- United States

- /

- Transportation

- /

- NYSE:UHAL

U-Haul Holding (NYSE:UHAL): Evaluating Valuation After Record Revenue Meets Cost Pressures in Q2 Results

Reviewed by Simply Wall St

U-Haul Holding (NYSE:UHAL) just announced record-breaking second quarter revenue, supported by further expansion of its dealer network. However, higher costs and depreciation contributed to a noticeable decline in net income for the period.

See our latest analysis for U-Haul Holding.

U-Haul Holding’s recent quarterly record for revenue came on the heels of opening a major new regional repair facility and closing a long-running shop as part of network realignment. Despite these efforts, the stock’s share price has steadily drifted lower, with a year-to-date share price return of -23% and a steep 12-month total shareholder return of -29%. This signals that investor momentum is still fading as cost pressures weigh on profitability and near-term optimism remains muted for now. Its five-year total return remains meaningfully positive.

If you’re tracking transportation or moving-industry trends, now’s the perfect chance to broaden your watchlist and discover fast growing stocks with high insider ownership

With the stock down sharply even as revenue reaches new highs, the key question now is whether U-Haul Holding is trading at a discount or if the market is already factoring in future recovery. Could there be a genuine buying opportunity here?

Most Popular Narrative: 40.9% Undervalued

The narrative consensus suggests U-Haul Holding's fair value is significantly above recent trading levels, setting up a debate about whether the market is mispricing the company's future prospects.

The company is focusing on adding self-storage units and expanding its self-storage footprint. With 8.5 million new square feet being developed, self-storage revenue is anticipated to continue growing, boosting overall revenue and earnings.

Want to know what drives this bold price target? One major building block is relentless expansion in high-growth business lines and future margins few would expect. Missing how these projections stack up to the company's history, or why analysts believe these numbers could become reality? The answers behind U-Haul Holding’s re-rating are more surprising than you’d think.

Result: Fair Value of $89.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and ongoing fleet imbalances from supply chain disruptions could still pressure U-Haul’s margins and present challenges to the earnings growth narrative.

Find out about the key risks to this U-Haul Holding narrative.

Another View: Valuation Gaps Widen

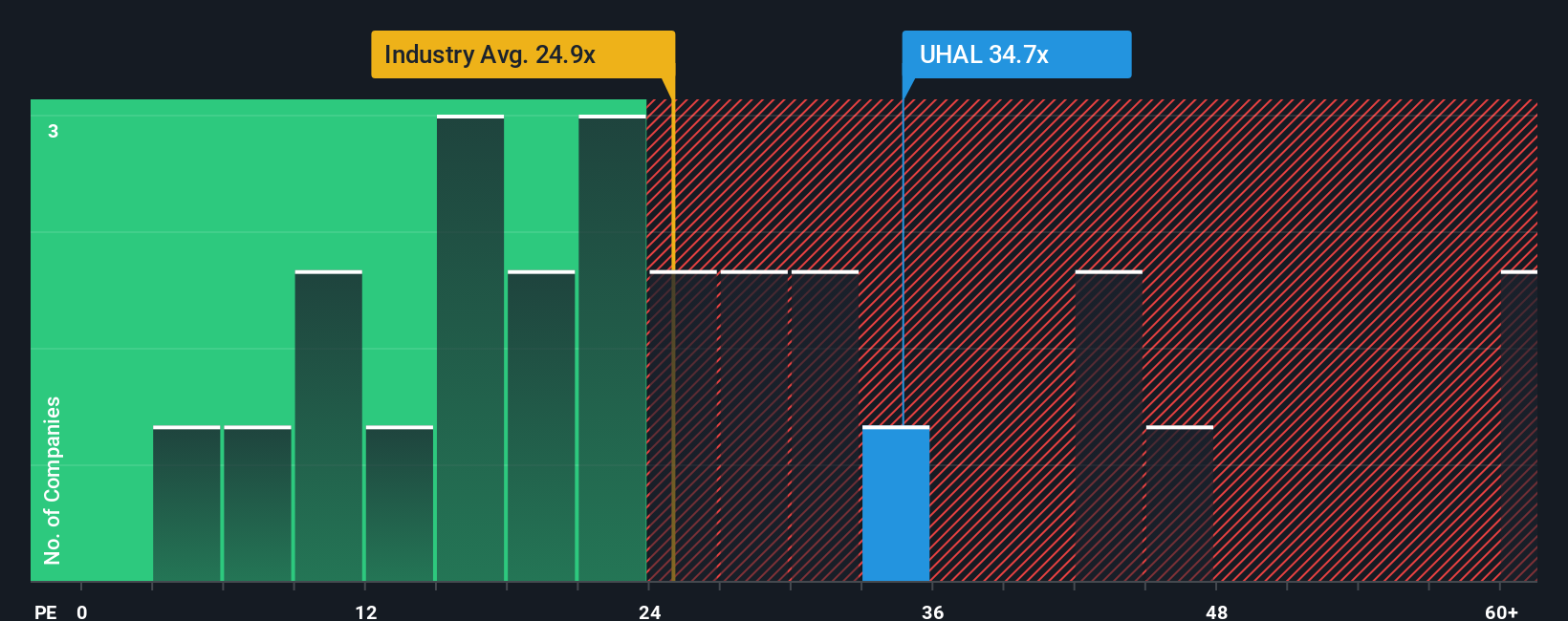

Looking through the lens of price-to-earnings, U-Haul Holding commands a lofty 44.7x, well above both its US Transportation industry average of 27.2x and a peer average of 29.5x. This suggests investors are already pricing in sizable improvement. As a result, there is little room for error if expectations slip. Could this premium signal risk rather than hidden value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U-Haul Holding Narrative

If you have a different take on the story, or want your own analysis, you can dive into the data and build your narrative in just a few minutes. Do it your way

A great starting point for your U-Haul Holding research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that broadening their horizons can uncover opportunities others miss, so do not stop at just U-Haul Holding. The right next move might be only a click away. Check out these powerful strategies to inspire your next selection:

- Uncover income potential with higher yields by checking out these 17 dividend stocks with yields > 3% that consistently reward shareholders.

- Tap into the frontier of technology by seeing these 28 quantum computing stocks blazing trails in quantum computing innovation and commercial breakthroughs.

- Catch early-stage momentum and explosive growth potential through these 3586 penny stocks with strong financials reshaping entire industries with their disruptive business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UHAL

U-Haul Holding

Operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives