- United States

- /

- Gas Utilities

- /

- NasdaqGM:RGCO

RGC Resources (NASDAQ:RGCO) Is Paying Out A Larger Dividend Than Last Year

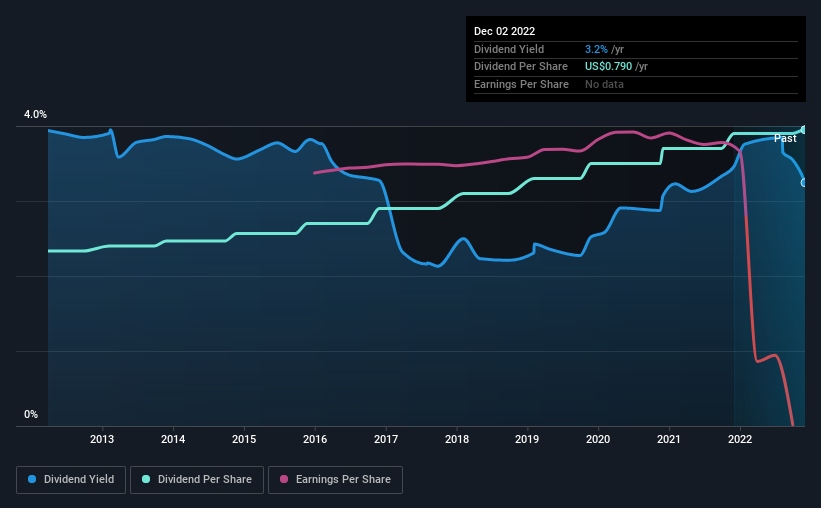

The board of RGC Resources, Inc. (NASDAQ:RGCO) has announced that it will be paying its dividend of $0.1975 on the 1st of February, an increased payment from last year's comparable dividend. This makes the dividend yield about the same as the industry average at 3.2%.

Check out the opportunities and risks within the US Gas Utilities industry.

RGC Resources Might Find It Hard To Continue The Dividend

Unless the payments are sustainable, the dividend yield doesn't mean too much. Even though RGC Resources is not generating a profit, it is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Recent, EPS has fallen by 35.4%, so this could continue over the next year. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

RGC Resources Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2012, the annual payment back then was $0.467, compared to the most recent full-year payment of $0.79. This implies that the company grew its distributions at a yearly rate of about 5.4% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Earnings per share has been sinking by 35% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

An additional note is that the company has been raising capital by issuing stock equal to 17% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

RGC Resources' Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think RGC Resources will make a great income stock. Although they have been consistent in the past, we think the payments are a little high to be sustained. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 4 warning signs for RGC Resources (3 don't sit too well with us!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RGCO

RGC Resources

Through its subsidiaries, operates as an energy services company.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion