- United States

- /

- Other Utilities

- /

- NasdaqGS:NWE

NorthWestern Energy (NWE): Exploring Current Valuation After Recent Period of Steady Share Price Movement

Reviewed by Kshitija Bhandaru

NorthWestern Energy Group (NWE) has seen its shares move slightly over the past month, drawing attention from investors curious about what is driving activity. Recently, the company’s performance metrics have been in focus.

See our latest analysis for NorthWestern Energy Group.

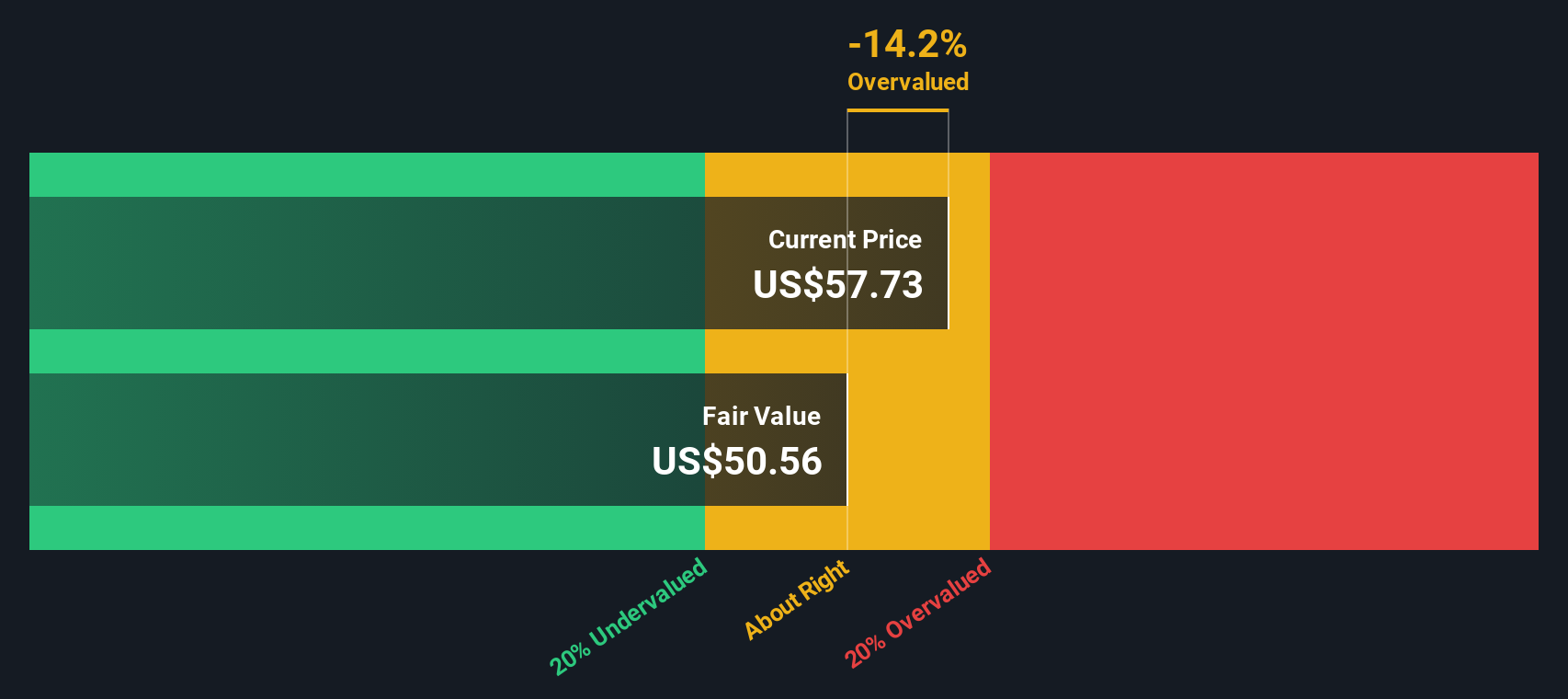

After a modest stretch of movement, NorthWestern Energy Group’s share price has held fairly steady, trading at $57.73. Despite a quiet few weeks, the company’s 1-year total shareholder return of 0.09% suggests that momentum has cooled compared to the multi-year trend, with longer-term returns outpacing short-term performance as investors weigh growth and valuation prospects.

If you’re considering your next move, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading near recent levels and a modest discount to analyst price targets, the big question is whether NorthWestern Energy Group is undervalued or if the market has already considered its future growth prospects.

Most Popular Narrative: 2.8% Undervalued

The most popular narrative suggests that NorthWestern Energy Group’s fair value estimate sits just above its last close price of $57.73. This small but meaningful margin has caught the attention of those following the stock's valuation debate. This prompts a closer look at what underpins this figure and how recent developments may shift expectations going forward.

NorthWestern is poised to benefit from outsized load growth driven by accelerating data center demand in Montana and South Dakota, which is likely to support above-trend revenue and earnings growth as long-term electrification of industry and digital infrastructure unfolds.

Want to discover the hidden drivers behind this verdict? The narrative hinges on aggressive growth forecasts and a bold assumption about future profitability. Can NorthWestern sustain this pace? Get ready to uncover the growth levers and bold financial outlook embedded in this fair value estimate.

Result: Fair Value of $59.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as stricter decarbonization policies and delayed regulatory approvals could quickly dampen the company’s growth outlook and long-term earnings potential.

Find out about the key risks to this NorthWestern Energy Group narrative.

Another Perspective: SWS DCF Model Raises Questions

While analysts see NorthWestern Energy Group as slightly undervalued, our SWS DCF model suggests the stock may actually trade above its estimated fair value of $50.56. This divergence challenges the narrative of simple upside. Could market optimism be outpacing fundamentals, or is the DCF model missing future catalysts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NorthWestern Energy Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NorthWestern Energy Group Narrative

If you have a different perspective or want to dig into the numbers personally, you’re only a few clicks away from building a narrative of your own. Do it your way

A great starting point for your NorthWestern Energy Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You won’t want to let these opportunities slip by. Uncover game-changing stocks and fresh investment angles with Simply Wall Street’s premium screeners today.

- Unlock the potential of future healthcare by reviewing these 32 healthcare AI stocks, delivering remarkable technology innovations in artificial intelligence across the sector.

- Target solid passive income streams when you review these 19 dividend stocks with yields > 3% with attractive yields and proven consistency in shareholder payouts.

- Get ahead of market inefficiencies by spotting bargains among these 893 undervalued stocks based on cash flows and position your portfolio for value-driven gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWestern Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWE

NorthWestern Energy Group

NorthWestern Energy Group, Inc., doing business as NorthWestern Energy, provides electricity and natural gas to residential, commercial, and various industrial customers.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives