- United States

- /

- Water Utilities

- /

- NasdaqGS:YORW

York Water (NASDAQ:YORW) Is Due To Pay A Dividend Of US$0.19

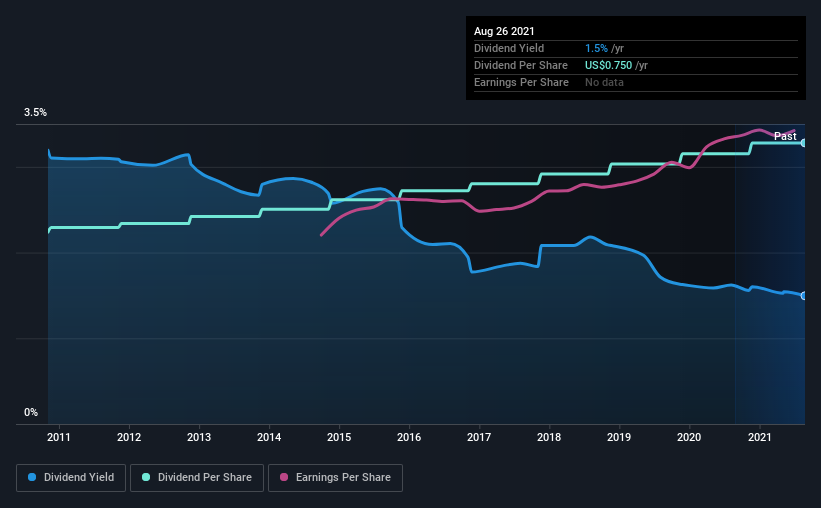

The York Water Company (NASDAQ:YORW) has announced that it will pay a dividend of US$0.19 per share on the 15th of October. Based on this payment, the dividend yield will be 1.5%, which is fairly typical for the industry.

See our latest analysis for York Water

York Water's Dividend Is Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. Before making this announcement, York Water was earning enough to cover the dividend, but it wasn't generating any free cash flows. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

The next year is set to see EPS grow by 3.6%. If the dividend continues along recent trends, we estimate the payout ratio will be 59%, which is in the range that makes us comfortable with the sustainability of the dividend.

York Water Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2011, the first annual payment was US$0.51, compared to the most recent full-year payment of US$0.75. This means that it has been growing its distributions at 3.9% per annum over that time. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

York Water Could Grow Its Dividend

The company's investors will be pleased to have been receiving dividend income for some time. We are encouraged to see that York Water has grown earnings per share at 5.7% per year over the past five years. The company is paying out a lot of its cash as a dividend, but it looks okay based on the payout ratio.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for York Water that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade York Water, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:YORW

York Water

The York Water Company impounds, purifies, and distributes drinking water.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026