- United States

- /

- Other Utilities

- /

- NYSE:BKH

Black Hills Corporation (NYSE:BKH): Are Analysts’ Forecast Signalling Trouble Ahead?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

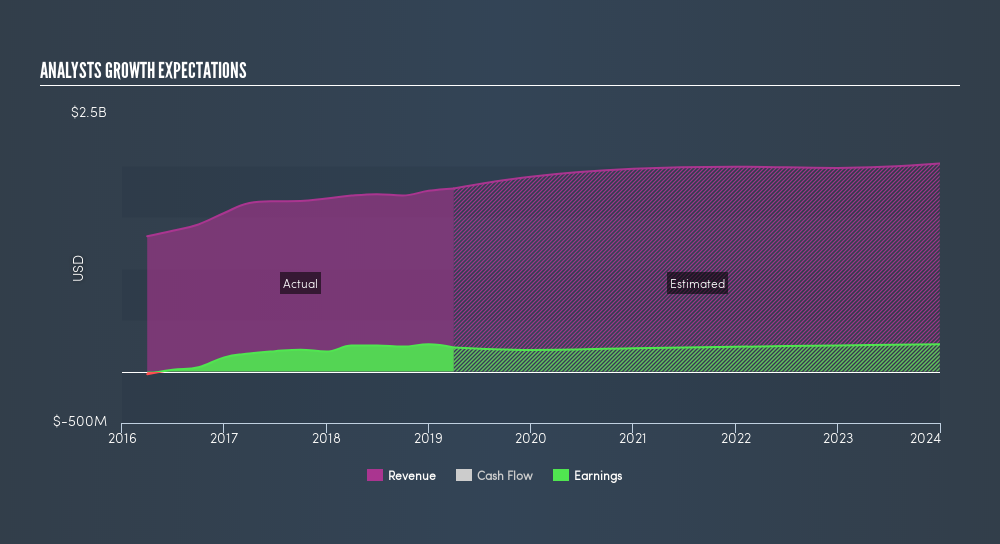

Looking at Black Hills Corporation's (NYSE:BKH) recent earnings update on 31 March 2019, analyst forecasts seem bearish, with earnings expected to decline by 8.7% in the upcoming year against the past 5-year average growth rate of 26%. With trailing-twelve-month net income at current levels of US$265m, the consensus growth rate suggests that earnings will decline to US$242m by 2020. In this article, I've outline a few earnings growth rates to give you a sense of the market sentiment for Black Hills in the longer term. Readers that are interested in understanding the company beyond these figures should research its fundamentals here.

See our latest analysis for Black Hills

Exciting times ahead?

The view from 5 analysts over the next three years is one of positive sentiment. Given that it becomes hard to forecast far into the future, broker analysts tend to project ahead roughly three years. To reduce the year-on-year volatility of analyst earnings forecast, I've inserted a line of best fit through the expected earnings figures to determine the annual growth rate from the slope of the line.

From the current net income level of US$265m and the final forecast of US$276m by 2022, the annual rate of growth for BKH’s earnings is 4.9%. However, if we exclude extraordinary items from net income, we see that earnings is projected to fall over time, resulting in an EPS of $3.91 in the final year of forecast compared to the current $4.88 EPS today. However, the expansion of the current 15% margin is not expected to be sustained, as it begins to contract to 14% by the end of 2022.

Next Steps:

Future outlook is only one aspect when you're building an investment case for a stock. For Black Hills, I've put together three fundamental factors you should look at:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is Black Hills worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Black Hills is currently mispriced by the market.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Black Hills? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives