- United States

- /

- Transportation

- /

- NYSE:YMM

A Look at Full Truck Alliance (NYSE:YMM) Valuation Following Strong Earnings, Dividend Announcement, and Upbeat Outlook

Reviewed by Simply Wall St

If you have been tracking Full Truck Alliance (NYSE:YMM), this week brought plenty for investors to consider. The company not only reported strong financials for the latest quarter, showing healthy increases in both revenue and net income compared to last year, but its board also approved a semi-annual dividend. In addition, management signaled confidence by issuing fresh guidance pointing to continued revenue growth for the third quarter. These are the kinds of developments that can bring a stock to the attention of investors as they consider their next steps.

Unsurprisingly, shares of Full Truck Alliance have picked up momentum over the past month. The stock has returned 22% in the past month and 11% over the past three months, putting its gain for the year at 21% and 81% over twelve months. These numbers reflect both improving fundamentals and a growing willingness by the market to price in higher expectations for the company, especially as dividend news and earnings beats tend to shift sentiment quickly. Recent events are reinforcing a strong long-term narrative that has played out well for shareholders so far.

After this burst of optimism and price appreciation, is Full Truck Alliance trading at a discount given its growth prospects, or is the market already pricing in another strong year ahead?

Most Popular Narrative: 13.9% Undervalued

According to the most widely followed narrative, Full Truck Alliance appears undervalued against its fair value estimate, with analysts seeing meaningful upside potential from current levels. This view rests on promising growth drivers and improved profitability that anchor its future earnings forecasts.

Accelerating digitalization, AI-driven efficiencies, and expanded value-added services are boosting platform engagement, reducing costs, and diversifying revenue streams for improved profitability. Growth in SME shipper and trucker bases, enhanced user experience, and broader addressable market strengthen network effects and long-term volume-driven earnings potential.

What if Full Truck Alliance's future valuation does not just rely on industry trends, but bold projections about its expanding margins, revenue runway, and platform scale? Want a clearer picture of the ambitious growth benchmarks and aggressive earnings targets driving this outlook? Find out what numbers really power this undervaluation call, and whether the current price leaves room for a re-rating as momentum builds.

Result: Fair Value of $15.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising user acquisition costs and slowing freight brokerage growth could challenge Full Truck Alliance’s upbeat outlook if these trends persist or intensify.

Find out about the key risks to this Full Truck Alliance narrative.Another View: Cross-Checking With Our DCF Model

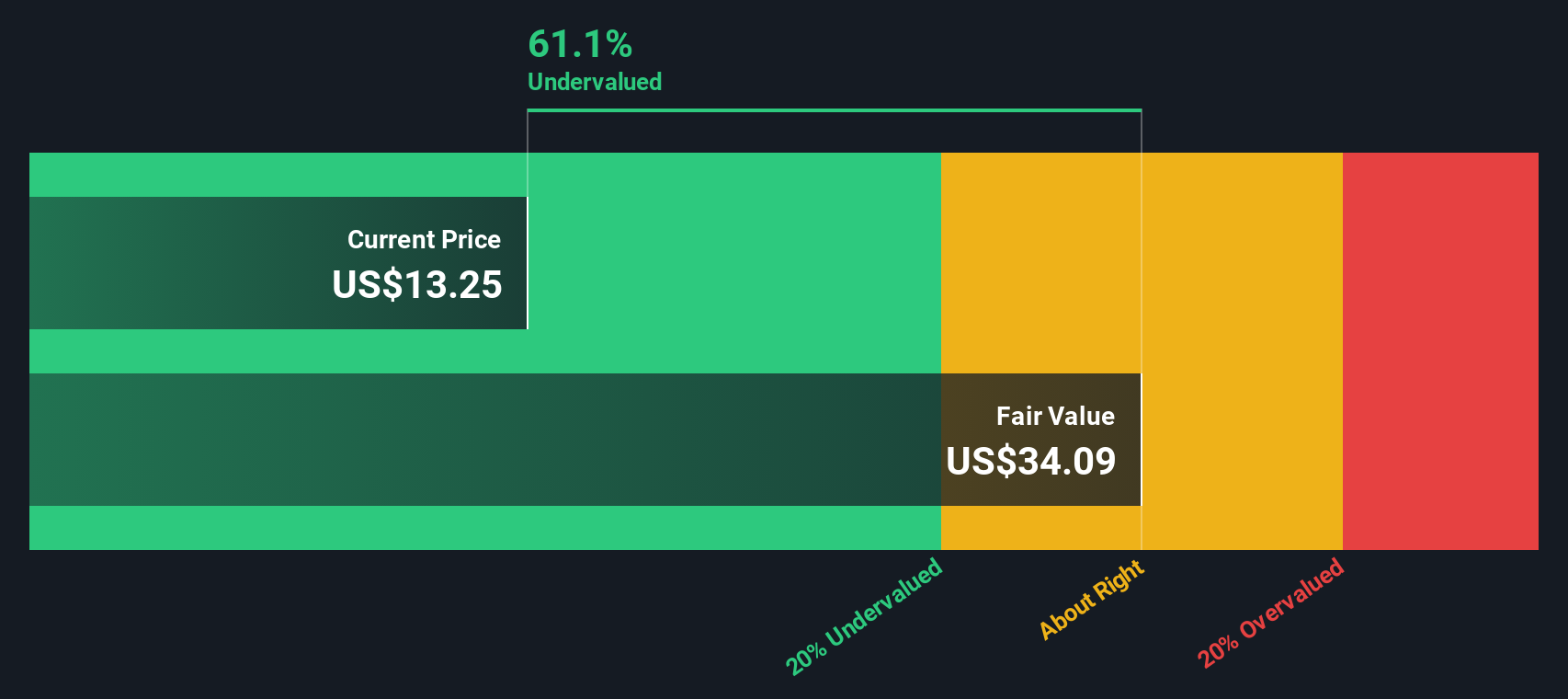

While analysts see upside potential using future earnings estimates and market-driven measures, our SWS DCF model also suggests the stock is undervalued but approaches valuation from a different perspective. The question is whether this second method confirms a real margin of safety or challenges the optimism of analyst forecasts.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Full Truck Alliance Narrative

If the numbers or outlook above do not align with your own view, you can analyze the data independently and map out your personal thesis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Full Truck Alliance.

Looking for More Smart Investment Ideas?

Unlock even more opportunities by seeing what other standout companies are doing right now. These screeners help you find standout ideas you might regret missing.

- Uncover stocks generating steady income streams with higher yields by using our handpicked dividend stocks with yields > 3% for a solid foundation in your portfolio.

- Catch the wave of innovation and tap into emerging leaders shaking up healthcare with smarter diagnostics, automation, and patient solutions using our healthcare AI stocks.

- Target companies priced below their true worth and set yourself up for potential gains by applying our trusted approach for spotting undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:YMM

Full Truck Alliance

Operates a digital freight platform that connects shippers with truckers to facilitate shipments across distance ranges, cargo weights, and types in the People’s Republic of China and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives