- United States

- /

- Renewable Energy

- /

- NYSE:BEPC

A Fresh Look at Brookfield Renewable (NYSE:BEPC) Valuation Following Strategic Growth Moves and Increased Market Optimism

Reviewed by Kshitija Bhandaru

Brookfield Renewable (NYSE:BEPC) is drawing new attention from investors after demonstrating sustained growth in both revenue and net income. The company also has a pipeline of active projects and strong long-term power purchase agreements with major tech firms.

See our latest analysis for Brookfield Renewable.

Brookfield Renewable’s share price has surged 38% year to date, fueled by a wave of optimism around clean energy and its recent strategic sale of solar assets for future growth. With a 34% one-year total shareholder return and momentum building behind green infrastructure, the company's performance stands out against a volatile market backdrop.

If recent clean energy moves have you watching the broader opportunity set, now is the perfect moment to discover fast growing stocks with high insider ownership.

With shares rallying and optimism running high, the key question for investors now is whether Brookfield Renewable's strong outlook is creating a real buying opportunity, or if the market has already priced in the company's future growth.

Most Popular Narrative: 12% Overvalued

The latest narrative suggests Brookfield Renewable’s fair value estimate sits below the last closing price of $38.76, signaling limited upside and possibly a premium market expectation. This creates a scenario where market enthusiasm and narrative projections might already be fully reflected in today’s price.

The landmark renewable energy agreement with Microsoft for 10.5 gigawatts of new capacity between 2026 and 2030 could significantly increase future revenues and secure stable cash flows.

Is the real story about to unfold? The narrative’s valuation math relies on bold revenue acceleration and new profit targets, along with tighter share counts and assumed sector multiples. The compelling aspect is that you will not know just how aggressive these profit forecasts are until you dive in.

Result: Fair Value of $34.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainties and delays in renewable project permitting could easily disrupt Brookfield Renewable’s expected growth. These factors could also challenge the bullish outlook.

Find out about the key risks to this Brookfield Renewable narrative.

Another View: Relative Value Risks

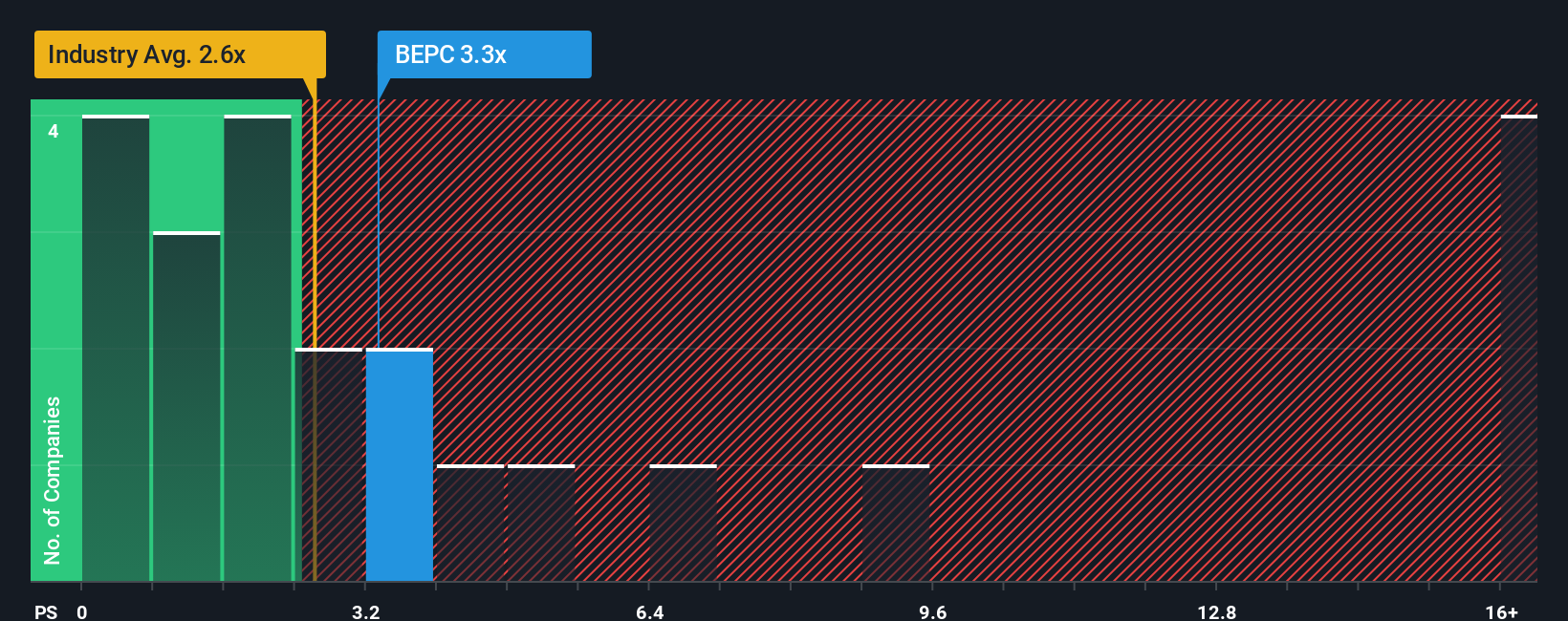

Looking at valuation through the lens of price-to-sales, Brookfield Renewable trades at 3.4x, higher than both its industry average of 2.6x and its peer average of 3.2x. However, the fair ratio suggests a level of 4.6x, leaving room for the market to move upward if growth meets expectations. Could this premium be justified by future expansion, or does it set investors up for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brookfield Renewable Narrative

Not convinced by the current view or want to dig deeper into the numbers yourself? Build your personal narrative in just a few minutes and Do it your way.

A great starting point for your Brookfield Renewable research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not just stop at one opportunity. Expand your horizons with handpicked lists that can sharpen your portfolio’s edge and spark your next breakthrough idea.

- Accelerate your search for tomorrow’s industry standouts by hunting for strong financials among these 3573 penny stocks with strong financials, making waves at the smaller end of the market.

- Boost your income potential by targeting stable yields above 3% when you add these 19 dividend stocks with yields > 3% to your watchlist of proven payers.

- Capitalize on high-growth trends by powering up with these 25 AI penny stocks, which are reshaping entire industries through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEPC

Brookfield Renewable

Owns and operates a portfolio of renewable power and sustainable solution assets.

Very low risk and overvalued.

Market Insights

Community Narratives