- United States

- /

- Renewable Energy

- /

- NYSE:AES

AES (NYSE:AES) Explores Sale Options As M&A Rumors Spark Takeover Interest

Reviewed by Simply Wall St

AES (NYSE:AES) is reportedly considering a potential sale following interest from infrastructure investors like BlackRock Inc.'s Global Infrastructure Partners and Brookfield Asset Management. Shares of AES experienced a notable jump in share price due to this news but closed the week with a 2.79% increase, which stands out when compared to the relatively flat market index movements. The speculation surrounding these potential sales discussions likely added buoyancy to AES's stock, further fueled by a sector-wide interest in renewable energy investments as the company has contracts with tech giants such as Google and Amazon.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

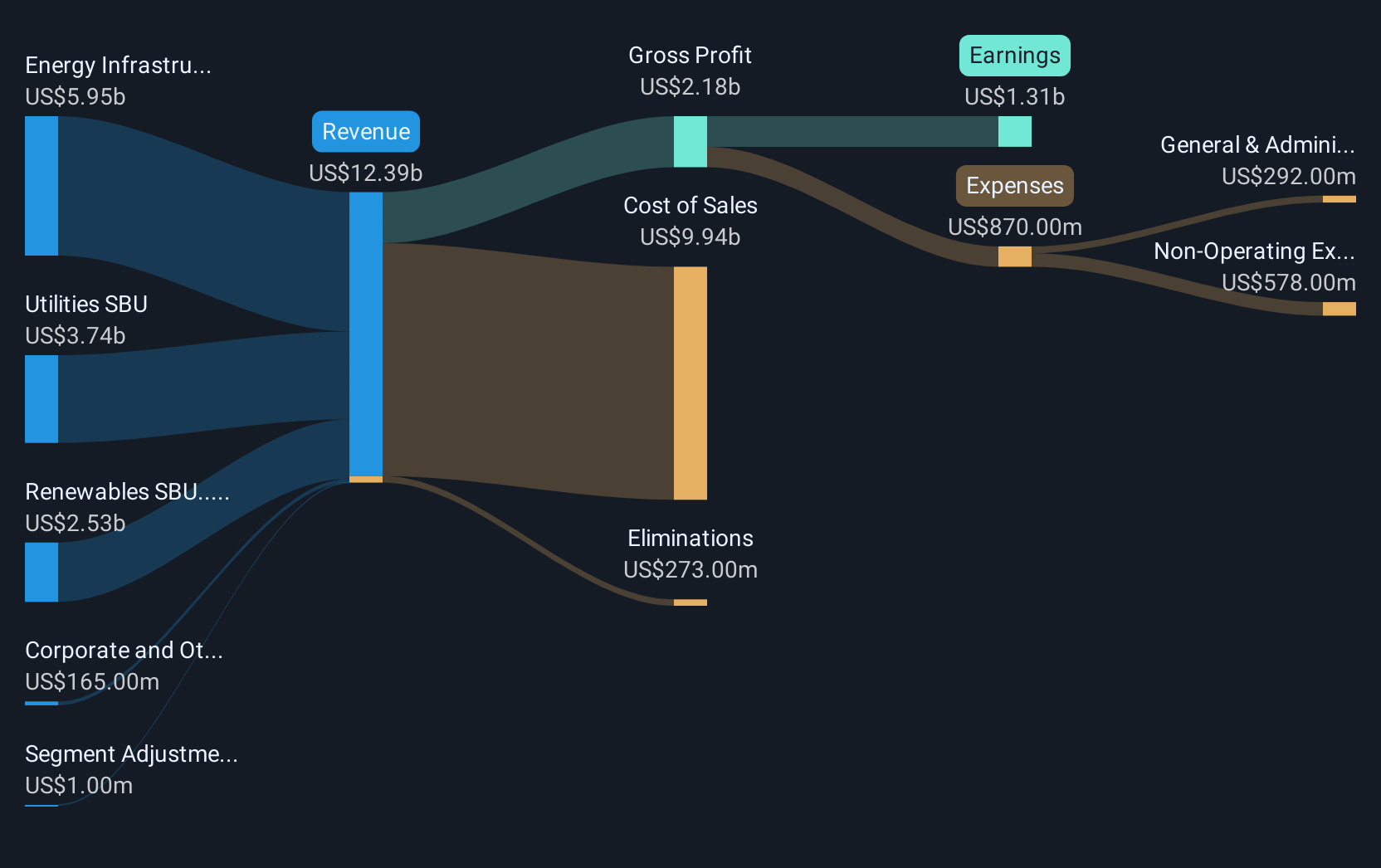

The recent speculation about a potential sale of AES to infrastructure investors could influence the company's strategic direction and performance metrics. This potential deal aligns with AES's focus on expanding its renewable energy operations, which is seen as a buffer against risks such as tariff implications and shifts in U.S. renewable policy. However, along with these prospects, revenue and margin risks remain due to its contract rigidity and substantial capital investments in the U.S. utilities, potentially impacting future revenue and earnings forecasts.

Over the long term, AES's total shareholder return, including dividends, recorded a 10.70% decline over the past five years. This performance signals that while recent news has stimulated short-term market activity, the longer-term investor experience has been more challenged. In the past year, AES underperformed the U.S. market, which returned 12.6%, and the Renewable Energy industry, which returned 50% during the same period.

With analysts predicting a revenue increase to US$14 billion and earnings of US$1.7 billion by May 2028, the news may boost investor confidence, potentially aligning with these forecasts. However, disagreement among analysts suggests varying expectations about the impact of the news on these forecasted figures. The current AES share price of US$10.44 is trading at a discount to the consensus price target of US$14.63, indicating potential upside if the company's initiatives prove successful and align with analysts’ expectations. Yet, individual evaluation and assumptions about AES's strategic execution remain crucial for investors considering this information.

Explore historical data to track AES' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AES

AES

Operates as a power generation and utility company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives