- United States

- /

- Water Utilities

- /

- NYSE:AWK

How Pennsylvania’s $64 Million Infrastructure Grants Could Influence American Water Works' (AWK) Future Service Upgrades

Reviewed by Sasha Jovanovic

- Earlier this month, the Shapiro administration announced that Pennsylvania American Water was awarded more than US$64 million in PENNVEST grants and low-interest loans to support water system upgrades, lead line replacements, and PFAS treatment projects across four Pennsylvania counties.

- This state-backed funding reflects the critical public and regulatory focus on infrastructure investment, water quality, and compliance for utility providers like American Water Works Company.

- We'll assess how winning significant state infrastructure funding could influence American Water's anticipated ability to accelerate service reliability and regulatory compliance.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American Water Works Company Investment Narrative Recap

Owning shares in American Water Works Company means believing in the ongoing need for dependable, regulated water utility service and the ability to earn stable returns from large-scale investments in infrastructure modernization. While the US$64 million in PENNVEST funds for Pennsylvania American Water underscores state support for utility upgrades and regulatory compliance, the short-term impact on the company’s most important revenue and rate case catalysts is likely incremental given its multibillion-dollar annual investment plan; however, execution risks around cost inflation and regulatory approvals remain crucial to watch.

The company's recent US$1 billion follow-on equity offering in August 2025 is directly relevant here, reinforcing the scale of capital required to meet both organic growth and infrastructure mandates like those supported by the PENNVEST funding. This capital raise highlights American Water's continued reliance on external funding to deliver projects aimed at modernizing water systems and meeting rising regulatory standards.

On the other hand, persistent increases in debt and financing costs, if rates remain elevated, could challenge future earnings and are something investors should not overlook...

Read the full narrative on American Water Works Company (it's free!)

American Water Works Company's outlook anticipates $6.0 billion in revenue and $1.4 billion in earnings by 2028. This projection is based on a 6.6% annual revenue growth rate and an increase in earnings of approximately $0.3 billion from the current $1.1 billion.

Uncover how American Water Works Company's forecasts yield a $141.11 fair value, in line with its current price.

Exploring Other Perspectives

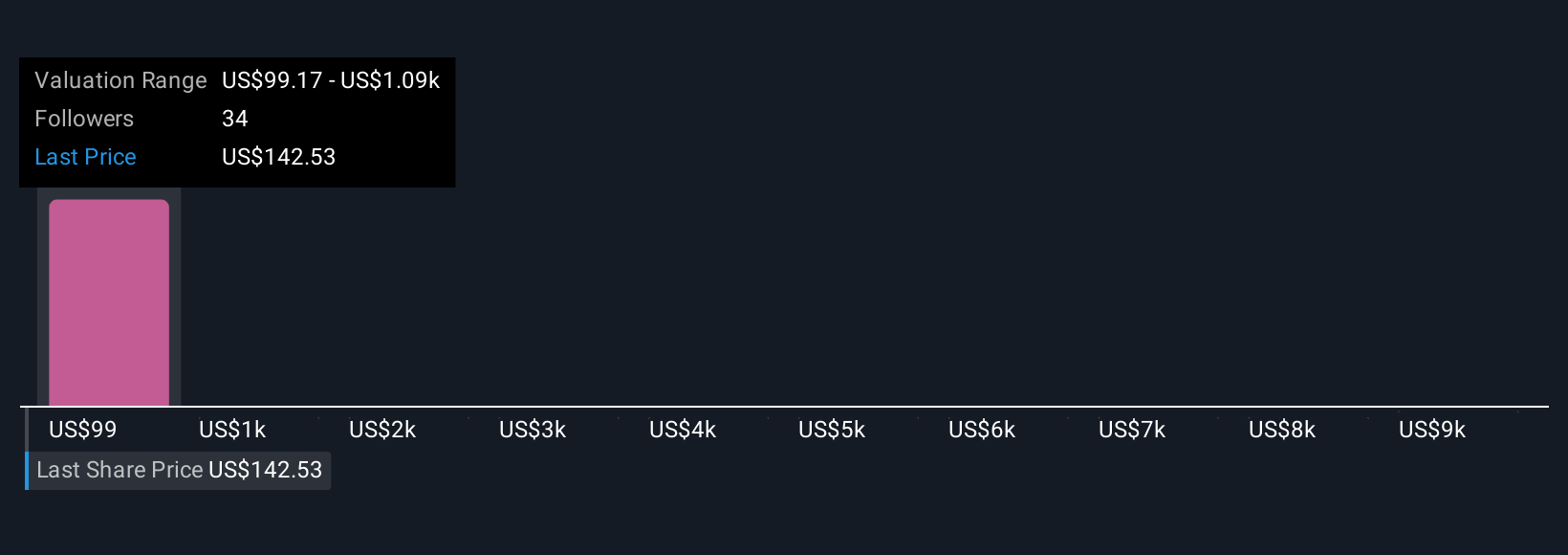

Three individual fair value estimates from the Simply Wall St Community range from US$101.15 up to US$9,999, reflecting substantial variation in how investors assess the company's future growth. Cost control and the company’s ongoing need for regulatory-approved rate increases continue to be major talking points that can influence performance, so it’s worth considering a broad spectrum of viewpoints.

Explore 3 other fair value estimates on American Water Works Company - why the stock might be worth 30% less than the current price!

Build Your Own American Water Works Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Water Works Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Water Works Company's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives