- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Is Constellation Energy's (CEG) AI Data Center Focus Reshaping Its Competitive Edge in Clean Power?

Reviewed by Sasha Jovanovic

- Constellation Energy has emerged as a focus in recent news after being highlighted by analysts for its unique positioning at the intersection of nuclear energy and artificial intelligence, which has led to major deals with technology firms seeking carbon-free power for expanding data center operations.

- An important insight is Constellation Energy's status as the largest source of carbon-free electricity in the US, a factor increasingly valued by institutional investors and corporations pursuing ambitious emissions targets and digital transformation projects.

- We’ll assess how Constellation Energy’s expanding role in powering AI-driven data centers is influencing its investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Constellation Energy Investment Narrative Recap

To own shares in Constellation Energy, an investor needs confidence in the continued surge in demand for reliable, carbon-free electricity, especially from AI-driven data centers, and belief that the company can balance growth with the risks of nuclear regulation and potential shifts in utility demand. While the stock’s short-term slide after recent sector volatility attracted headlines, there was no material change to the direct catalyst of large-scale clean energy contracts, nor to the most significant risk tied to regulatory and operational nuclear costs.

The recent 20-year power purchase agreement with Meta stands out as an example of Constellation’s success in securing long-term, high-profile partnerships with major technology firms. These agreements reinforce the revenue visibility that underpins the company’s investment thesis, though they also highlight the importance of managing exposure to concentration risk in major customer contracts and evolving energy policy trends.

By contrast, it’s important for investors to be aware of how future regulatory changes could impact...

Read the full narrative on Constellation Energy (it's free!)

Constellation Energy is projected to reach $26.7 billion in revenue and $3.6 billion in earnings by 2028. This outlook assumes a 2.5% annual revenue growth and an increase in earnings of $0.6 billion from the current $3.0 billion.

Uncover how Constellation Energy's forecasts yield a $359.31 fair value, in line with its current price.

Exploring Other Perspectives

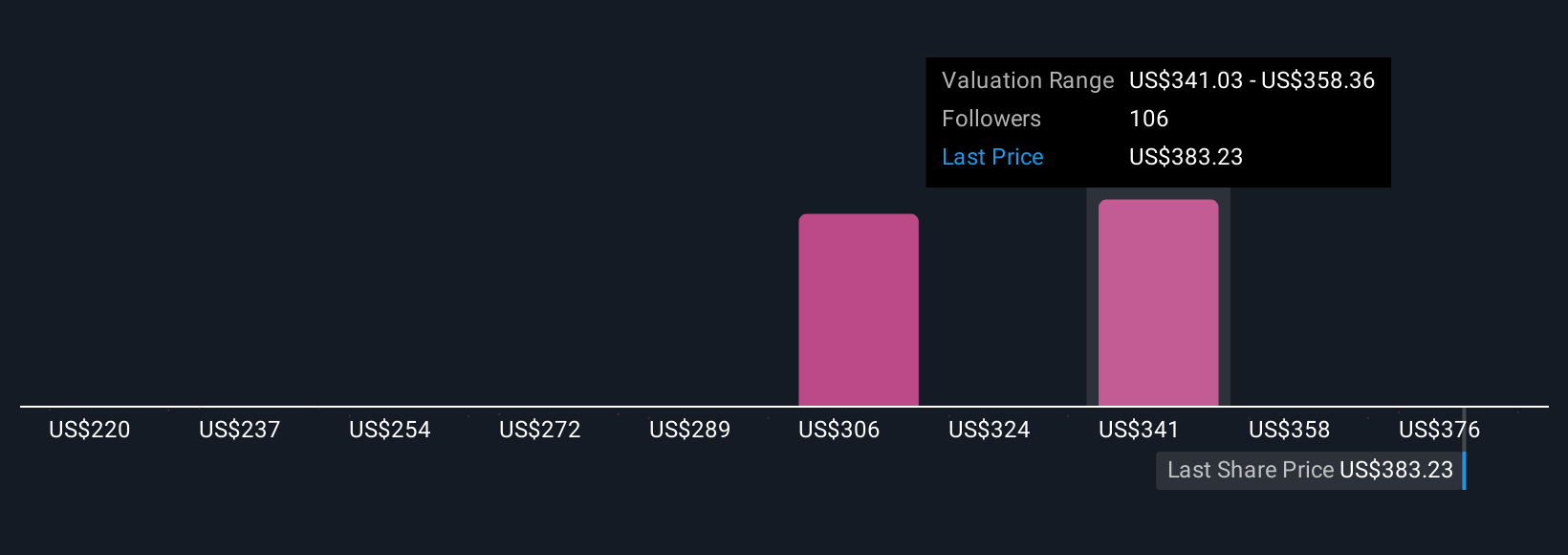

Fourteen fair value estimates from the Simply Wall St Community range widely from US$219.78 to US$393 per share. This diversity of outlooks comes as institutional demand for carbon-free energy continues to drive interest and long-term partnerships in the sector.

Explore 14 other fair value estimates on Constellation Energy - why the stock might be worth 40% less than the current price!

Build Your Own Constellation Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Constellation Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives