- United States

- /

- Logistics

- /

- NYSE:UPS

A Fresh Look at UPS (UPS) Valuation Following Recent Share Price Declines

Reviewed by Simply Wall St

Most Popular Narrative: 19.2% Undervalued

United Parcel Service is currently considered undervalued by the most widely followed narrative, with shares trading well below the estimated fair value. The dominant valuation thesis is built on projected earnings improvement, cost savings, and operational transformation.

UPS anticipates $3.5 billion in annual cost reductions for 2025 through variable, semi-variable, and fixed cost savings, positioned to exceed the revenue loss from Amazon. This should improve profitability and free cash flow.

This isn’t your average logistics story. There is a bold earnings shakeup happening behind the scenes, driven by a sweeping network overhaul and financial projections that could reset expectations for UPS. Wondering which surprising assumptions unlock the path to that higher fair value? You will want to see the numbers and the strategic moves that analysts are betting on.

Result: Fair Value of $104.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing global trade uncertainties and UPS's significant reduction of Amazon shipping volumes could challenge optimism about its future profitability and growth.

Find out about the key risks to this United Parcel Service narrative.Another View: SWS DCF Model Weighs In

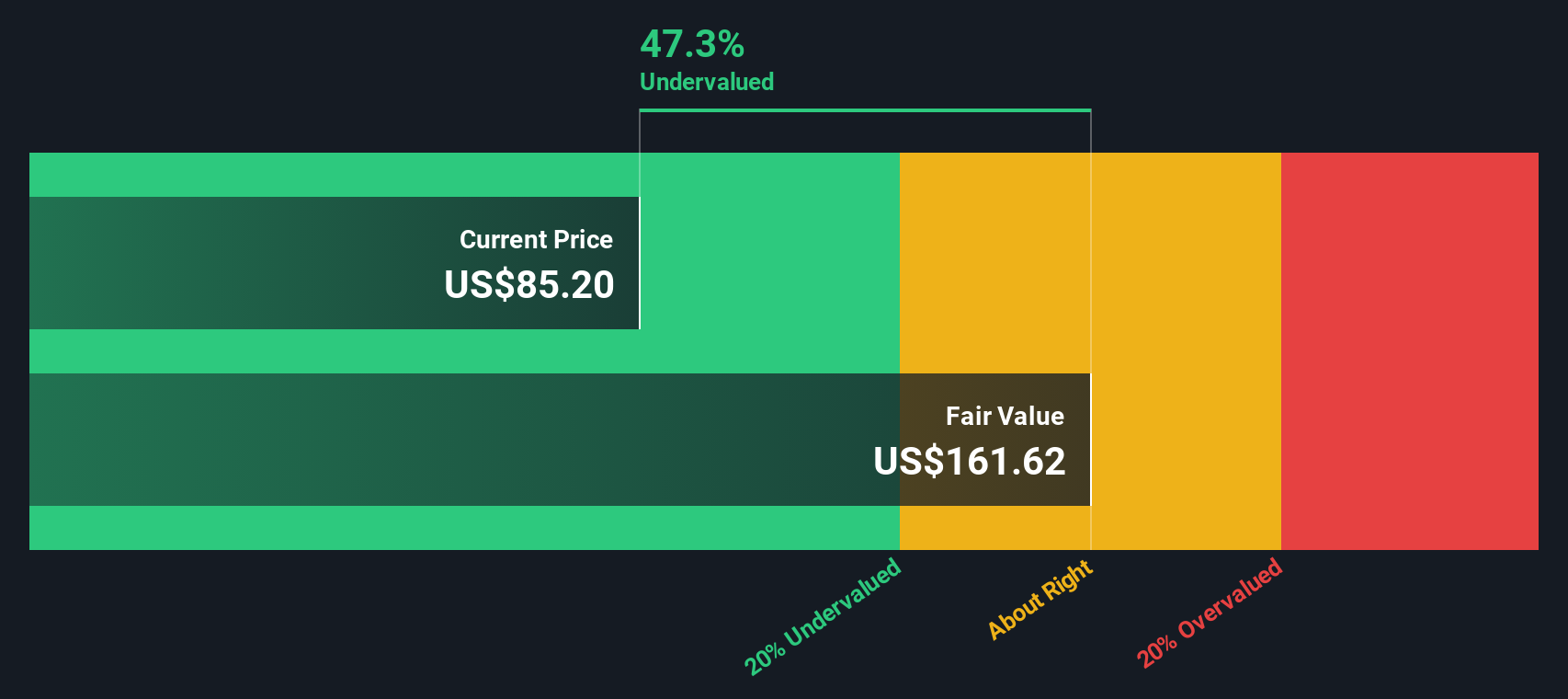

Looking at things from a different angle, our discounted cash flow (DCF) model also finds UPS shares undervalued. In fact, the margin appears wider compared to typical analyst estimates. Do fundamentals suggest more upside than the consensus?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own United Parcel Service Narrative

If you think the story could unfold differently or want to dive deep into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your United Parcel Service research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Sharpen your portfolio strategy by going beyond just one stock. The market is packed with fresh opportunity if you know where to look. Do not let the best ideas pass you by. Give yourself an edge by using these powerful tools to find tomorrow’s market leaders today:

- Target steady income streams and assess market resilience by tapping into dividend stocks with yields > 3% for stocks boasting yields above 3%.

- Ride the wave of advanced innovation as you analyze AI penny stocks focused on transformative artificial intelligence breakthroughs.

- Uncover promising companies currently trading for less than their future potential using the undervalued stocks based on cash flows to spot value-driven opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives