- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Is Evergy’s (EVRG) Advanced Nuclear Collaboration With TerraPower Shaping Its Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- On September 23, 2025, TerraPower, Evergy, and the Kansas Department of Commerce announced a memorandum of understanding to explore siting TerraPower's Natrium nuclear reactor and energy storage system within Evergy’s Kansas service territory.

- This collaboration marks a potential step forward in bringing advanced nuclear energy to Kansas, with an emphasis on evaluating community support, technical feasibility, and regulatory pathways for a cutting-edge, non-carbon emitting power plant.

- We'll explore how Evergy's partnership with TerraPower to evaluate advanced nuclear technology could influence its future growth strategy.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Evergy Investment Narrative Recap

For those interested in Evergy, the investment thesis often hinges on robust electricity demand growth from commercial customers, long-term opportunities in grid modernization, and the company’s drive to diversify generation assets. While the newly announced MOU with TerraPower to explore advanced nuclear technology aligns with Evergy’s renewables push, its influence on the most immediate catalyst, execution of planned generation expansion, appears limited for now, given the early stage and long lead times typical for nuclear projects.

Among Evergy’s recent announcements, the October 2024 plans to build two large combined-cycle natural gas plants stand out as the most relevant to current catalysts. These projects directly target near-term load growth from major clients and support rate base expansion, a primary driver behind the company’s projected earnings and revenue growth trajectory.

However, against this backdrop, investors should also pay attention to the risk that Evergy’s extensive capital needs expose it to swings in interest rates and funding costs, especially as...

Read the full narrative on Evergy (it's free!)

Evergy's narrative projects $6.8 billion revenue and $1.2 billion earnings by 2028. This requires 5.0% yearly revenue growth and a $359.9 million earnings increase from $840.1 million today.

Uncover how Evergy's forecasts yield a $75.60 fair value, in line with its current price.

Exploring Other Perspectives

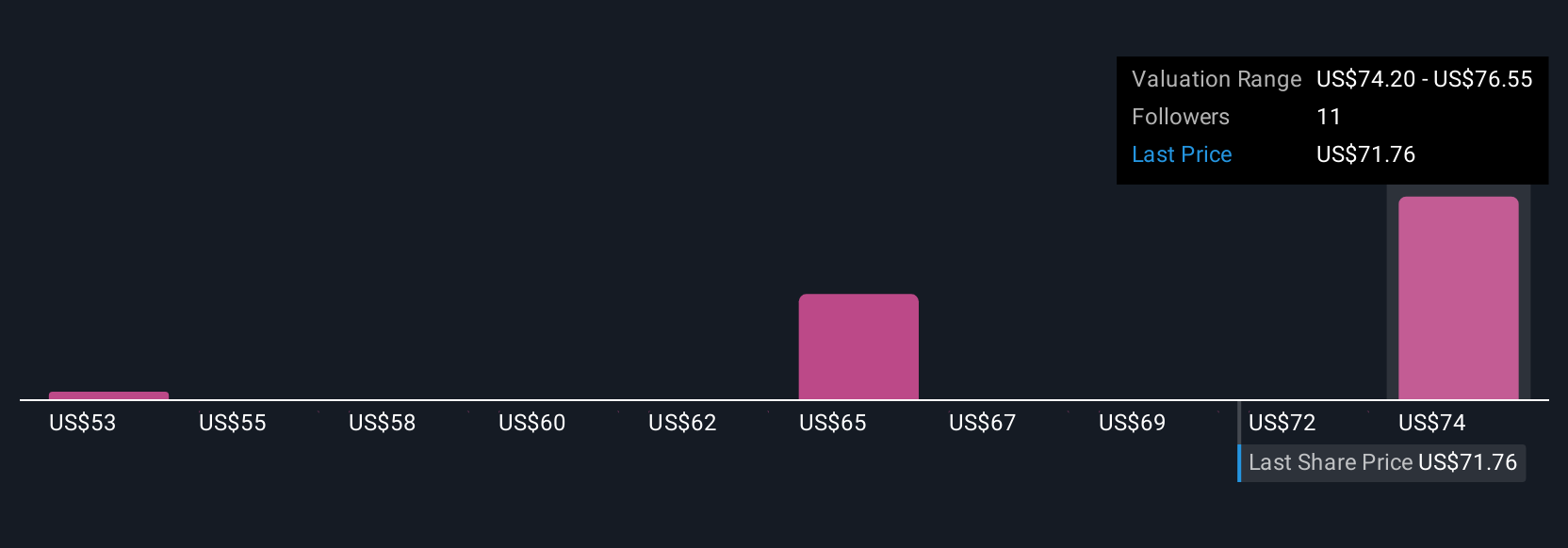

Simply Wall St Community members supplied four fair value estimates for Evergy, ranging from US$53 to US$76.55 per share. With generation expansion plans driving future growth, your view on load growth risk could shape where you stand among these diverse opinions.

Explore 4 other fair value estimates on Evergy - why the stock might be worth 28% less than the current price!

Build Your Own Evergy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evergy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Evergy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evergy's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives