- United States

- /

- Transportation

- /

- OTCPK:RRTS

Did Changing Sentiment Drive Roadrunner Transportation Systems's (NYSE:RRTS) Share Price Down A Disastrous 99%?

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Imagine if you held Roadrunner Transportation Systems, Inc. (NYSE:RRTS) for half a decade as the share price tanked 99%. We also note that the stock has performed poorly over the last year, with the share price down 38%. Even worse, it's down 26% in about a month, which isn't fun at all.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Roadrunner Transportation Systems

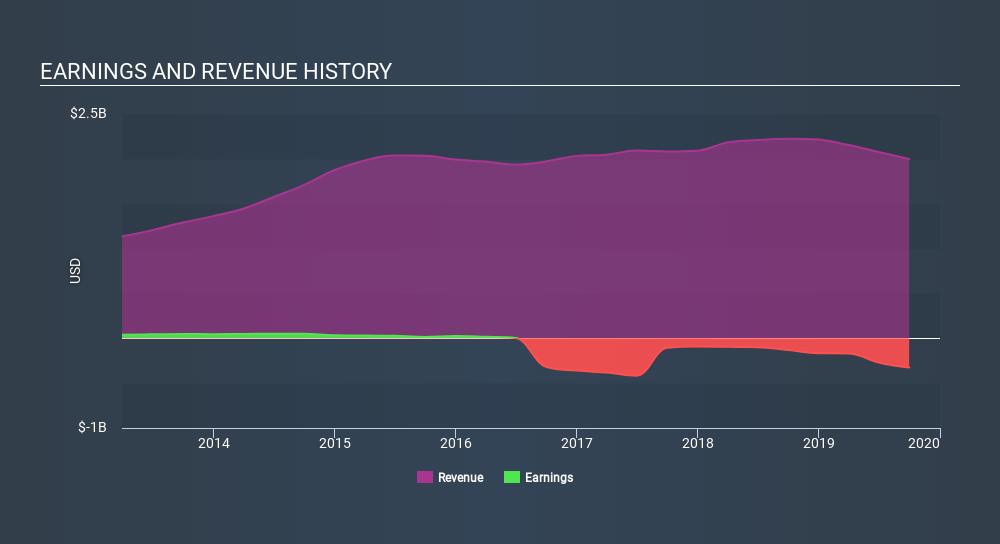

Because Roadrunner Transportation Systems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Roadrunner Transportation Systems saw its revenue increase by 2.9% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 59% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Roadrunner Transportation Systems shareholders are down 38% for the year, but the market itself is up 6.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 59% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Roadrunner Transportation Systems (1 shouldn't be ignored) that you should be aware of.

We will like Roadrunner Transportation Systems better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:RRTS

Roadrunner Transportation Systems

Provides asset-right transportation and asset-light logistics services.

Very low with weak fundamentals.

Market Insights

Community Narratives