- United States

- /

- Other Utilities

- /

- NYSE:AVA

Avista (AVA): Exploring Valuation Following Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Avista (AVA) shares have nudged higher over the past week, climbing nearly 4% and adding to their gains for the past month. Investors are keeping an eye on the utility’s steady performance and recent price movement.

See our latest analysis for Avista.

After a relatively steady stretch, Avista’s 1-month share price return of 6.66% marks a meaningful pickup in momentum, suggesting investor sentiment is firming. Over the past year, the company delivered a total shareholder return of 6.49%, adding to healthy gains of nearly 39% over the past five years. Steady performance and recent results keep Avista in the spotlight.

If you're weighing your next move, now’s an ideal time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Avista’s shares showing renewed strength, the key question becomes whether this utility stock is undervalued with more upside ahead, or if the current price already reflects the company’s growth prospects. Is there a real buying opportunity, or is the market already accounting for future gains?

Most Popular Narrative: 6.2% Undervalued

With Avista's fair value estimated at $41.00, the most widely followed narrative sees upside from the current price of $38.44. Investors are paying close attention to what’s driving this gap in expectations and the numbers behind it.

Robust, multi-year capital investment plans approaching $3 billion (2025 to 2029), with additional upside from grid expansion projects and new generation needs tied to large load requests, position Avista to earn regulated returns and drive long-term earnings expansion.

What’s behind the analyst price target? There’s a key financial assumption buried in this narrative, one that could fundamentally rewrite Avista’s growth story. Want to see exactly what future profit margins and earnings projections are powering this valuation? Don’t miss the full details—see why this narrative stands out.

Result: Fair Value of $41.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including regulatory uncertainty and the potential for increased wildfire-related costs. Either of these factors could challenge Avista’s earnings outlook.

Find out about the key risks to this Avista narrative.

Another View: What Does the SWS DCF Model Suggest?

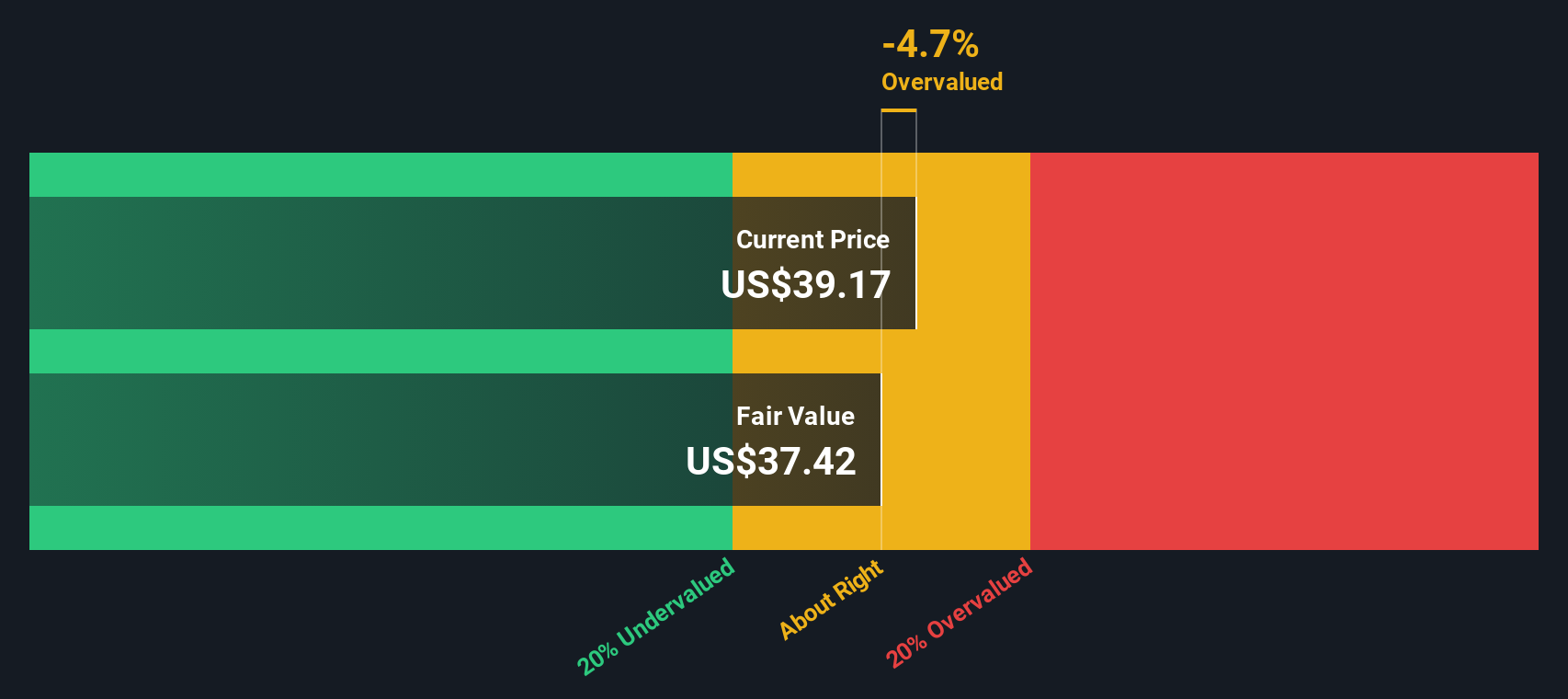

Looking at Avista through the SWS DCF model presents a more cautious take. The model estimates the fair value at $37.59, which is actually below the current price. This suggests that, by this calculation, Avista might be a touch overvalued right now. Could the market be a bit ahead of itself, or is the consensus narrative seeing potential others are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avista for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avista Narrative

Keep in mind, you can dig into the numbers and craft your own Avista story. Building a personalized view takes less than three minutes. Do it your way

A great starting point for your Avista research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your potential. Jump on the smartest trends and find tomorrow’s winners today with a few clicks. The right screener can open up unexpected opportunities that others might overlook.

- Generate income potential and safeguard your portfolio by checking out these 18 dividend stocks with yields > 3% offering attractive yields over 3%.

- Give your strategy an edge with innovation by tapping into these 24 AI penny stocks poised to shape future industries through cutting-edge artificial intelligence.

- Stay ahead of the curve and spot value opportunities with these 875 undervalued stocks based on cash flows based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVA

Avista

Operates as an electric and natural gas utility company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives