- United States

- /

- Transportation

- /

- NYSE:XPO

AI Investments and Resilient Results Could Be a Game Changer for XPO (XPO)

Reviewed by Sasha Jovanovic

- XPO Inc. reported a strong third-quarter performance, with adjusted operating income in its North American LTL segment rising 10% despite difficult freight conditions, while also advancing its investments in artificial intelligence to improve productivity.

- A noteworthy takeaway is that these AI initiatives have given XPO a tangible operational edge, drawing positive attention from industry analysts.

- We'll explore how XPO's enhanced focus on AI-driven productivity changes the outlook for its investment narrative moving forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

XPO Investment Narrative Recap

For shareholders, the central investment case in XPO centers on the company's ability to offset industry volatility through meaningful improvements in operational efficiency, particularly with its investments in artificial intelligence. The recent strong Q3 results affirmed XPO’s progress in this area, but ongoing weakness in tonnage and persistent exposure to cyclical freight markets remain the most influential catalysts and risks in the short term; the AI gains haven’t fully neutralized these factors, so the balance between opportunity and challenge is largely unchanged for now. Of the company's recent updates, the October share repurchase program stands out as the most relevant: XPO bought back US$50 million worth of stock in Q3, reflecting the company’s continued commitment to returning capital to shareholders and potentially supporting the share price during broader industry headwinds. It’s a sign that XPO is acting on financial flexibility, while still demonstrating discipline in capital allocation as it navigates freight market challenges. However, despite these positive developments, investors should keep a close eye on a pressure point that could still impact results in the quarters ahead...

Read the full narrative on XPO (it's free!)

XPO's outlook anticipates $9.2 billion in revenue and $661.0 million in earnings by 2028. This reflects a 4.7% annual revenue growth rate and an earnings increase of $316.0 million from the current $345.0 million.

Uncover how XPO's forecasts yield a $148.62 fair value, a 12% upside to its current price.

Exploring Other Perspectives

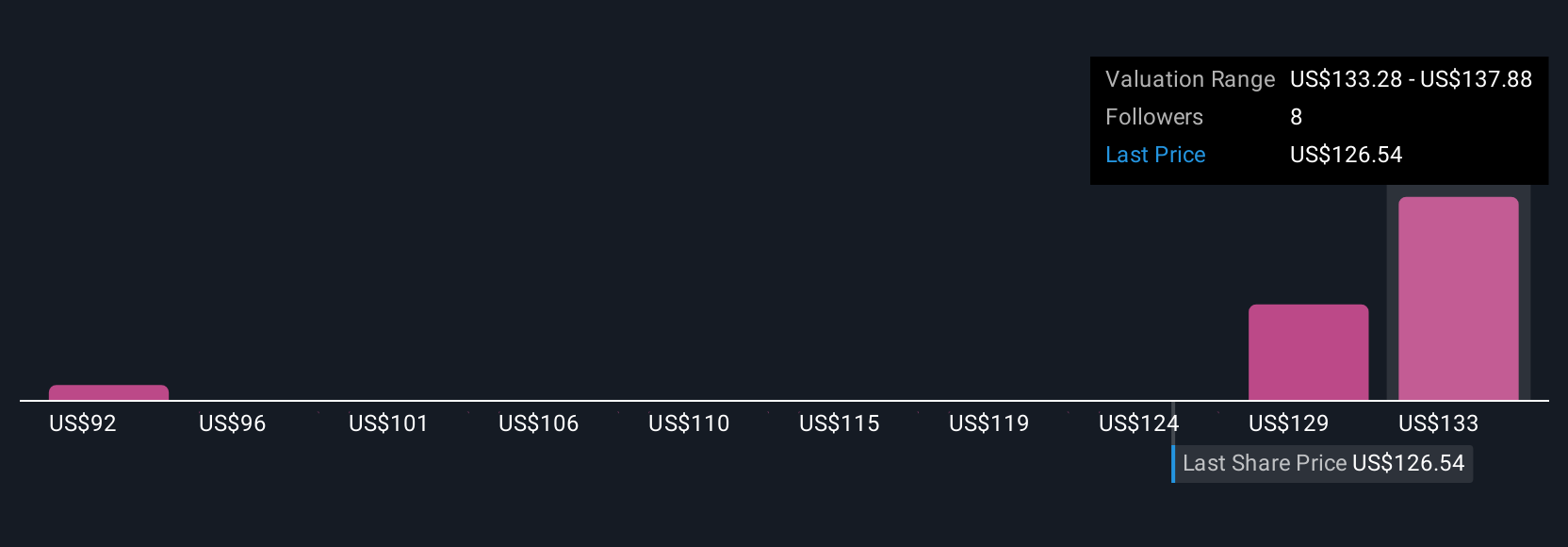

Three Community members gave fair value targets for XPO ranging from US$91.89 to US$148.63, reflecting varied outlooks and approaches. With these contrasting views, it becomes even more important to consider how XPO’s AI-powered productivity initiatives could affect future operating margins and competitive positioning.

Explore 3 other fair value estimates on XPO - why the stock might be worth as much as 12% more than the current price!

Build Your Own XPO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free XPO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPO's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives