- United States

- /

- Other Utilities

- /

- NYSE:BIP

Brookfield Infrastructure Partners (NYSE:BIP) Buyback Renewal: What the Expanded Repurchases Signal for Its Valuation

Reviewed by Simply Wall St

Brookfield Infrastructure Partners (NYSE:BIP) just refreshed its buyback playbook, securing approval to repurchase up to 5% of its LP units and 10% of certain preferred series through late 2026, with all repurchased securities cancelled.

See our latest analysis for Brookfield Infrastructure Partners.

The backdrop here is a unit price that has quietly regained its footing, with a 30 day share price return of 5.1% and a 90 day share price return of 17.4%. At the same time, the 1 year total shareholder return of 8.1% and 5 year total shareholder return of 29.0% point to steadily rebuilding, rather than explosive, momentum.

If this kind of capital allocation story has you thinking more broadly about where to put new money to work, now could be a good time to explore fast growing stocks with high insider ownership.

With buybacks ramping up, a double digit discount to analyst targets and a steep implied gap to intrinsic value, investors have to ask: is Brookfield Infrastructure still trading below its true worth, or is the market already baking in its next leg of growth?

Most Popular Narrative: 13.9% Undervalued

With Brookfield Infrastructure Partners closing at $35.83 against a narrative fair value of $41.64, the implied upside leans on a powerful earnings and margin story.

Active capital recycling selling partial stakes in mature assets at compelling multiples and redeploying proceeds into higher yielding, growth oriented opportunities enhances return on invested capital, underpins ongoing distributable earnings expansion, and provides built in upside to net margins.

Curious how shrinking revenues can still support richer margins and higher earnings power, all at a lower future multiple than today? See what this narrative is really betting on.

Result: Fair Value of $41.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated deal activity and rising leverage could quickly test this optimism if acquisition discipline slips or refinancing costs unexpectedly move higher.

Find out about the key risks to this Brookfield Infrastructure Partners narrative.

Another View: Rich On Earnings

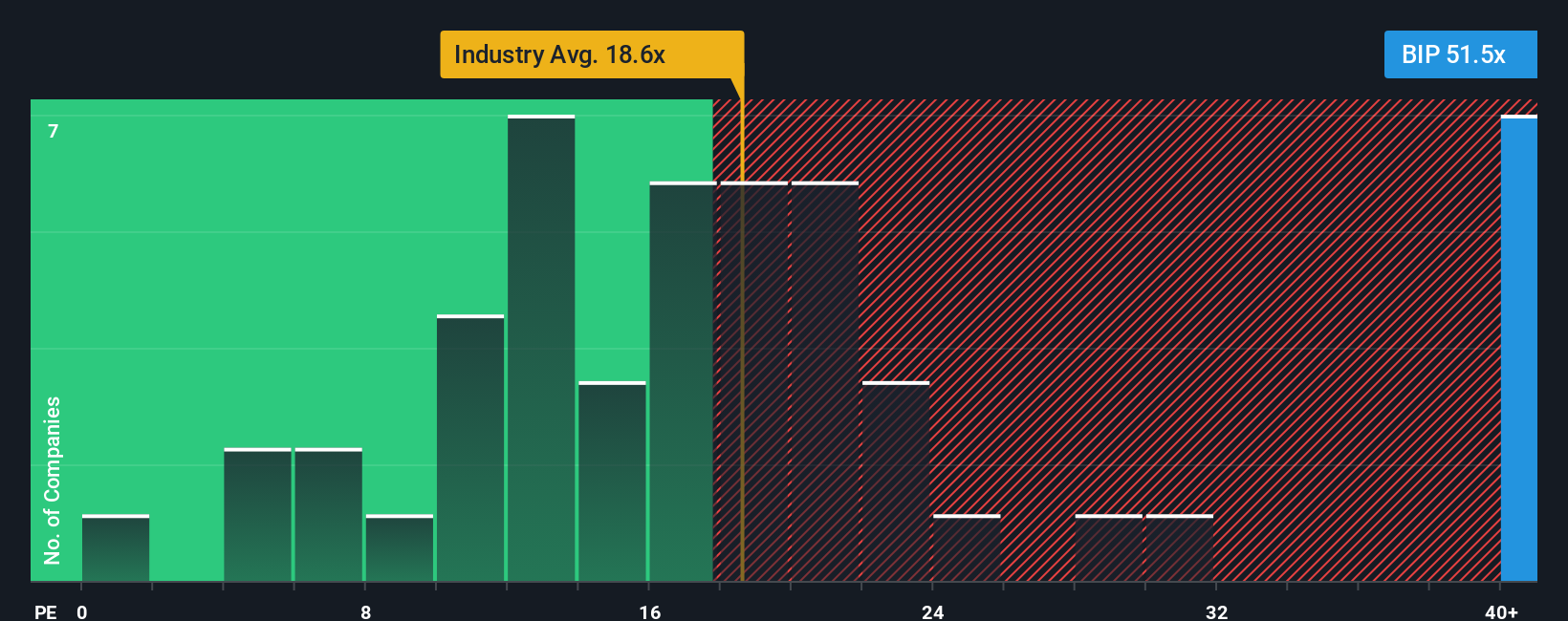

Zooming out from narrative fair value to simple earnings maths, Brookfield Infrastructure trades on a 51.2x price to earnings ratio versus 21.8x for peers and a fair ratio of just 1.3x. That kind of gap tilts the balance toward valuation risk rather than easy upside, so what convinces you it can keep justifying this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brookfield Infrastructure Partners Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single opportunity when the market is full of overlooked setups. Use the Simply Wall Street Screener to uncover what others are missing.

- Capture potential upside from mispriced businesses by targeting these 908 undervalued stocks based on cash flows that strong cash flows suggest the market has not fully appreciated yet.

- Tap into cutting edge innovation by reviewing these 26 AI penny stocks positioned at the front line of machine learning and automation trends.

- Lock in resilient income streams by focusing on these 15 dividend stocks with yields > 3% that can strengthen your portfolio with dependable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIP

Brookfield Infrastructure Partners

Engages in the utilities, transport, midstream, and data businesses.

Average dividend payer with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026