- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Has the Rally in Constellation Energy Gone Too Far After Its 2025 Surge?

Reviewed by Bailey Pemberton

If you're watching Constellation Energy, you're probably wondering whether now is the right moment to jump in, cash out, or simply hold tight. After all, this is a stock that's hardly sat still recently. Just over the last month, the price has leapt upward by 22.8%, adding to a remarkable 63.5% climb since the start of the year. Over the past year, shares have gained an impressive 47.1%, and if you look even further back, the three-year return sits at an eye-popping 380.8%. That is the kind of performance that can redefine the conversation about what is possible in the utilities sector.

Much of this momentum has been driven by a shift in the market’s perception of companies powering clean energy transitions. As the global spotlight pivots toward decarbonization and grid resilience, Constellation Energy has started to look like a dynamic player, not just a steady utility. Investors seem to be rewarding the company for its footprint in nuclear and renewable generation, anticipating more growth as policy and investment dollars flow into the sector.

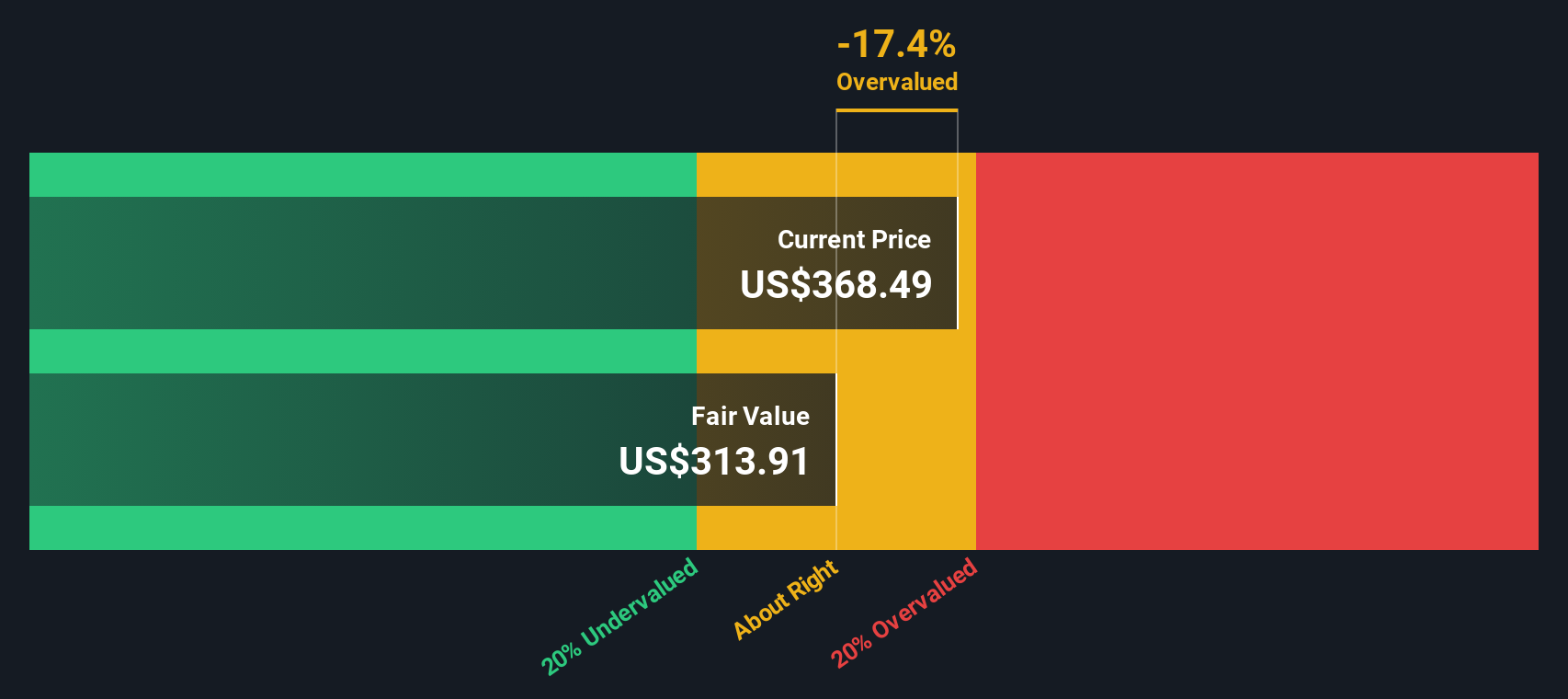

But when it comes to deciding if Constellation Energy is a buy, valuation always matters. According to a range of standard valuation checks, the company is currently undervalued in 0 out of 6 ways. By the numbers, it is priced to perfection, or maybe even a bit beyond. Of course, valuation methods are not created equal, so in the next section we will dig into those approaches, and later on, I will share a useful perspective for sizing up whether this stock truly deserves a place in your portfolio.

Constellation Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Constellation Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and discounting them back to their present value. For Constellation Energy, this approach uses a two-stage free cash flow to equity model. It starts from current financial performance and then estimates further growth years into the future.

Right now, Constellation’s most recent twelve-month free cash flow stands at -$2.6 billion, reflecting a challenging baseline. Analyst forecasts anticipate a sharp reversal and project free cash flow to climb to $3.6 billion by 2029. While official analyst estimates are limited to the next five years, later years’ cash flows through 2035 are extrapolated, with projections showing a steady upward trajectory in future billions of dollars.

Based on these estimates, the DCF model calculates a fair value of $220.80 per share. Compared to the current share price, this suggests the stock is trading at a 79.6% premium to intrinsic value, making it appear significantly overvalued according to this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Energy may be overvalued by 79.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Constellation Energy Price vs Earnings

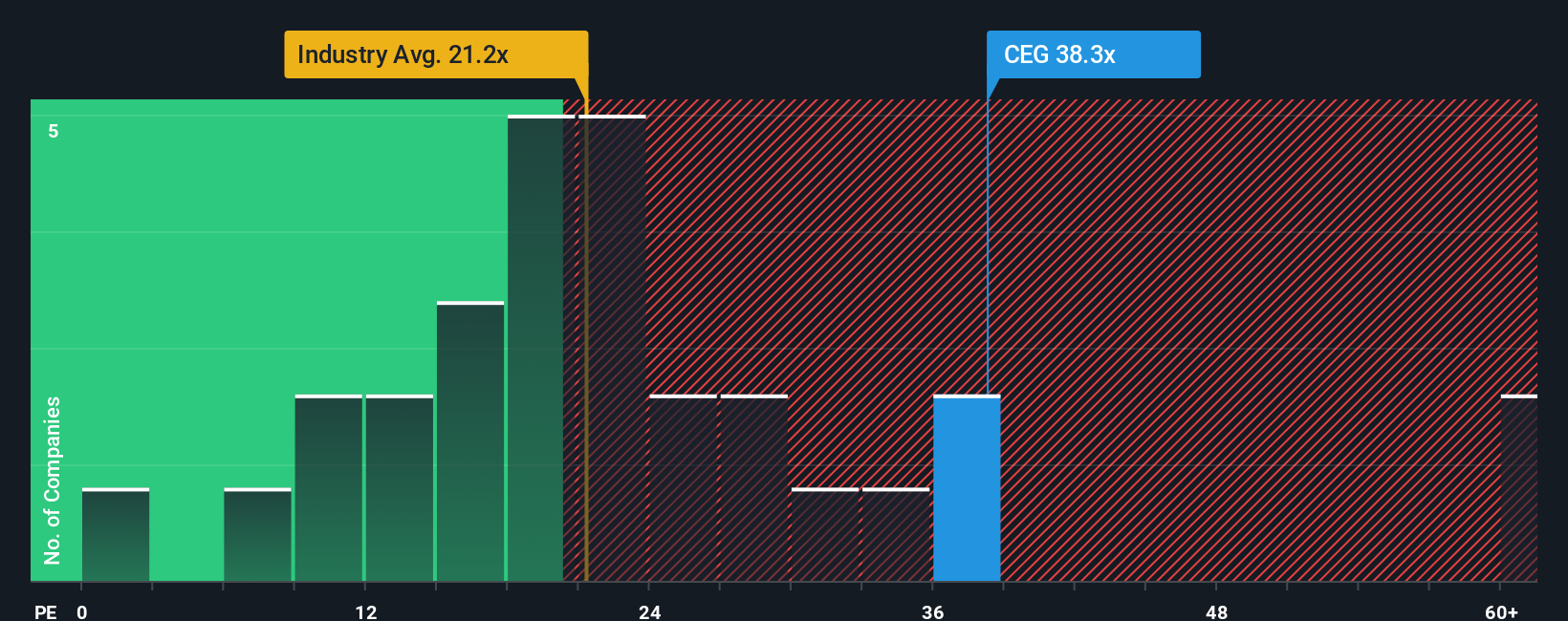

The price-to-earnings (PE) ratio is often the preferred multiple when evaluating established, profitable companies like Constellation Energy. This metric gives investors a straightforward way to compare how much the market is willing to pay today for a dollar of current earnings, making it especially useful when a company's profits are expected to persist or grow over time.

What makes a "fair" PE ratio, however, is not a one-size-fits-all calculation. Companies with stronger growth prospects and lower risks typically justify higher PE ratios, while those in mature or riskier sectors may attract lower multiples. Looking at Constellation Energy, its current PE sits at 41.2x. For context, the average for the Electric Utilities industry is 21.4x and its direct peers average 23.3x, both considerably lower than Constellation’s current valuation.

To give this comparison more nuance, Simply Wall St introduces the “Fair Ratio.” This proprietary calculation incorporates not just industry benchmarks or historical averages, but also factors like the company’s own growth prospects, profit margins, risk profile, and market capitalization. This approach goes beyond simple peer or industry comparisons by tailoring the expected multiple to Constellation’s unique situation. For Constellation Energy, the Fair Ratio stands at 39.3x, only slightly below the current PE multiple. This narrow difference suggests that, despite Constellation Energy trading at a premium to its industry, the price is roughly in line with what its growth and quality might warrant.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Constellation Energy Narrative

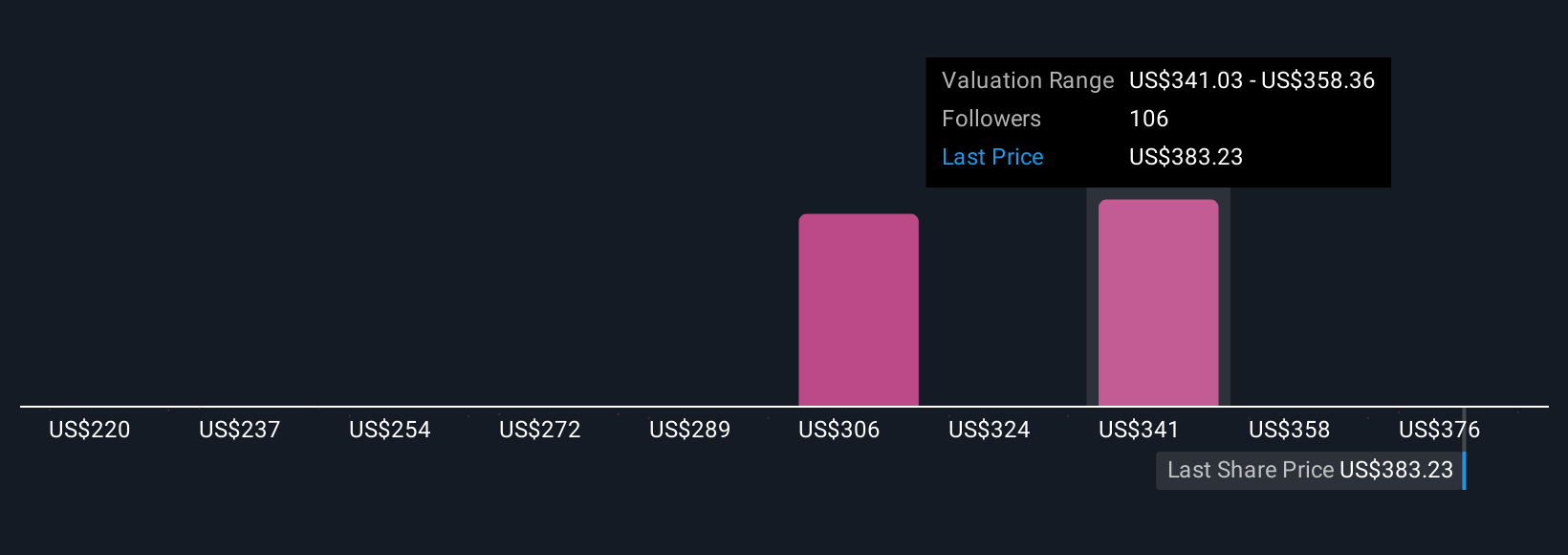

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your story about a company, connecting your view of its prospects and risks to your own forecast of its future financials and the Fair Value you believe is justified. Narratives act as a bridge between headlines, earnings forecasts, and what you are willing to pay for a stock, turning numbers into actionable decisions.

On Simply Wall St’s Community page, Narratives are accessible for every investor, breaking down complex valuation models into easy-to-follow logic shared by millions of users. Narratives refresh dynamically as new information such as earnings, big news events, or regulatory changes roll in, keeping your view current and relevant.

This empowers you to answer critical buy or sell questions by simply comparing your Fair Value (or the Community’s) to the price on offer. For example, some Constellation Energy Narratives forecast a fair value as high as $393 per share, based on strong earnings growth and nuclear capacity expansion, while others are much more cautious, assigning just $184 per share in light of regulatory risks and changing demand.

Your Narrative lets you see your assumptions side by side with the market, so your investment approach is always grounded in what you actually believe will happen.

Do you think there's more to the story for Constellation Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives