- United States

- /

- Water Utilities

- /

- NasdaqGS:YORW

York Water (NASDAQ:YORW) Is Paying Out A Larger Dividend Than Last Year

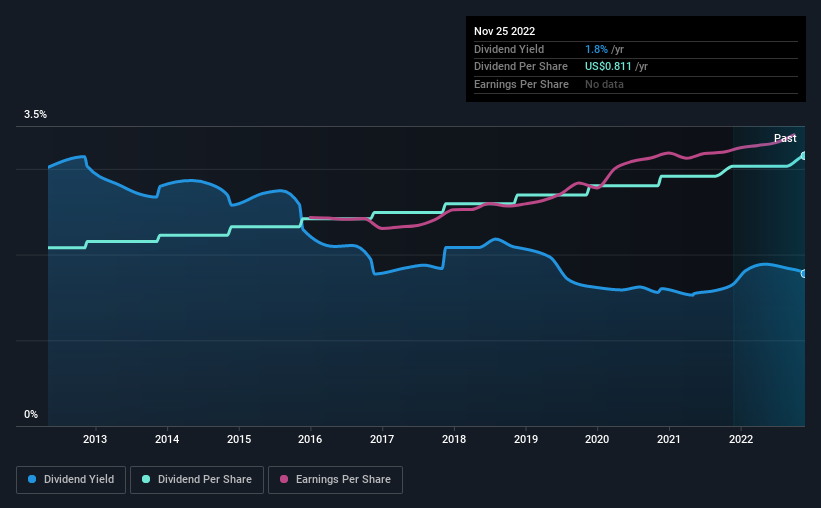

The York Water Company (NASDAQ:YORW) will increase its dividend from last year's comparable payment on the 17th of January to $0.2027. Based on this payment, the dividend yield for the company will be 1.8%, which is fairly typical for the industry.

Check out the opportunities and risks within the US Water Utilities industry.

York Water's Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, York Water's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

Over the next year, EPS is forecast to expand by 3.7%. Assuming the dividend continues along recent trends, we think the payout ratio could be 61% by next year, which is in a pretty sustainable range.

York Water Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2012, the dividend has gone from $0.534 total annually to $0.811. This implies that the company grew its distributions at a yearly rate of about 4.3% over that duration. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

We Could See York Water's Dividend Growing

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that York Water has been growing its earnings per share at 6.2% a year over the past five years. While on an earnings basis, this company looks appealing as an income stock, the cash payout ratio still makes us cautious.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 3 warning signs for York Water (1 can't be ignored!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:YORW

York Water

The York Water Company impounds, purifies, and distributes drinking water.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026