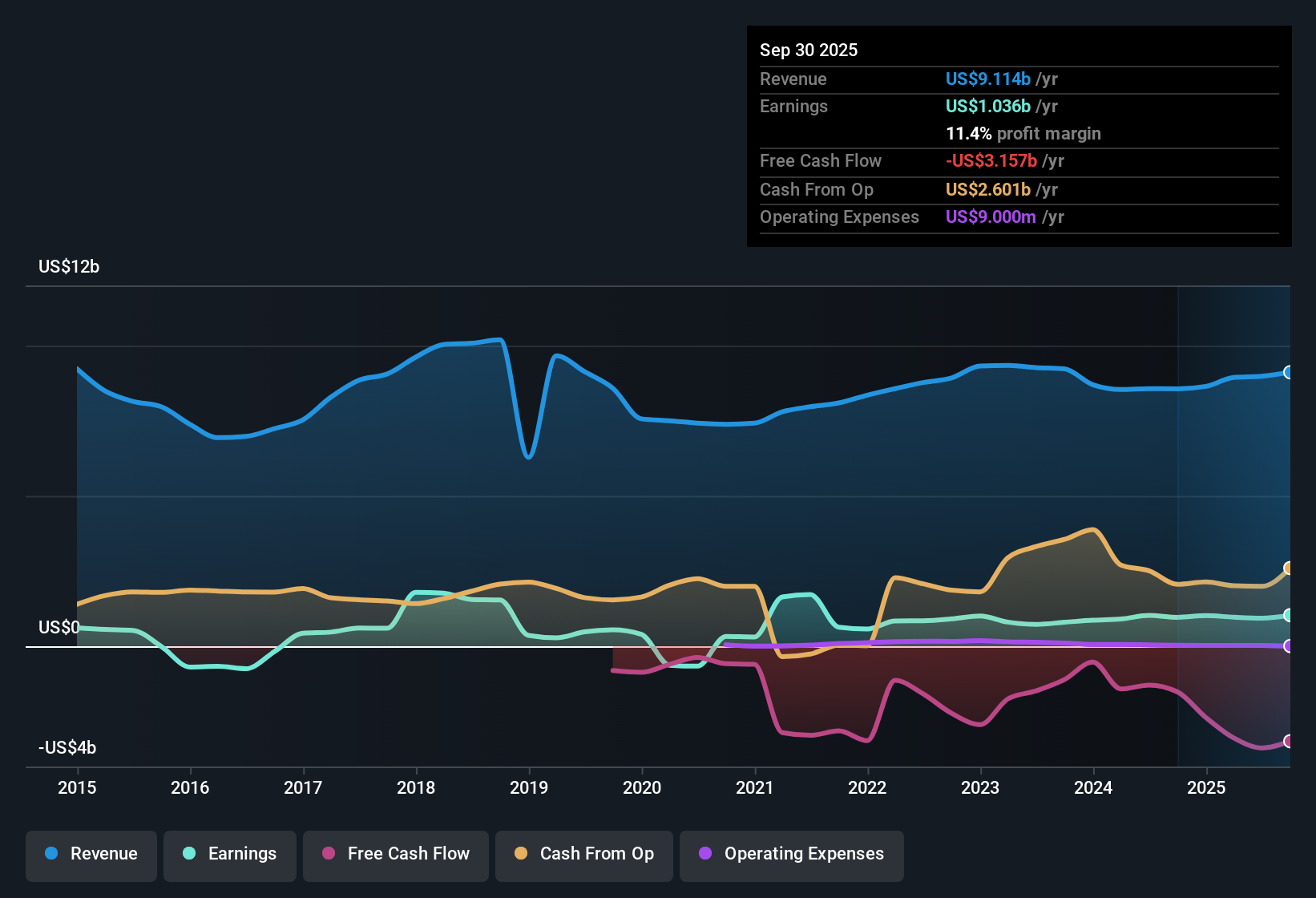

CenterPoint Energy (CNP) is forecasting earnings growth of 12.5% per year, with revenue expected to rise 6.4% annually. Net profit margins have declined to 10.4% from 12% a year ago, and over the last five years, annual earnings growth has averaged 3.4%. While these forecasts point to ongoing profitability, both revenue and earnings growth are tracking below broader US market expectations.

See our full analysis for CenterPoint Energy.Next, we will see how these headline numbers stack up against the market’s narrative for CenterPoint Energy. This will highlight where consensus holds up and where the data starts to challenge established views.

See what the community is saying about CenterPoint Energy

Profit Margin Expansion Forecast

- Analysts project that profit margins could rise from 10.4% now to 14.4% within three years, pointing to meaningful earnings leverage if operational improvements and regulatory outcomes hold steady.

- Analysts' consensus view highlights that greater grid automation and the $1 billion boost to capital investment are expected to help drive efficiency, supporting the push for higher net margins and smoother earnings.

- Forecasts are anchored in regulatory stability, with 80% of the rate base expected to be stabilized through 2029.

- This margin expansion is seen as achievable if recent cost-control and infrastructure investments deliver but will require solid execution to overcome historical profit declines.

Consensus sees recent progress, but whether margin gains materialize depends on executing operational upgrades and navigating regulatory hurdles. 📈 Read the full CenterPoint Energy Consensus Narrative. 📊 Read the full CenterPoint Energy Consensus Narrative.

Premium Valuation Signals High Expectations

- With shares trading at a Price-To-Earnings ratio of 27.6x, CenterPoint Energy stands above the global integrated utilities average of 18.5x and peer average of 22.7x, indicating investors are betting on sustained growth beyond sector norms.

- Analysts' consensus view notes that to justify the current share price of $39.60 with a consensus price target of 42.21, CenterPoint will need to accelerate profit growth and ultimately trade at a still-elevated future PE of 21.3x. This challenges the idea that today’s premium is entirely supported by near-term fundamentals.

- This leaves little margin for error if earnings stall or capital investments run over budget, as the market already prices in much of the anticipated upside.

- Comparing to the DCF fair value of $26.40, shares currently trade at a significant premium, raising questions about whether higher growth and margin forecasts will be fully realized.

Debt Growth and Dividend Sustainability Concerns

- CenterPoint has added about $3.4 billion in net new debt since early last year, amplifying the financial risks cited in regulatory filings and raising concerns over whether current dividend levels can be maintained if profit expansion falters.

- Analysts' consensus view points out that while new capital is earmarked for future infrastructure upgrades, critics highlight that rising interest costs and asset sales at book loss put direct pressure on both cash flow and dividend security.

- The sale of Louisiana and Mississippi Gas LDCs at a book loss underlines challenges in monetizing assets without eroding value.

- Investors are watching closely to see whether CenterPoint’s planned upgrades deliver enough bottom-line growth to absorb these added costs and stabilize payouts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CenterPoint Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own outlook on these results? Share your unique take and build a fresh narrative in just a few minutes with Do it your way.

A great starting point for your CenterPoint Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

CenterPoint Energy’s high debt load and premium valuation raise questions about the company’s ability to sustain dividends and withstand financial pressures.

Prefer sturdier finances? Use our solid balance sheet and fundamentals stocks screener (1984 results) to discover companies with stronger balance sheets and healthier liquidity, designed to weather tough conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Questionable track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives