- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

AEP (AEP) Valuation: How the $1.1 Billion Debt Offering Shapes the Investment Case

Reviewed by Kshitija Bhandaru

If you’re watching American Electric Power Company (AEP) this week, you’re not alone. The company's recent $1.1 billion fixed-income offering, featuring junior subordinated unsecured notes due in 2056, has put it squarely in the investment spotlight. Adding to the interest, AEP also brought in CIBC World Markets Corp. and Guggenheim Securities, LLC as co-lead underwriters for the deal. For investors weighing the stock, these moves signal AEP is seeking additional capital, raising plenty of questions about what comes next.

Looking back over the past year, AEP’s stock has delivered an 11% total return, with the share price up nearly 19% year to date. While there was a dip in the last month, momentum appears to have returned recently, with gains in both the last week and quarter. Outside of this capital markets activity, however, there haven’t been big headlines or shifts in the utility’s operating environment. This bond issuance stands out as the clear market catalyst right now.

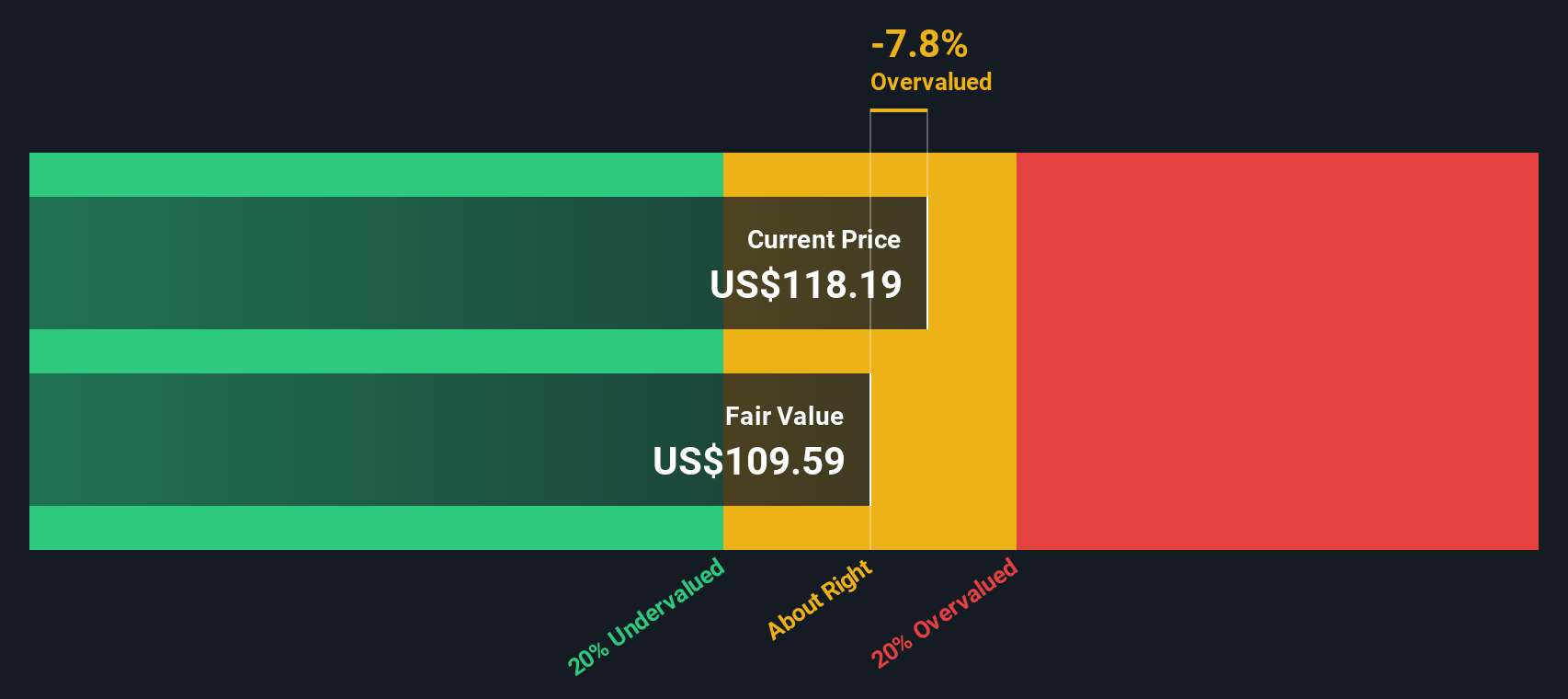

So is the stock’s recent trajectory hinting at an undervalued opportunity for new investors, or is the market simply pricing in all prospects for future growth?

Most Popular Narrative: 5% Undervalued

The most widely followed narrative suggests that American Electric Power Company is modestly undervalued, with future growth prospects supporting a fair value above today's share price.

Analysts are assuming American Electric Power Company's revenue will grow by 6.0% annually over the next 3 years. The company has a substantial capital investment plan of $54 billion over the next 5 years, with an additional potential of $10 billion, primarily aimed at expanding transmission and distribution. This indicates future growth in earnings.

Think the grid is just business as usual? This narrative attributes its high valuation to a bold infrastructure overhaul and ambitious financial forecasts that could surprise even seasoned investors. Want to unravel which specific financial leaps and strategic moves might justify this market optimism? The key numbers behind this fair value might just change your outlook on utilities.

Result: Fair Value of $115 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, commercial demand is less profitable than residential. In addition, regulatory uncertainty, especially in Ohio, could limit the upside for earnings growth.

Find out about the key risks to this American Electric Power Company narrative.Another View: The SWS DCF Model’s Perspective

The SWS DCF model offers a different angle by focusing on cash flows rather than market comparisons. According to its results, American Electric Power Company is trading below its fair value. Does this support analyst optimism, or does it overlook risks that may be present beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Electric Power Company Narrative

If you see the story differently or prefer hands-on research, crafting your own investment thesis is quick and straightforward. Do it your way with Do it your way.

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Don’t miss your chance to get ahead of the market. Unique opportunities are waiting for investors who look beyond the obvious. Uncover promising stocks and sectors with confidence using these handpicked ideas:

- Pinpoint value with companies boasting strong cash flows and capital efficiency by seeking out undervalued stocks based on cash flows hiding in plain sight.

- Get in early on future-focused breakthroughs, from artificial intelligence to next-level automation, by checking out AI penny stocks powering tomorrow’s innovation leaders.

- Ramp up your long-term returns with steady income potential by scouting dividend stocks with yields > 3% delivering consistent yields above the market norm.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026