- United States

- /

- Water Utilities

- /

- NYSE:AWK

American Water Works Company, Inc.'s (NYSE:AWK) Shareholders Might Be Looking For Exit

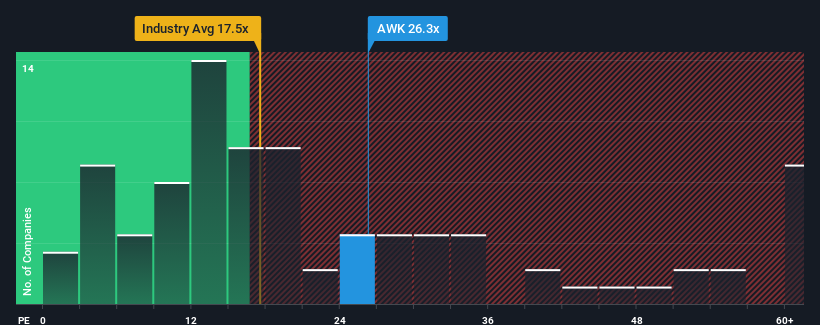

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider American Water Works Company, Inc. (NYSE:AWK) as a stock to avoid entirely with its 26.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

American Water Works Company certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for American Water Works Company

How Is American Water Works Company's Growth Trending?

In order to justify its P/E ratio, American Water Works Company would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a decent 8.0% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 24% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 7.8% per year during the coming three years according to the nine analysts following the company. That's shaping up to be materially lower than the 9.9% per year growth forecast for the broader market.

In light of this, it's alarming that American Water Works Company's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From American Water Works Company's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that American Water Works Company currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with American Water Works Company (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

If you're unsure about the strength of American Water Works Company's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives