- United States

- /

- Other Utilities

- /

- NYSE:BKH

Black Hills (BKH): Assessing Valuation Following $449.7 Million Senior Notes Offering

Reviewed by Kshitija Bhandaru

Black Hills (NYSE:BKH) just wrapped up a $449.7 million fixed-income offering by issuing senior unsecured notes. This new funding move is a key development for investors, particularly in light of the company's ongoing growth plans.

See our latest analysis for Black Hills.

Black Hills’ recent $449.7 million bond offering arrives as the stock’s 1-year total shareholder return stands at just over 4%, reflecting steady progress rather than explosive momentum. While the latest share price hovers around $59.76, recent moves like this financing highlight the company’s ongoing push to invest in its growth platform and reinforce longer-term confidence.

If you’re curious which other companies are capitalizing on growth and insider conviction, now is the perfect time to discover fast growing stocks with high insider ownership

With earnings and revenue trending higher and the stock still trading below analyst price targets, the question now is whether Black Hills can deliver future upside for new investors or if the market already reflects its growth story.

Most Popular Narrative: 12.8% Undervalued

The most commonly referenced narrative points to a fair value of $68.50 per share, compared to Black Hills' last close at $59.76. This gap is shaped by analyst expectations for robust growth ahead, even as present earnings multiples trail sector norms.

Large-scale capital investments, such as the Ready Wyoming transmission expansion, Lange II natural gas generation, and Colorado Clean Energy Plan renewables projects, are expected to materially expand Black Hills' regulated rate base. These developments may enable predictable, above-sector-average long-term earnings and net margins through constructive rate recovery mechanisms and innovative tariffs.

Want to know what’s fueling this higher valuation? The most closely watched projection involves a major shift in future growth rates and margins, uncommon for a utility of this size. The model also assumes a premium-worthy earnings multiple. Find out exactly which growth levers push Black Hills toward this bold target in the full narrative.

Result: Fair Value of $68.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital spending requirements and exposure to volatile, concentrated tech customers could quickly challenge the optimistic growth story if assumptions do not play out.

Find out about the key risks to this Black Hills narrative.

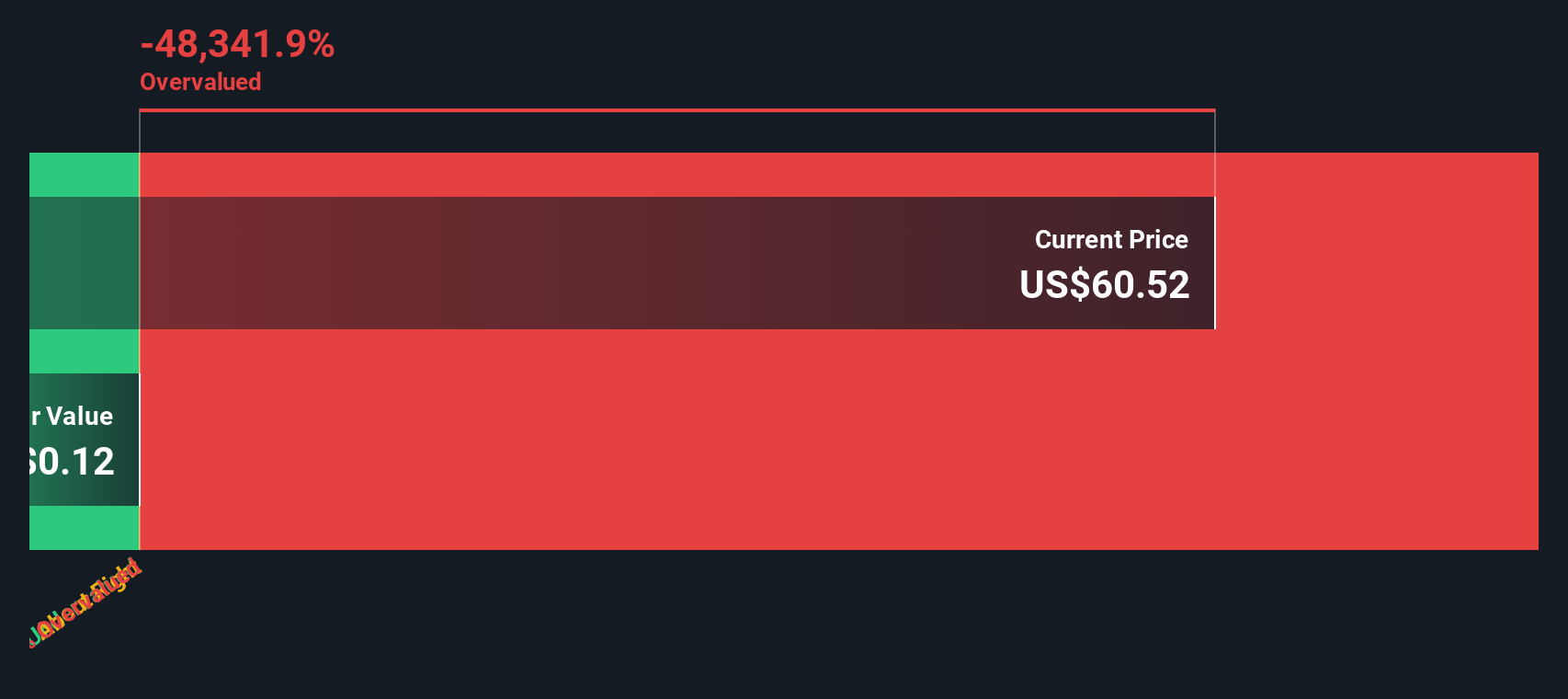

Another View: What the SWS DCF Model Suggests

While analyst consensus points to Black Hills being undervalued, our SWS DCF model tells a different story. It indicates the shares may actually be trading above their estimated fair value. This challenges the upbeat outlook from multiples-based valuation. Could this mean the market is already pricing in much of the optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Black Hills for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Black Hills Narrative

Keep in mind, if our conclusions do not match your perspective or you prefer to dig into the numbers on your own, you can craft a fresh narrative in just a few minutes: Do it your way

A great starting point for your Black Hills research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity does not wait. Take the lead and scan the market’s best potential with screeners focused on tomorrow’s top performers. Why settle for average returns?

- Accelerate your returns by targeting steady cash flows through these 19 dividend stocks with yields > 3%, and tap into companies with strong, reliable yields over 3%.

- Ride the wave of innovation and see which companies are revolutionizing industries with artificial intelligence by checking out these 24 AI penny stocks.

- Stay ahead of the crowd and uncover hidden gems trading below their fair value with these 904 undervalued stocks based on cash flows, designed to spotlight the market’s most overlooked opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Hills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives