- United States

- /

- Other Utilities

- /

- NYSE:CNP

A Fresh Look at CenterPoint Energy (CNP) Valuation as Shares Extend Upward Momentum

Reviewed by Simply Wall St

See our latest analysis for CenterPoint Energy.

Building on this steady momentum, CenterPoint Energy’s share price return of 25.69% year-to-date signals growing optimism among investors. This comes after a long stretch of modest gains. That growth is even clearer when you look at the 1-year total shareholder return of 35.35%. This shows that recent price appreciation is part of a much stronger long-term performance story.

If you’re looking to discover what else is on the move in the broader market, now is a great time to broaden your search and check out fast growing stocks with high insider ownership

But with shares climbing and market optimism running high, the key question is whether CenterPoint Energy remains undervalued at current levels or if the market is already pricing in future growth and leaving little room for upside.

Most Popular Narrative: 6.8% Undervalued

According to the most followed narrative, CenterPoint Energy’s fair value estimate stands above the last close, suggesting expectations are still optimistic. The stock price is now just a step behind the narrative’s projected future, setting the stage for a debate about whether this optimism is grounded in reality.

The company announced a $1 billion increase to its capital investment plan through 2030, driven by significant load growth in the Houston Electric service territory. This is expected to bolster capital expenditures and, consequently, long-term revenue and earnings.

Wondering which forecasts power this valuation? The narrative hinges on some bold top-line and profit margin assumptions paired with a forward-looking profit multiple that is rarely seen in this sector. Think you know what is driving the optimism? Read on for the numbers that might change your perspective.

Result: Fair Value of $42.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory delays or rising debt costs could quickly shift sentiment. This may limit the upside for CenterPoint Energy if market conditions change.

Find out about the key risks to this CenterPoint Energy narrative.

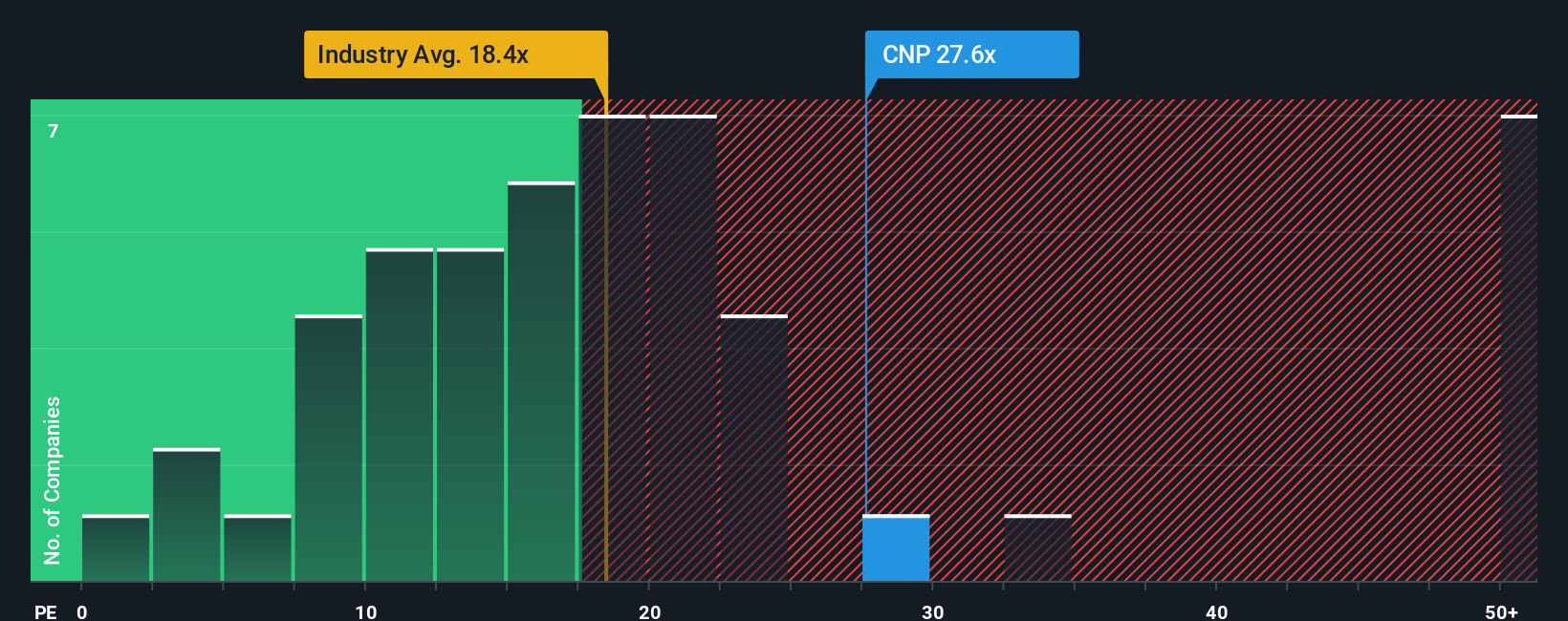

Another View: Multiples Tell a Different Story

While narrative-based valuations suggest CenterPoint Energy is undervalued, a closer look at its price-to-earnings ratio paints a more expensive picture. The current P/E stands at 24.9x, above both the industry average of 18.2x and peer average of 21.5x. It is also higher than the fair ratio of 22.6x. This gap implies investors are paying a premium, and the risk is that expectations for future growth may already be fully reflected in today’s price. So, which story will prove right for shareholders as the year unfolds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CenterPoint Energy Narrative

If you see the numbers differently or want a fresh perspective, you can build your own narrative from scratch in just a few minutes, Do it your way.

A great starting point for your CenterPoint Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let other exciting opportunities slip past you. Make smarter moves and energize your research by tapping into these one-of-a-kind investment screens:

- Accelerate your hunt for steady income by scanning these 15 dividend stocks with yields > 3%, which offers reliable yields above 3%.

- Unearth transformative companies shaping healthcare’s future by checking out these 31 healthcare AI stocks, a screener that blends medical innovation with artificial intelligence breakthroughs.

- Capitalize on the world’s blockchain momentum and uncover unique growth stories in these 82 cryptocurrency and blockchain stocks, where digital finance and secure transactions are being reshaped.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives