- United States

- /

- Other Utilities

- /

- NYSE:AEE

Ameren (AEE) Valuation Check as New Site Acceleration Program Targets Clean Energy Investment and Jobs

Reviewed by Simply Wall St

Ameren (AEE) is drawing fresh attention after launching its Site Acceleration Program, a push to make key downstate Illinois sites shovel ready for investment, job creation, and clean energy aligned growth.

See our latest analysis for Ameren.

The Site Acceleration Program lands at a time when Ameren’s $97.99 share price has cooled off in the short term. However, its double digit year to date share price return and solid five year total shareholder return of 48.22 percent suggest that long term momentum is still intact, especially as leadership additions and conference appearances underscore its push on technology, risk management, and clean energy growth.

If you like the mix of stability and growth Ameren offers, it is worth scouting other regulated players and adjacent opportunities across healthcare stocks as the energy transition increasingly intersects with healthcare infrastructure and reliability.

Against that backdrop, and with shares trading about 15 percent below the average analyst target, the key question now is whether Ameren is quietly undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 13% Undervalued

With Ameren last closing at 97.99 dollars against a narrative fair value near 112 dollars, the prevailing view sees meaningful upside still on the table.

Ongoing and future investments in grid modernization, resilience (e.g., smart substations, composite poles, automation), and clean energy resources (wind, solar, batteries) are expected to expand Ameren's regulated rate base at a forecasted 9.2% CAGR, enabling higher allowed returns and improved net margins.

Curious how steady load growth, rising margins, and a premium future earnings multiple all combine into that fair value target? The narrative connects those dots in detail.

Result: Fair Value of $112.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could be tested if data center load builds more slowly than expected or if regulators become more conservative about approving major capex.

Find out about the key risks to this Ameren narrative.

Another Angle on Valuation

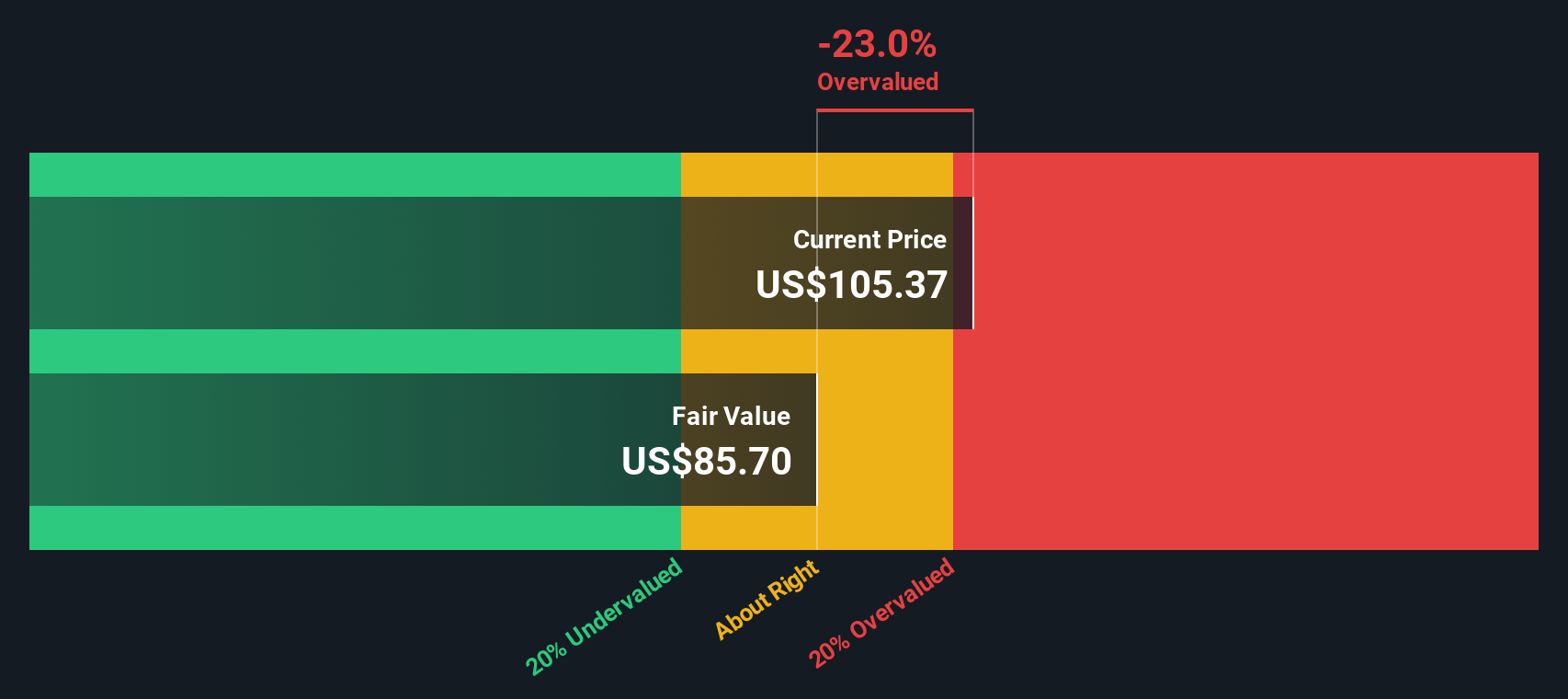

Our SWS DCF model paints a cooler picture, putting Ameren's fair value near 85 dollars, below the current 97.99 dollar share price and implying the stock may be overvalued on cash flow assumptions. If earnings and rate base growth disappoint, does this more cautious view win out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ameren for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ameren Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Ameren research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall Street’s Screener to work and build a shortlist of fresh opportunities that could help reshape the next stage of your portfolio’s returns.

- Explore potential growth tailwinds by reviewing these 909 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows and fundamentals.

- Support your passive income stream by targeting these 13 dividend stocks with yields > 3% that align with your risk tolerance and yield expectations.

- Position yourself at the frontier of digital finance by considering these 80 cryptocurrency and blockchain stocks pioneering real world blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)