Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Black Hills Corporation (NYSE:BKH) share price is 37% higher than it was a year ago, much better than the market return of around 7.6% (not including dividends) in the same period. So that should have shareholders smiling. The longer term returns have not been as good, with the stock price only 24% higher than it was three years ago.

See our latest analysis for Black Hills

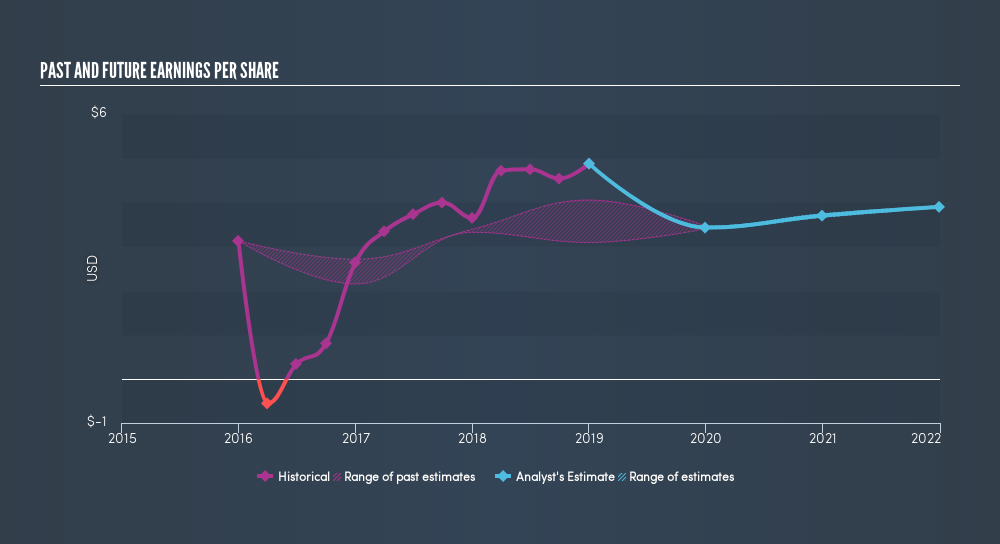

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Black Hills grew its earnings per share (EPS) by 34%. This EPS growth is reasonably close to the 37% increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. It looks like the share price is responding to the EPS.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Black Hills's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Black Hills the TSR over the last year was 42%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Black Hills shareholders have received a total shareholder return of 42% over the last year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 7.9%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Black Hills in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives