- United States

- /

- Other Utilities

- /

- NYSE:BIP

Why Brookfield Infrastructure Partners (BIP) Is Up 6.0% After $700 Million Debt Raise and Hotwire Acquisition—And What's Next

Reviewed by Sasha Jovanovic

- Brookfield Infrastructure Partners L.P. recently completed a $700 million medium-term note offering, including $375 million of Series 15 Notes due 2031 with a 3.700% interest rate and $325 million of Series 16 Notes due 2035 at 4.526%; proceeds are earmarked for general corporate purposes, including debt repayment.

- This financing move coincided with the company's nearly $7 billion acquisition of Hotwire Communications, reflecting a clear intent to expand and diversify its infrastructure portfolio across multiple sectors.

- We'll assess how Brookfield's major debt raise to support new acquisitions could reshape its investment outlook and long-term growth drivers.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Brookfield Infrastructure Partners Investment Narrative Recap

Owning Brookfield Infrastructure Partners means believing in the long-term value of global infrastructure and the company’s ability to grow through acquisitions, asset recycling, and disciplined capital allocation. The recent $700 million debt financing, coinciding with the nearly $7 billion acquisition of Hotwire Communications, does not materially change the most important short-term catalyst, ongoing integration and performance of recent digital infrastructure deals, or the immediate risk around elevated leverage and future refinancing costs in a higher-rate environment.

Among the latest announcements, Brookfield’s 6% increase in its quarterly distribution stands out as especially relevant. This underscores the company's ongoing commitment to returning cash to shareholders, even as it expands its asset base and takes on new investments like Hotwire, which could support future growth.

But while dividend growth is appealing, the pace at which Brookfield is deploying capital in a higher-rate environment raises concerns investors should be aware of, especially if...

Read the full narrative on Brookfield Infrastructure Partners (it's free!)

Brookfield Infrastructure Partners' narrative projects $14.5 billion revenue and $1.1 billion earnings by 2028. This requires a 12.3% annual revenue decline but a substantial $1.06 billion increase in earnings from the current $38.0 million level.

Uncover how Brookfield Infrastructure Partners' forecasts yield a $39.91 fair value, a 19% upside to its current price.

Exploring Other Perspectives

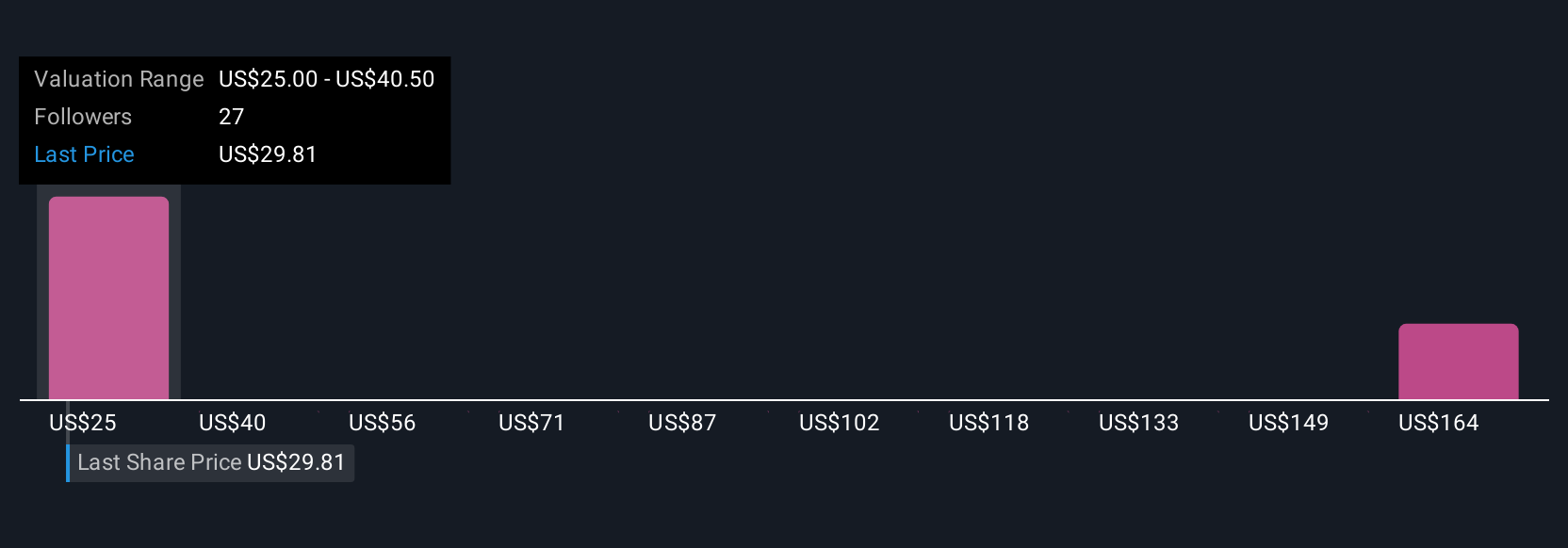

Five fair value estimates from the Simply Wall St Community range from US$25.03 to US$177.71, reflecting broad disagreement on Brookfield’s intrinsic worth. With more capital being deployed amid rising rates, staying informed about refinancing risk could better prepare you to weigh these differing views.

Explore 5 other fair value estimates on Brookfield Infrastructure Partners - why the stock might be worth over 5x more than the current price!

Build Your Own Brookfield Infrastructure Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Infrastructure Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Infrastructure Partners' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIP

Brookfield Infrastructure Partners

Engages in the utilities, transport, midstream, and data businesses.

Undervalued average dividend payer.

Market Insights

Community Narratives