- United States

- /

- Gas Utilities

- /

- NYSE:ATO

Atmos Energy (NYSE:ATO) Reports Earnings Growth & Raises 2025 Guidance with US$3.48 Dividend

Reviewed by Simply Wall St

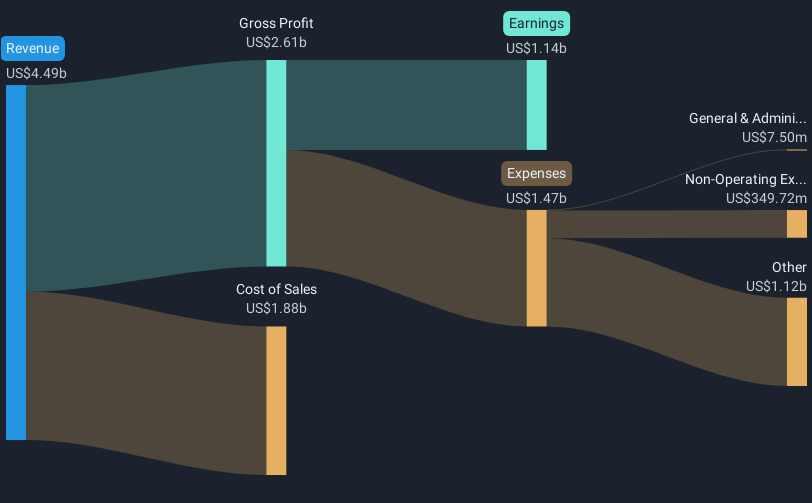

Atmos Energy (NYSE:ATO) recently reported strong second-quarter financial results, with sales increasing to $1,951 million and net income rising to $486 million. Additionally, the company raised its earnings guidance for fiscal 2025 and announced a quarterly dividend of 87 cents per share. These events, reflecting the company's robust financial health and commitment to shareholder returns, likely supported its stock's impressive 14% rise over the last quarter. Amid broader market growth of 8% over the year, Atmos Energy's performance added positive weight to the upward market trend.

Atmos Energy has 2 weaknesses we think you should know about.

The recent news about Atmos Energy's strong financial results, including a US$1.95 billion sales figure and US$486 million net income, coinciding with an earnings guidance raise and increased dividends, underscores the company's robust commitment to shareholders. This financial health aligns with the narrative of expecting continued revenue stability, supported by infrastructure improvements and an expanding customer base, particularly in growth areas like Texas. These initiatives are crucial in mitigating risks associated with high capital expenditures and regulatory challenges.

Atmos Energy has delivered a total return, including share price appreciation and dividends, of 91.57% over five years. This resilience in the energy sector demonstrates substantial growth, marking a solid performance over this extended period. Recently, over the past year, the company's return exceeded that of the US Gas Utilities industry, which saw a 20.2% increase, showcasing its competitive edge.

The newly reported results and strategic focus are expected to positively influence revenue and earnings forecasts by showcasing improved supply reliability and potential for higher earnings growth amid modernization projects. However, these forecasts must navigate anticipated increases in capital expenses and regulatory uncertainties. The stock's current price of US$161.96, slightly above the consensus price target of US$157.20, indicates a 3% decline in expected value according to analyst projections, suggesting it is trading near fair value, assuming current forecasts materialize. This slight deviation highlights the importance of aligning revenue and earnings projections with prevailing industry and regulatory conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Atmos Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATO

Atmos Energy

Engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives