- United States

- /

- Electric Utilities

- /

- NasdaqGS:EXC

Exelon (NasdaqGS:EXC) Promotes Khouzami To EVP As Energy Demand Expected To Surge

Reviewed by Simply Wall St

Exelon (NasdaqGS:EXC) is undergoing a significant leadership change, with Carim Khouzami taking on the role of Executive Vice President to enhance transmission operations during rising energy demands. These changes come amid a strong quarterly performance, reflected in a 19% increase in the company's share price. Exelon's recent appointment of David DeWalt to its board, bringing cybersecurity expertise, and solid earnings growth add further strength to its market position. Additionally, Exelon's quarterly dividend increase highlights confidence in continued performance. This upward trend contrasts with the flat broader market, underscoring Exelon's positive trajectory in the energy sector.

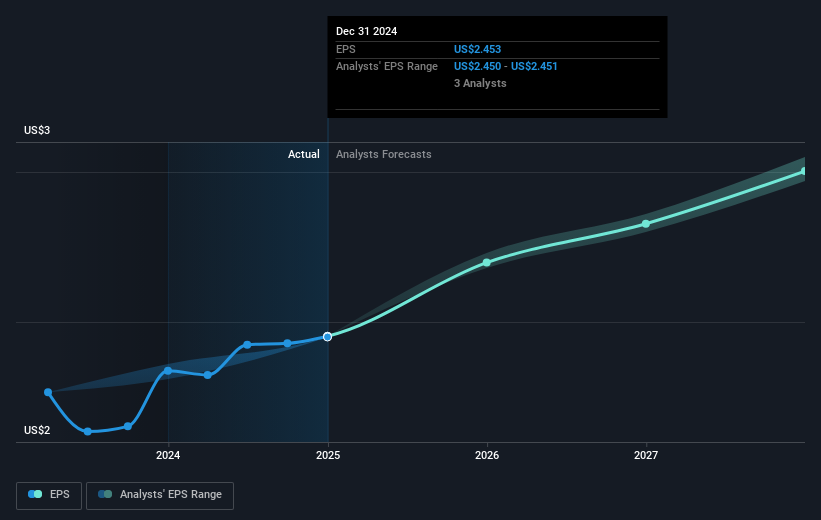

The leadership changes at Exelon, with Carim Khouzami stepping in as Executive Vice President, and David DeWalt joining the board, are poised to strengthen the company's focus on transmission and cybersecurity. These moves align with Exelon's planned $38 billion investment from 2025 onwards to enhance energy transformation and transmission expansion, indicating a potentially positive impact on future revenue and earnings growth. Analysts predict a 3.2% annual revenue growth and an annual earnings growth of 5% to 7% through 2028, backed by favorable regulatory outcomes and strategic projects.

Over the past five years, Exelon's total shareholder return, including dividends, was 118.52%, reflecting substantial gains. This performance stands out compared to the 18.5% return of the US Electric Utilities industry over the past year, highlighting Exelon's relative strength. However, while the share price has seen recent upward momentum, it currently trades slightly above the analyst consensus price target of US$45.53, suggesting a 2.1% decline from its current level of US$46.51.

These developments could potentially enhance Exelon's earnings forecasts and revenue prospects, further supporting its market position. Nevertheless, with ongoing regulatory challenges and the substantial capital demands of its projects, Exelon must carefully manage these dynamics to sustain its growth trajectory.

Evaluate Exelon's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXC

Exelon

A utility services holding company, engages in the energy distribution and transmission businesses.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives