- United States

- /

- Gas Utilities

- /

- NYSE:ATO

How Investors May Respond To Atmos Energy (ATO) Analyst Upgrades and Raised Earnings Outlook

Reviewed by Sasha Jovanovic

- Recently, Atmos Energy was highlighted for its improved analyst sentiment and positive earnings outlook, with the Zacks Consensus Estimate for full-year earnings moving 0.9% higher over the past 90 days, and the stock outperforming its Utilities sector peers on a year-to-date basis.

- An especially interesting detail is that Atmos Energy’s ranking in the Utilities sector has climbed, now holding a Zacks Rank of #2 (Buy), reinforcing analyst confidence in the company’s future performance.

- We’ll examine how this improved analyst outlook and earnings estimate revision could influence Atmos Energy’s overall investment narrative and future growth prospects.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Atmos Energy Investment Narrative Recap

To be a shareholder in Atmos Energy, you need to believe that continued customer and industrial demand growth, especially in high-growth Texas regions, will underpin stable long-term revenue, while regulatory structures enable predictable earnings. The recent boost in analyst sentiment and a higher full-year earnings outlook add confidence to the short-term catalyst: sustained earnings growth. However, these developments do not materially lessen the company’s biggest risk right now, the strain that rising capital expenditures and increased operating costs could put on margins and free cash flow.

One of the most relevant announcements that aligns with this upbeat news is Atmos’s raised earnings guidance for 2025, now projecting between US$7.35 and US$7.45 per diluted share. This update directly ties to analyst optimism, but it also draws attention to whether higher spending and maintenance costs could complicate efforts to consistently meet such targets, especially if external financing needs rise.

On the other hand, investors should be aware that persistent capital spending and cost inflation can have…

Read the full narrative on Atmos Energy (it's free!)

Atmos Energy's narrative projects $6.3 billion revenue and $1.6 billion earnings by 2028. This requires 11.1% yearly revenue growth and a $0.4 billion increase in earnings from $1.2 billion today.

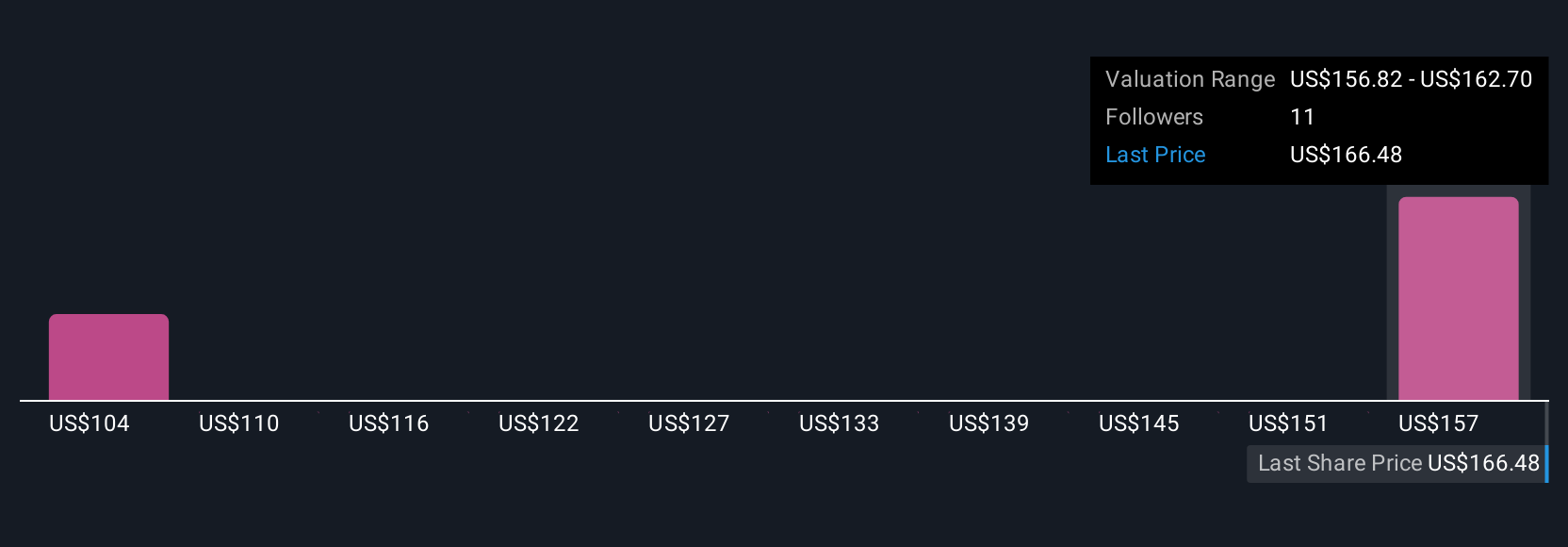

Uncover how Atmos Energy's forecasts yield a $162.70 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely from US$108.37 to US$162.70 per share. While views may vary, the ongoing surge in capital expenditures raises important questions about long-term profitability and returns, making it essential to consider multiple perspectives before forming your own outlook.

Explore 3 other fair value estimates on Atmos Energy - why the stock might be worth 38% less than the current price!

Build Your Own Atmos Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atmos Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atmos Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atmos Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATO

Atmos Energy

Engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives