- United States

- /

- Logistics

- /

- NYSE:UPS

Is There Now an Opportunity in UPS After Announcing Expanded Amazon Delivery Partnership?

Reviewed by Bailey Pemberton

Thinking about what to do with United Parcel Service stock? You are not alone. With shipping and logistics at the heart of global commerce, UPS is a familiar name for investors, but the recent price action might have you wondering what is really next. The stock has seen a modest 3.7% bump in the last week, and is up 1.7% over the past month, which could make you optimistic that sentiment is turning. Still, the big picture tells a different story, as UPS shares remain down nearly 30% this year and have lost almost 40% over the past five years. These numbers hint that investors are reassessing expectations, perhaps due to evolving freight volumes, shifting market dynamics, or changes in global demand for shipping services.

Yet where things get interesting is in the valuation story. On a scale designed to highlight undervalued opportunities, UPS scores a 5 out of 6, meaning it checks the box for value in five of the six key categories analysts look at. This high score suggests that the market may be overlooking some of the stock’s underlying strengths, even as price performance has lagged.

So, what does this valuation score really mean, and how does it stack up against other ways of sizing up a stock? Let’s break down the different valuation tools analysts use to weigh a company like UPS, and keep reading, because the best way to cut through the noise and truly measure value might surprise you.

Why United Parcel Service is lagging behind its peers

Approach 1: United Parcel Service Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic worth by projecting its future cash flows and discounting them back to their present value. This method is based on the idea that a business is only as valuable as the future cash it can generate, adjusted for the time value of money.

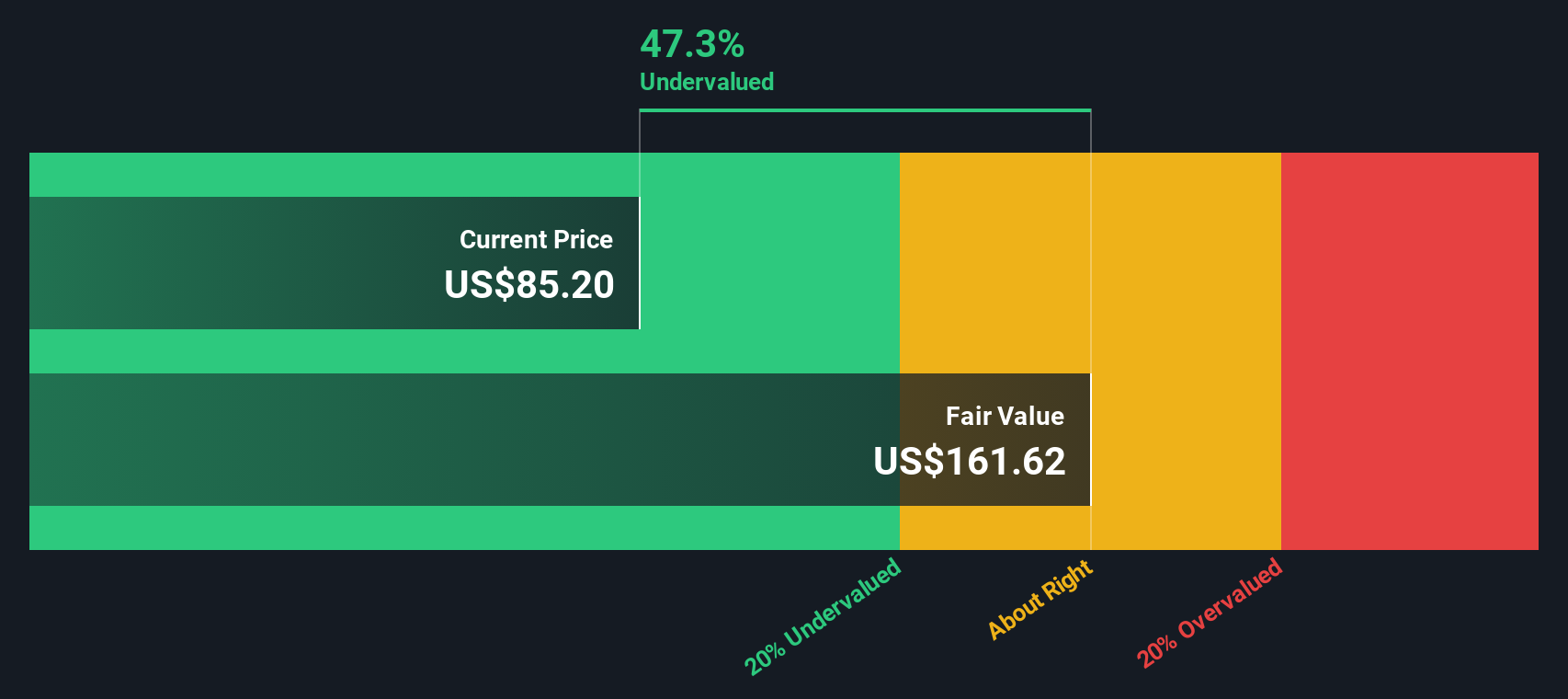

For United Parcel Service, analysts project Free Cash Flow (FCF) going forward, starting with the latest trailing twelve months FCF of $2.75 Billion. Looking ahead, analyst estimates suggest that FCF could reach approximately $7.05 Billion by 2029. The first five years rely on analyst input, and the further projections to 2035 use modeling assumptions by Simply Wall St, which extrapolate growth trends.

The result of these cash flow projections is an intrinsic fair value of $163.09 per share for UPS stock. With the model’s implied discount at 46.8%, DCF analysis indicates the shares may be significantly undervalued compared to their current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parcel Service is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United Parcel Service Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like United Parcel Service because it quickly shows how much investors are willing to pay for each dollar of earnings. The PE ratio is especially useful when evaluating established businesses with a track record of profits, as it reflects both current results and future growth expectations.

It's important to remember that what counts as a "normal" or "fair" PE ratio depends on how quickly a company's earnings are expected to grow and how risky its business is. Companies with higher growth prospects or lower perceived risk tend to command higher PE ratios, while slower-growing or riskier businesses usually trade at lower multiples.

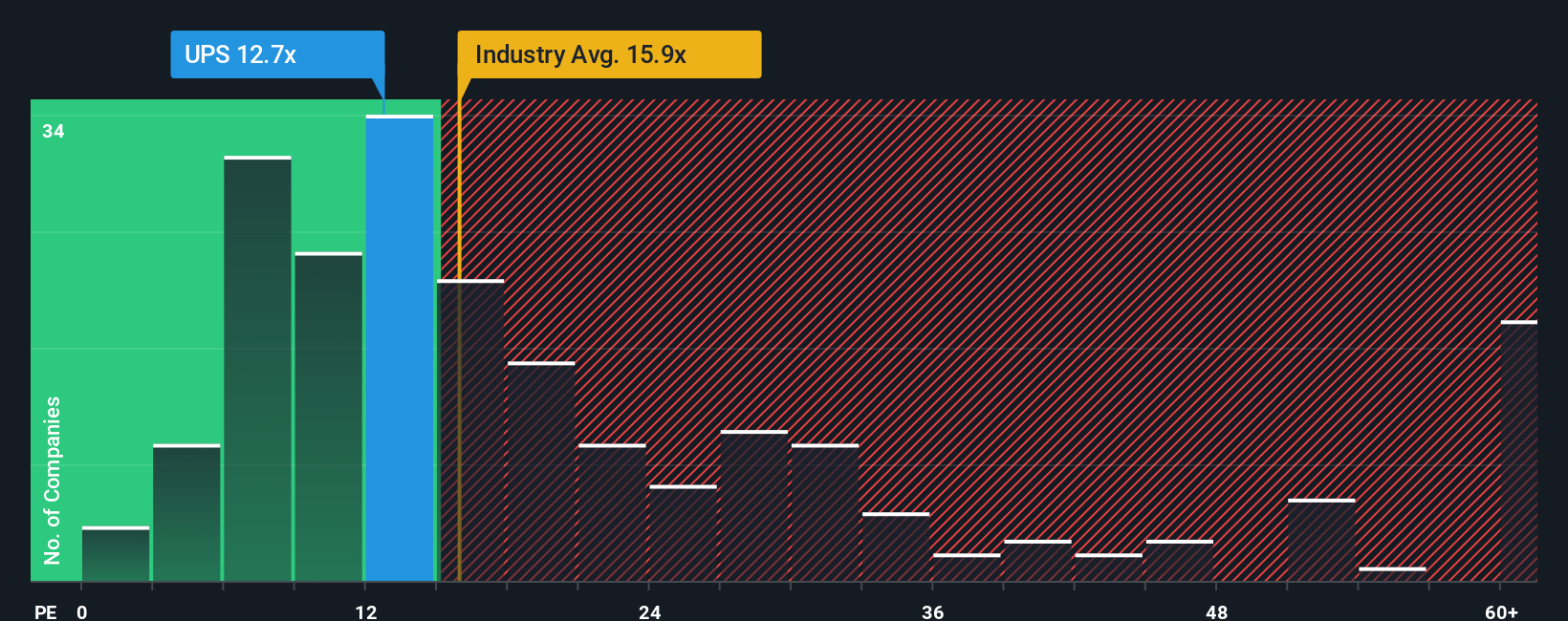

United Parcel Service’s current PE stands at 12.8x, which is below the logistics industry average of 16.0x and also falls short of peer companies averaging 19.0x. At first glance, this discounted multiple might raise eyebrows for value investors searching for bargains, but context matters.

This is where Simply Wall St’s proprietary Fair Ratio comes in. Unlike a straight industry or peer comparison, the Fair Ratio reflects what the PE “should” be for UPS by weighing important factors such as earnings growth outlook, profit margins, company size, and perceived risk. UPS’s Fair Ratio is 17.2x, noticeably higher than its current multiple. This indicates the stock may have more value than the market is crediting. Because the Fair Ratio incorporates the full picture of UPS’s business quality and prospects, it is a more reliable benchmark for investors making decisions today.

Comparing the Fair Ratio to UPS’s actual PE, it’s clear that the shares appear attractively valued based on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Parcel Service Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is Simply Wall St’s easy, dynamic method for investors to connect the story they see unfolding for a company, like UPS, with concrete numbers such as their own fair value and forecasts for revenue, profit, and margins.

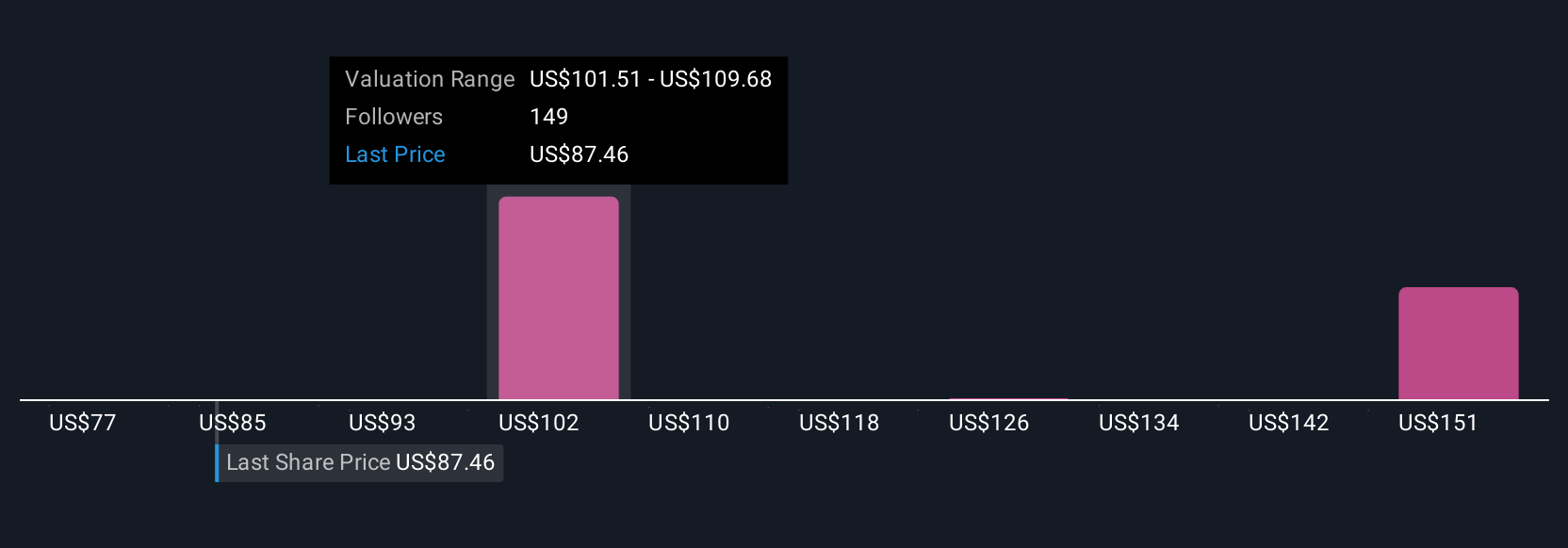

By framing your investment thesis as a Narrative, you are not just looking at ratios or past price changes. Instead, you are tying the business’s real-world strategy and risks directly to forward-looking financial estimates, which immediately produces a fair value tailored to your view. Narratives are accessible in the Community page used by millions of investors, making it simple to build or compare perspectives. Whether you think UPS will face headwinds (with a fair value near $75), capitalize decisively on automation and global growth (with a fair value closer to $133), or land somewhere in between, Narratives can support your analysis.

Because Narratives update automatically with new news, earnings, or market changes, they help investors easily sense-check their assumptions, see where they stand versus both consensus and optimism, and make buy or sell decisions by comparing their fair value to the current market price, all in one place.

Do you think there's more to the story for United Parcel Service? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives