- United States

- /

- Electric Utilities

- /

- NasdaqGS:MGEE

How Investors May Respond To MGE Energy (MGEE) Earning Dividend King Status and Attracting Institutions

Reviewed by Simply Wall St

- Earlier this quarter, MGE Energy was recognized as a Dividend King after raising its quarterly dividend from US$0.45 to US$0.475 per share, attracting attention from institutional investors such as Strs Ohio and Nuveen LLC.

- This recent activity reflects both confidence in the company’s ongoing ability to return capital to shareholders and the stability signaled by its AA- S&P credit rating.

- Next, we'll explore how heightened institutional investor interest supports the company's investment narrative around consistent dividend growth.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is MGE Energy's Investment Narrative?

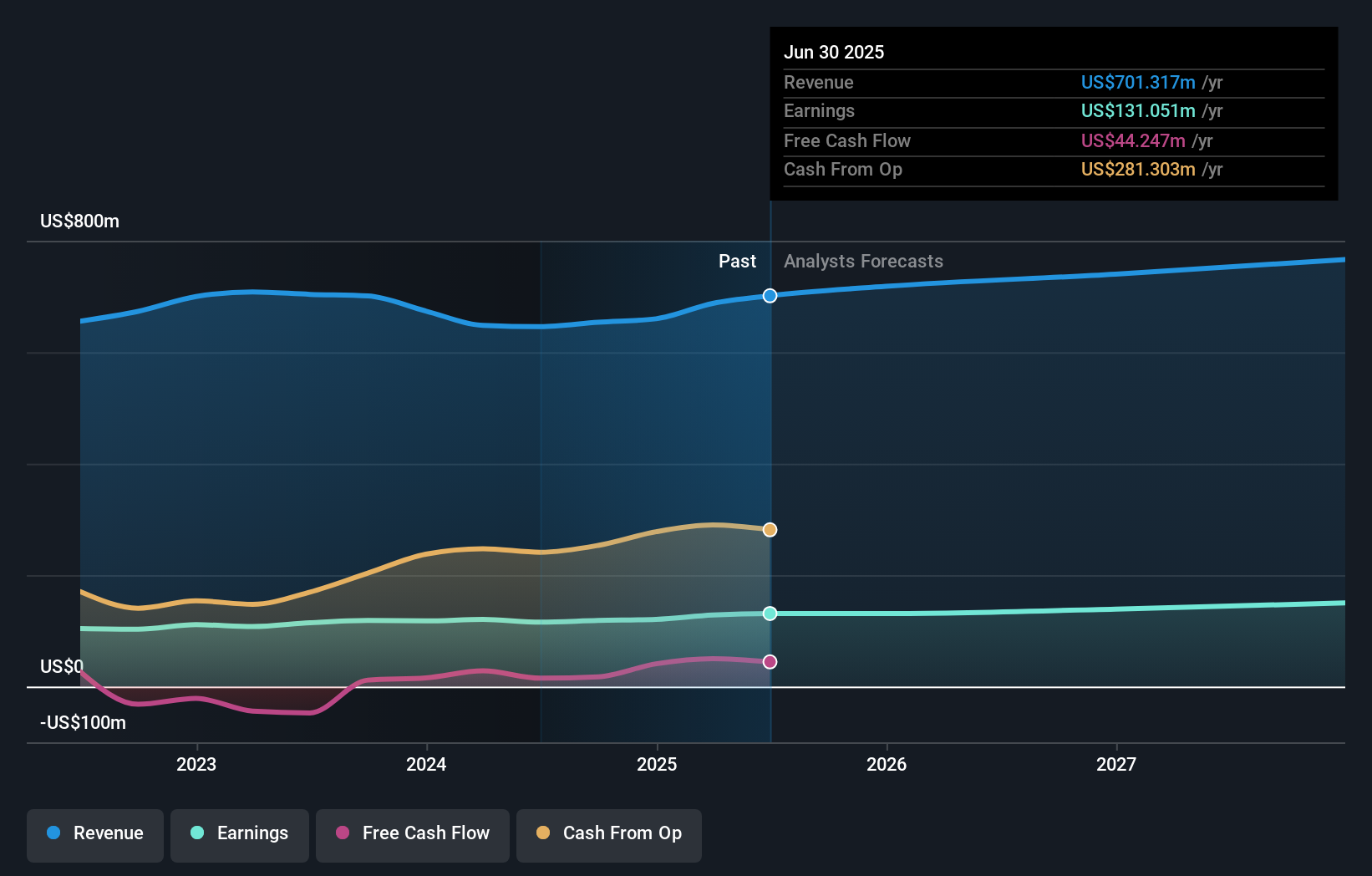

To believe in MGE Energy as a shareholder, you need to have conviction in its consistent dividend growth, financial conservatism, and its role as a regulated utility with a stable customer base. The recent recognition as a Dividend King and another dividend increase builds on this narrative, reinforcing the company’s reputation for delivering shareholder value over time. The news of new institutional backing gives further credibility to this stability, but it does not significantly alter the key short-term risks and catalysts identified previously. The most important short-term catalyst remains management’s ability to sustain profit growth while supporting reliable dividends, given slower revenue growth forecasts and limited upside based on the most recent analyst price targets. Risks center around the stock’s valuation, which remains high relative to industry peers, and ongoing concerns about whether cash flows can fully support its rising dividends. While the boost in institutional interest slightly reduces short-term risk, changes to the company’s underlying growth outlook or its ability to keep pace with competitors are more likely to impact share performance.

But, despite the dividend strength, questions around valuation and cash flow cover should not be overlooked. MGE Energy's shares have been on the rise but are still potentially undervalued by 12%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on MGE Energy - why the stock might be a potential multi-bagger!

Build Your Own MGE Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MGE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MGE Energy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGEE

MGE Energy

Through its subsidiaries, operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives