- United States

- /

- Electric Utilities

- /

- NasdaqGS:EXC

Exelon (EXC): Fresh Analyst Upgrades Spark a New Look at Valuation and Growth Potential

Reviewed by Kshitija Bhandaru

Exelon, one of the largest utility companies in the US, has seen a wave of updated analyst views. Several firms have expressed renewed confidence in the company's prospects and performance, which has sparked heightened interest from investors.

See our latest analysis for Exelon.

Exelon's positive analyst momentum arrives on the heels of a few noteworthy milestones, including the company’s 25th anniversary celebration on the Nasdaq and reaffirmed guidance ahead of its upcoming quarterly results. The stock has enjoyed a meaningful boost, with a 1-month share price return of nearly 11% and a year-to-date gain of 25.8%. Looking longer-term, total shareholder return sits at an impressive 20.6% over the past year and nearly 88% over five years. These are clear signs that recent confidence is part of an ongoing pattern of solid returns.

If you’re interested in uncovering other utility companies showing strong performance and insider backing, now is a great opportunity to broaden your view and discover fast growing stocks with high insider ownership

Yet with analyst upgrades sending shares to new highs, investors may wonder if Exelon’s strong performance still offers upside or if the market has already factored in all of its future growth potential.

Most Popular Narrative: Fairly Valued

With a narrative fair value of $47.93 and Exelon's last close at $47.36, the gap has nearly disappeared. Investors are seeing a near match between the fair value estimate and the market price, a signal that current momentum has aligned pricing with expectations.

*Robust growth in electricity demand from large-scale data centers, quantum computing campuses, and industrial electrification is materially expanding Exelon's large-load interconnection pipeline, driving higher volumes and enabling greater capital deployment in grid infrastructure, supporting long-term revenue and regulated rate base growth.*

What's fueling this market optimism? The narrative hinges on forward-looking earnings and aggressive infrastructure investment. These numbers could set a new benchmark for Exelon’s future growth. Want to know exactly which forecasts power this valuation? Only the full narrative reveals the bold financial projections at play.

Result: Fair Value of $47.93 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and persistent cost increases could undermine Exelon's growth story. These challenges may put future earnings and margin stability at risk.

Find out about the key risks to this Exelon narrative.

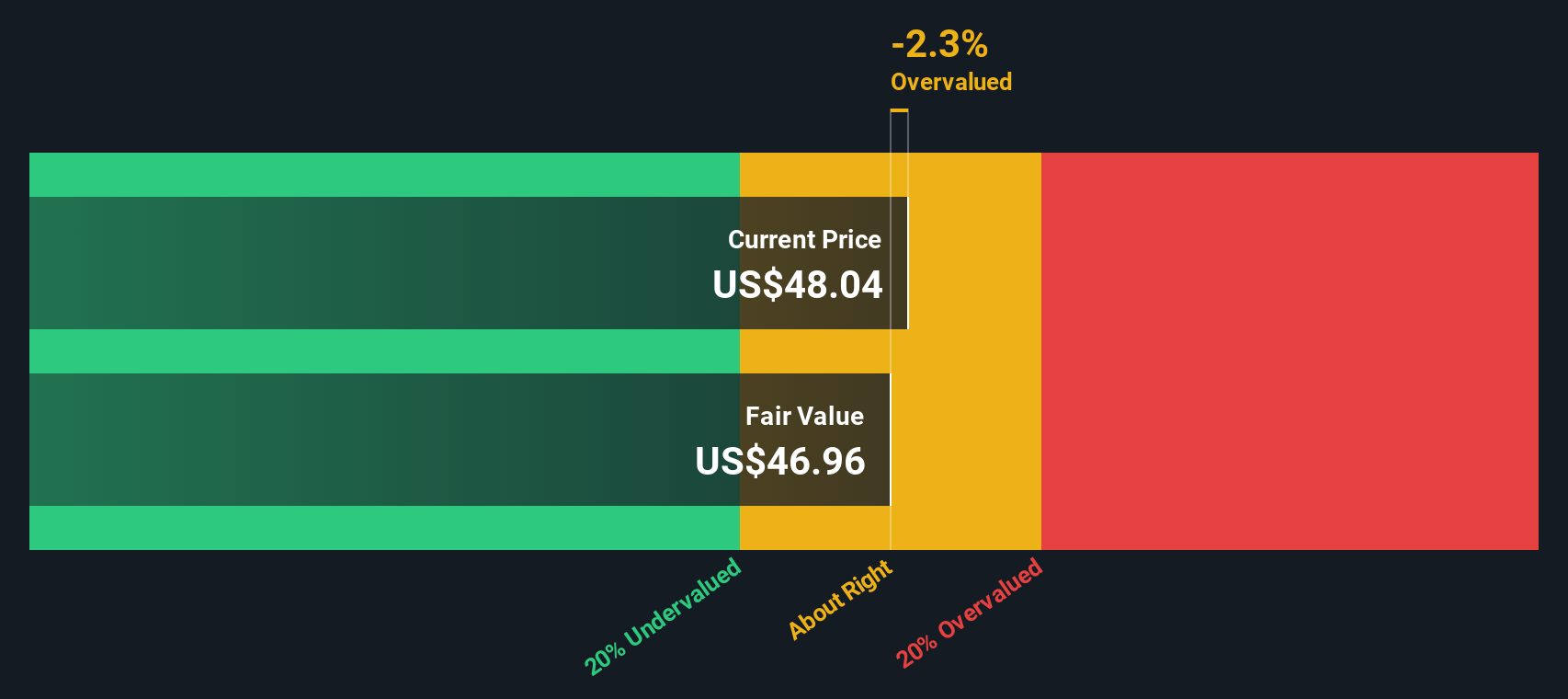

Another View: DCF Model Perspective

While fair value estimates based on earnings multiples suggest Exelon is about correctly priced, our SWS DCF model tells a slightly different story. By projecting Exelon's future cash flows and discounting them back to today, the model produces a value just under the current share price. This hints the stock might be leaning toward slight overvaluation. Which approach should investors trust more when assessing opportunity and risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Exelon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Exelon Narrative

If you have a different perspective or want to see where your own analysis leads, it's quick and easy to craft your own story in just a few minutes. Do it your way

A great starting point for your Exelon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always searching for fresh opportunities. Don’t limit yourself to just one stock when a world of trends could boost your returns.

- Capitalize on robust yields and steady payouts by browsing these 20 dividend stocks with yields > 3% with attractive income potential above 3%.

- Uncover a surge of innovation by checking out these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs in every sector.

- Position yourself ahead of the market by hunting for overlooked value among these 874 undervalued stocks based on cash flows generating strong cash flow and hidden upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXC

Exelon

A utility services holding company, engages in the energy distribution and transmission businesses.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives