- United States

- /

- Electric Utilities

- /

- NasdaqGS:LNT

Is Alliant Energy’s (LNT) $725 Million Notes Offering Enhancing Its Growth and Investment Flexibility?

Reviewed by Sasha Jovanovic

- Alliant Energy Corporation recently completed a US$725 million public offering of fixed-to-floating rate junior subordinated unsecured notes due April 1, 2056, with proceeds intended for debt reduction and general corporate purposes.

- This action enhances Alliant Energy’s flexibility to fund infrastructure projects, including the newly announced Columbia Energy Storage Project supported by federal grants.

- We’ll explore how bolstered financial flexibility from this bond offering could influence Alliant Energy’s investment outlook and growth opportunities.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Alliant Energy Investment Narrative Recap

To be a shareholder in Alliant Energy, you need to believe in the long-term opportunity created by surging electricity demand from major data center projects and the company’s ability to profitably fund the required infrastructure. The recent US$725 million fixed-to-floating note offering gives Alliant flexibility for near-term capital projects, but given the scale of upcoming investment needs, it is unlikely to materially alter the most important short-term catalyst, timely onboarding of new data center loads, or mitigate the biggest immediate risk of overdependence on these projects and potential delays.

The newly announced Columbia Energy Storage Project is especially relevant to this bond issuance, as both focus on supporting grid reliability for new and anticipated customer demand. Federal grant support for this project aligns with Alliant’s broader investment in innovative technologies aimed at efficiently managing higher loads from data center expansion, which remains the key driver for future revenue and earnings growth.

However, it’s worth noting that if data center onboarding is slower than expected, investors should be aware that...

Read the full narrative on Alliant Energy (it's free!)

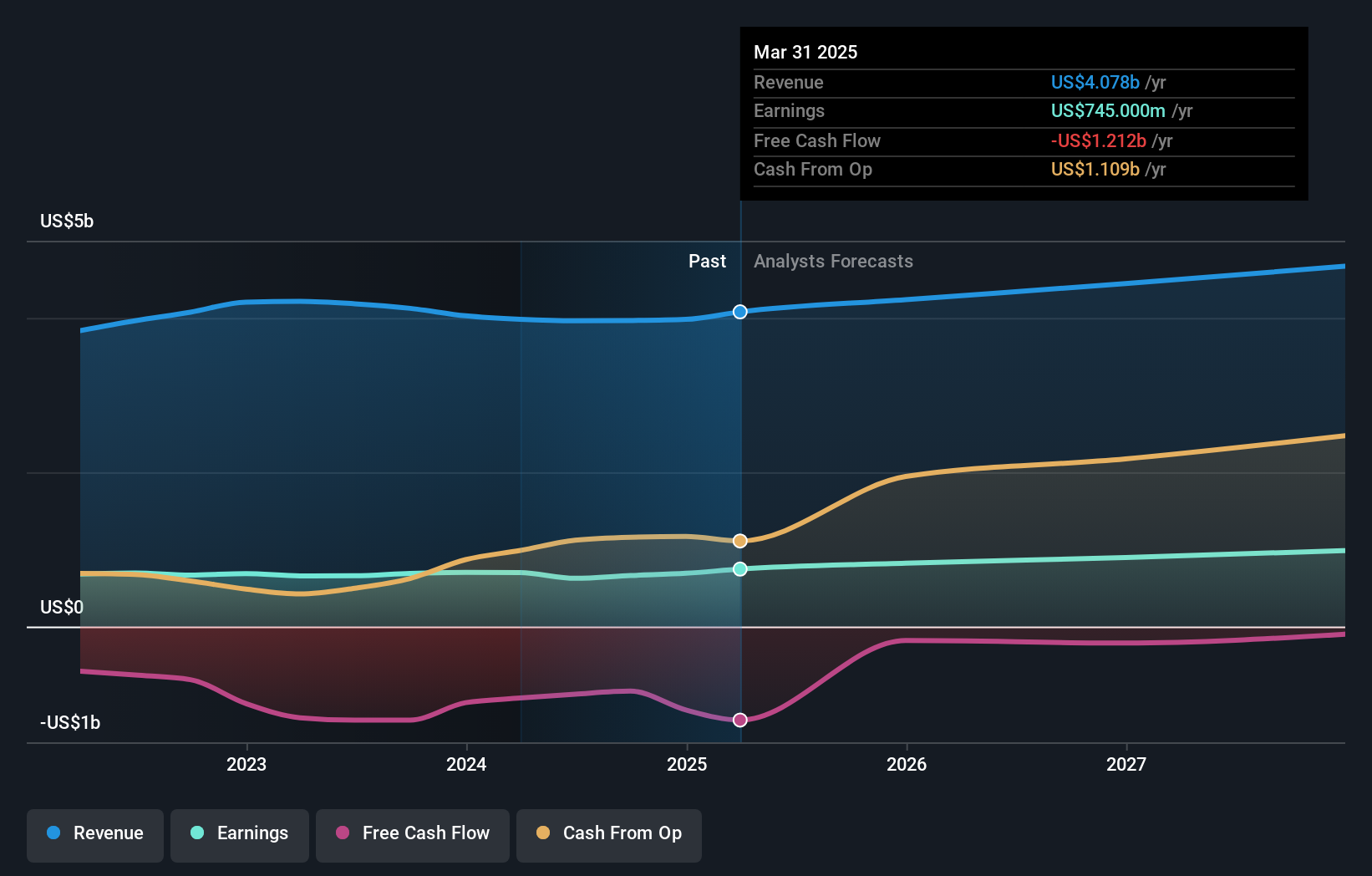

Alliant Energy is projected to reach $4.9 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a yearly revenue growth rate of 5.4% and an increase in earnings of $268 million from current earnings of $832 million.

Uncover how Alliant Energy's forecasts yield a $68.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Alliant Energy’s fair value between US$60.77 and US$68.50, based on 2 independent forecasts. While you consider these opinions, remember that the company’s reliance on large data center projects for future growth could significantly impact performance if project timelines shift unexpectedly.

Explore 2 other fair value estimates on Alliant Energy - why the stock might be worth 9% less than the current price!

Build Your Own Alliant Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alliant Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alliant Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alliant Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LNT

Alliant Energy

Operates as a utility holding company that provides regulated electric and natural gas services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives