- United States

- /

- Transportation

- /

- NYSE:XPO

XPO (XPO) Valuation: Assessing Growth Potential After Earnings and Strong AI-Driven Margin Gains

Reviewed by Simply Wall St

XPO (XPO) just released its quarterly results, showing a 10% increase in adjusted operating income in the North American less-than-truckload segment despite a tough freight market. The company’s ongoing focus on AI investment appears to be driving results.

See our latest analysis for XPO.

XPO shares recently popped over 5% in a single day on the back of fresh earnings and upbeat sentiment, but the one-year total shareholder return still sits at -11%, reflecting a year of shifting momentum after several bullish runs. The bigger picture shows that XPO has delivered an extraordinary 252% total shareholder return over three years, rewarding investors with serious long-term growth even as near-term volatility continues to spark attention.

If you’re interested in spotting other movers with strong long-term track records, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With XPO’s fundamentals showing resilience and analysts raising price targets, investors must decide whether today’s valuation offers real upside or if the market has already factored in the company’s future growth trajectory.

Most Popular Narrative: 10.8% Undervalued

The most popular narrative values XPO at $148.63, which is over 10% higher than its last close of $132.53. This suggests the market may be underestimating near-term business momentum. The central thesis is that recent margin expansion and productivity gains, coupled with bullish forecasts, support a future value proposition that is not fully reflected in today’s price.

XPO's ongoing investments in AI-powered optimization and proprietary technology are driving measurable productivity gains, even in a weak freight market, by reducing linehaul miles, improving labor efficiency, and cutting maintenance costs. As industry shipping volumes recover and these technology benefits compound, this should drive sustained margin expansion and higher net income.

Want to know what’s fueling this upbeat view? Expect aggressive growth forecasts on earnings, revenue, and margins. There is a valuation twist involving a future profit multiple that even outpaces the industry average. Which financial leaps are behind this price target? Your answer is just a click away.

Result: Fair Value of $148.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight market weakness or rising labor costs could still pressure XPO’s margins and challenge even the most optimistic outlooks for growth.

Find out about the key risks to this XPO narrative.

Another View: Is the Market Already Pricing in Growth?

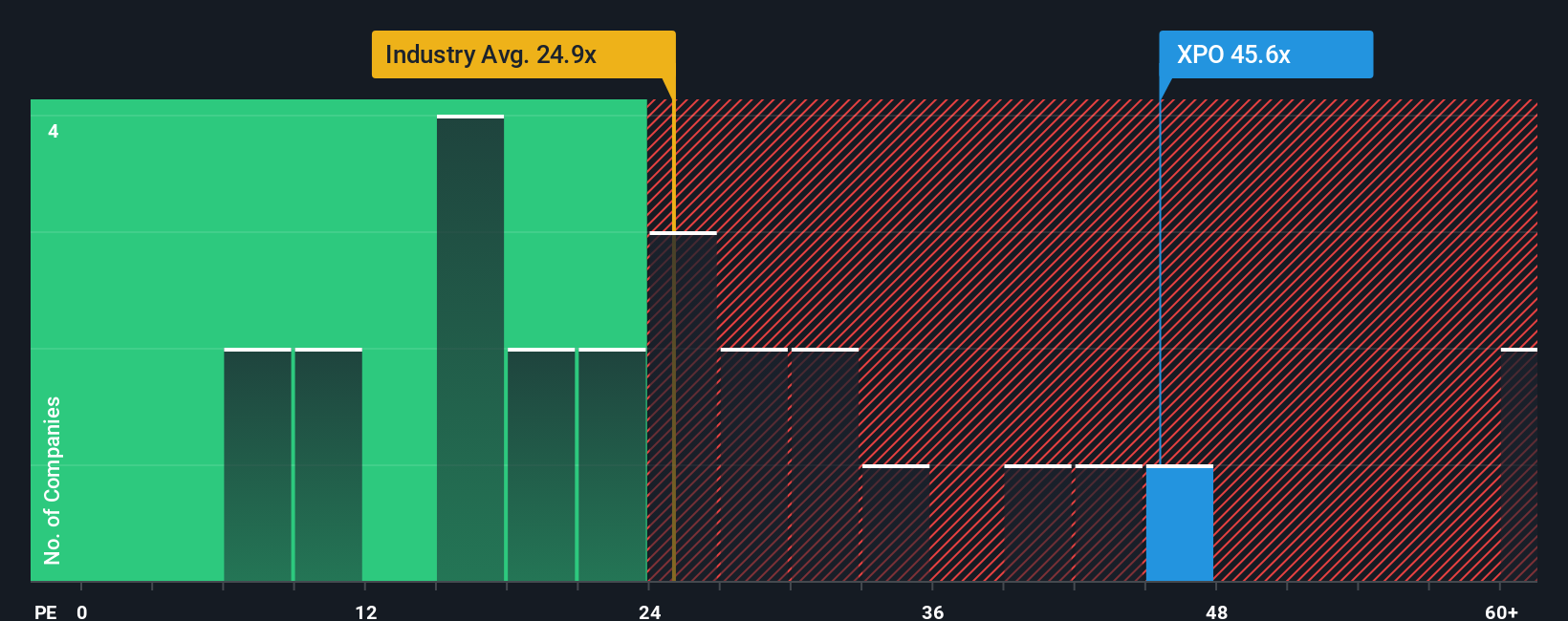

Looking from a different angle, XPO currently trades at a price-to-earnings ratio of 46.9x. That is not just higher than the US Transportation industry average of 25x, but also well above its peers at 28.8x, and over double our calculated fair ratio of 19.2x. This large premium raises the question: are investors taking on extra risk by paying too much for future growth that might not fully materialize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPO Narrative

Feel free to take a closer look at the numbers and shape a narrative that matches your own research and convictions. After all, building your perspective takes just a few minutes. Do it your way

A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on the next big opportunity. Widen your horizons now; missing out means leaving potential gains on the table.

- Catch explosive price gains by targeting undervalued gems. Spot possibilities with these 924 undervalued stocks based on cash flows that others might overlook.

- Benefit from high-yielding portfolios by finding standout picks offering solid income via these 17 dividend stocks with yields > 3% with yields above 3%.

- Capitalize on the AI surge by seizing early advantage with these 25 AI penny stocks leading breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives