- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

Strong Q2 Earnings and Director Share Sale Could Be a Game Changer for American Electric Power (AEP)

Reviewed by Simply Wall St

- Earlier this month, American Electric Power Company reported second-quarter earnings for 2025 that exceeded expectations, posting earnings per share of US$1.43 compared to the forecasted US$1.22, alongside higher-than-expected revenue and a director selling 5,000 shares worth US$543,250 under a pre-set plan.

- Analysts highlighted both the company’s robust financial performance and its plans for increased capital spending, while recent regulatory decisions and asset sales have influenced expectations for American Electric Power’s near-term outlook.

- We’ll explore how American Electric Power’s strong earnings performance this quarter affects its investment narrative and future growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

American Electric Power Company Investment Narrative Recap

To be a shareholder in American Electric Power Company today, you need to believe in the strength of its commercial and industrial growth strategy and the potential for robust returns from substantial capital investments. The recent earnings beat reinforces optimism around near-term growth, but does not materially change the key short-term catalyst, the execution of its US$54 billion capital plan, or mitigate the biggest current risk, which remains regulatory uncertainty, especially related to decisions in Ohio and outcomes for new multi-year rate plans (MYPs).

Of the recent announcements, AEP’s decision to sell a 5% stake in its transmission business for US$2.8 billion stands out. The proceeds are earmarked for accelerating capital expenditures and reducing debt, both of which tie directly to its growth ambitions and financial resilience, core themes at the heart of its investment case, especially as regulatory outcomes remain a significant variable.

But investors should also keep in mind, contrary to recent momentum, that changes in Ohio’s regulatory landscape could significantly impact returns and valuation...

Read the full narrative on American Electric Power Company (it's free!)

American Electric Power Company's narrative projects $24.6 billion revenue and $4.1 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.5 billion earnings increase from $3.6 billion today.

Uncover how American Electric Power Company's forecasts yield a $115.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

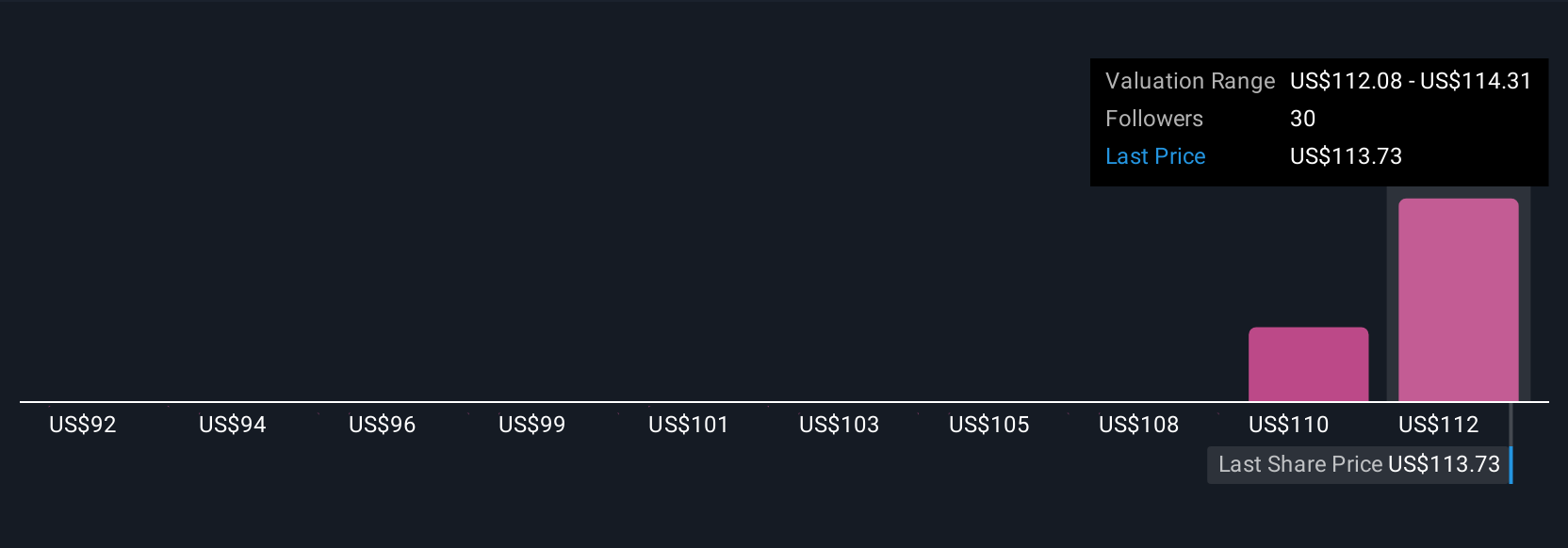

Four individual fair value estimates from the Simply Wall St Community range from US$92 to US$115 per share. While participants' views span over US$20, the ongoing uncertainty in Ohio’s regulatory environment remains front of mind for many weighing the company’s future performance.

Explore 4 other fair value estimates on American Electric Power Company - why the stock might be worth as much as 8% more than the current price!

Build Your Own American Electric Power Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Electric Power Company's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives