- United States

- /

- Water Utilities

- /

- NYSE:AWR

Assessing American States Water's Valuation After Military Contract Pursuits and Major Infrastructure Investment Plans

Reviewed by Simply Wall St

American States Water (AWR) is expanding its footprint, actively seeking new long-term contracts with military bases and has announced plans to invest up to $210 million in infrastructure upgrades for 2025. This renewed momentum has caught the attention of investors as recent months have brought a slight uptick in analyst earnings estimates.

See our latest analysis for American States Water.

Recent optimism around contract wins and infrastructure investments has helped American States Water hold its ground, with shares closing at $74.03. Still, despite the renewed momentum, the stock’s one-year total shareholder return sits at -11.03%, and its three-year figure is down nearly 20%. Overall, short- and long-term performance has lagged the market. The latest news hints at potential for a turnaround as sentiment shifts.

If you’re curious to see what else is gaining traction beyond the utilities sector, this is the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and sentiment starting to shift, is American States Water a potential bargain for value seekers? Or has the market already factored in every bit of its future growth outlook?

Most Popular Narrative: 9% Undervalued

The most-followed narrative sees a fair value of $81.50 for American States Water, a level notably above the latest closing price of $74.03. Here is what could be fueling this view of upside potential, even as the company faces industry headwinds.

Robust infrastructure investment, with $170 to $210 million targeted for 2025 and rate base growth authorized by recent CPUC rate case decisions, positions the company to earn higher returns on a growing asset base, contributing to long-term increases in both revenue and potential net margins.

Imagine a future where American States Water secures outsized returns while expanding in California. The narrative hinges on the compounding effects of crucial financial assumptions and a profit margin target well above industry averages. Can this growth blueprint really justify such a premium? See the full breakdown behind these bullish expectations.

Result: Fair Value of $81.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty and rising supply costs could still challenge the growth story and impact the stability of American States Water's earnings in the future.

Find out about the key risks to this American States Water narrative.

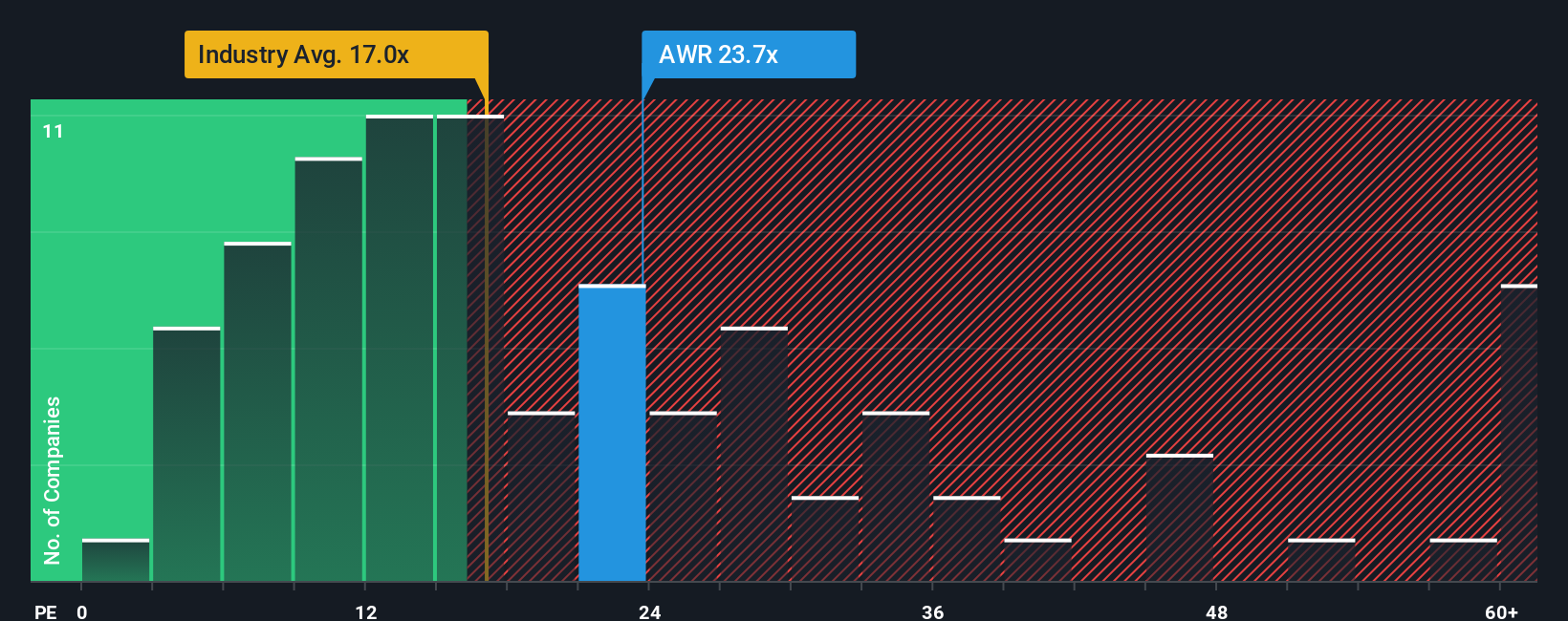

Another View: Market Multiples Signal Caution

While analyst models point to upside, a check against price-to-earnings tells a more cautious story. American States Water is trading at 22.1 times earnings, which is well above both the global water utilities average of 15.9 and its peers’ 18.4. The fair ratio is just 17.4, suggesting the market may be asking a premium not easily justified by fundamentals. Could this premium expose investors to downside if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American States Water Narrative

If you see things differently or enjoy diving into the data your own way, you can easily build your own narrative for American States Water in just a few minutes. Do it your way

A great starting point for your American States Water research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for the best opportunities to pass you by. Unlock new investment possibilities using the Simply Wall Street Screener and spot tomorrow’s winners today.

- Capture unique value by uncovering these 932 undervalued stocks based on cash flows that have been overlooked but show strong cash flow fundamentals and may be ready for a rebound.

- Tap into sustainable income streams with these 15 dividend stocks with yields > 3%, featuring companies offering yields above 3% to grow your passive earnings.

- Join the future of healthcare innovation by checking out these 30 healthcare AI stocks, making breakthroughs in medical technology and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWR

American States Water

Through its subsidiaries, provides water and electric services to residential, commercial, industrial, and other customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.