- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Evergy, Inc.'s (NASDAQ:EVRG) Price In Tune With Earnings

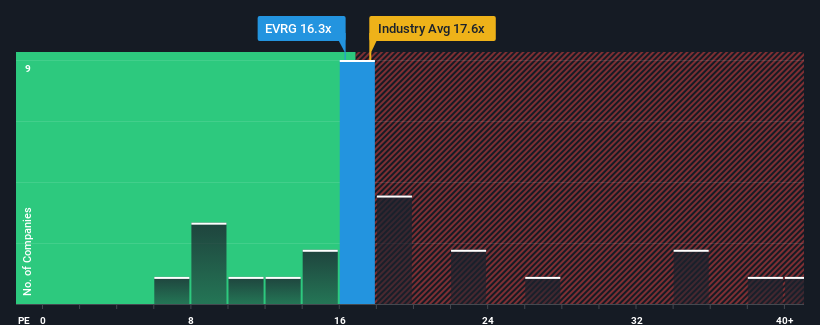

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about Evergy, Inc.'s (NASDAQ:EVRG) P/E ratio of 16.3x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

There hasn't been much to differentiate Evergy's and the market's retreating earnings lately. The P/E is probably moderate because investors think the company's earnings trend will continue to follow the rest of the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue tracking the market.

View our latest analysis for Evergy

How Is Evergy's Growth Trending?

Evergy's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.9%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 10.0% per year over the next three years. That's shaping up to be similar to the 10% per annum growth forecast for the broader market.

In light of this, it's understandable that Evergy's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Evergy's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Evergy is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on Evergy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives