- United States

- /

- Water Utilities

- /

- NYSE:AWK

American Water Works Company (NYSE:AWK) Increases Dividend, Affirms 2025 Earnings Guidance

Reviewed by Simply Wall St

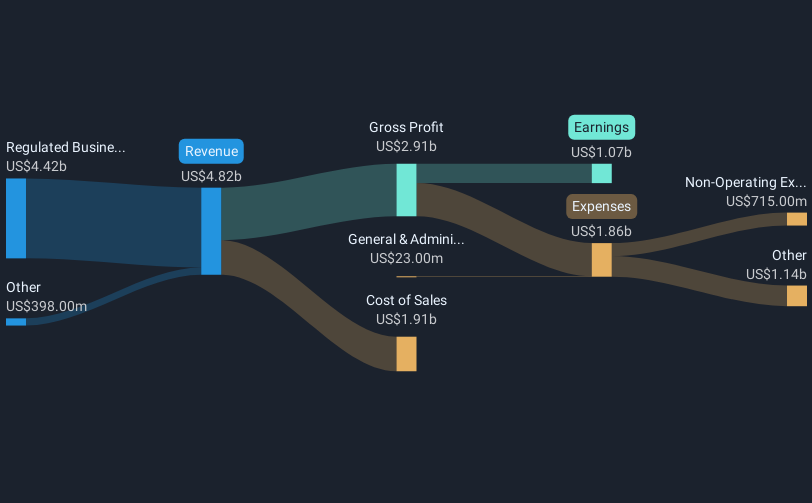

American Water Works Company (NYSE:AWK) made headlines with an 18.88% price increase over the last quarter, reflecting positive investor sentiment bolstered by several key developments. The company announced an 8.2% dividend increase, linking effectively with its robust financial performance highlighted by increased Q1 2025 earnings and sales figures. Affirming its 2025 earnings guidance, the company’s debt financing activities further stabilized its financial outlook. These events contributed positively to its overall market performance, aligning with the general upward trend of the major indices, including the S&P 500 and Dow, which also reflected strong earnings across sectors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments at American Water Works Company, highlighted by an 18.88% share price increase in the last quarter, could influence the narrative centered around their investments in water quality and resilience. This recent uptick aligns well with their strategic focus on infrastructure investments, benefiting their expanded customer base and service reliability. Such positive news may potentially support revenue and earnings forecasts by sustaining investor confidence in the company's growth trajectory.

Over the longer term, the company's total return, including share price and dividends, registered a 36.81% increase over five years. A comparative view shows that over the past year, AWK's performance exceeded that of the US Water Utilities industry, which returned 14.6%. This indicates a relatively strong performance by the company amid industry dynamics.

The recent dividend increase and affirmed earnings guidance bolster the potential for stable revenue growth and earnings forecasts. Analysts project a revenue growth rate of 6.4% annually, emphasizing a promising outlook for earnings stability. However, AWK is trading at a premium with a Price-To-Earnings (P/E) ratio of 27.3x compared to the industry average of 17.7x. Given its current share price of US$145.86 against a consensus price target of US$141.70, the company is trading slightly above analysts' expectations, indicating market anticipation of its growth efforts. This valuation context underscores the need to consider both current market perceptions and long-term growth potential when evaluating investment decisions.

Learn about American Water Works Company's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives