- United States

- /

- Transportation

- /

- NYSE:UBER

Uber's (NYSE:UBER) Diversification May Provide Some Comfort on the Road to Profitability

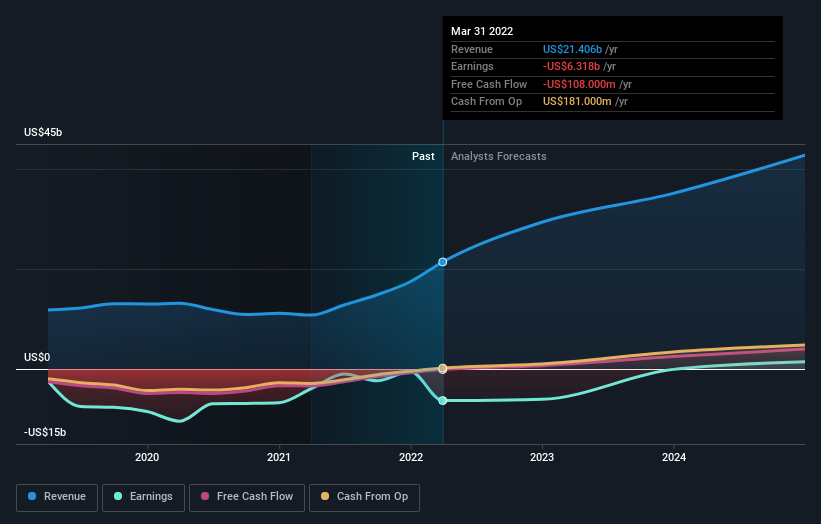

Uber Technologies, Inc. (NYSE: UBER) released the latest earnings report, delivering growth in mobility booking and total revenue. Yet, net loss widened to almost US$6b, owing to equity investments and significant stock-based compensation.

Despite surprise in 3 out of 5 latest earnings reports, the stock has been steadily declining, losing over 55% from its peak.

View our latest analysis for Uber Technologies

First-quarter 2022 results:

- US$3.04 loss per share (down from US$0.058 loss in 1Q 2021).

- Revenue: US$6.85b (up 136% from 1Q 2021).

- Net loss: US$5.93b (loss widened US$5.82b from 1Q 2021).

Revenue exceeded analyst estimates by 12%. Earnings per share (EPS) missed analyst estimates by 972%.

Performance per segment:

- Mobility: US$10.7b (+58% Y/Y)

- Delivery: US$13.9b (+12% Y/Y)

- Freight: US$1.8b

Over the next year, revenue is forecast to grow 44%, compared to a 16% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have increased by 62% per year, but its share price has fallen by 14% per year, which means it is significantly lagging behind earnings.

Can we expect growth from Uber Technologies?

Future outlook is an important aspect when you’re buying a stock, especially if you are an investor looking for growth in your portfolio. Uber Technologies' earnings are expected to increase by 27% in the upcoming year, indicating an optimistic future ahead.

Yet, looking at the earnings projection, it is likely that the company is at least 2 years away from reaching positive numbers.

What does this mean for investors?

Ride-hailing companies have been on a prolonged decline, yet Uber fared much better than its main rival Lyft (NASDAQ: LYFT), which dropped over 30% in the last week alone. Uber owes this to its successful diversification efforts, as its food delivery division (Uber Eats) remains the biggest segment, showing surprising post-pandemic resilience.

While losing US$3 per share at the share price of US$30 looks concerning, one has to be aware this is due to unrealized losses. The Securities Exchange Commission (SEC) now requires this from publicly listed companies, which often results in some spectacular numbers. The best example was the Amazon earnings in February 2022, beating the estimate by over 660% due to unrealized gains on Rivian investment. Reflecting on this situation, Uber CFO Nelson Chai stated that the company has the liquidity to sit on those positions and wait for the situation to improve.

Although reporting unrealized losses from equity investments isn’t the best outlook for an unprofitable company, we’re more concerned about US$359m of stock-based compensation, which is excluded from adjusted EBITDA. Even for a US$50b company, this is a significant number that continues to weigh on the company. Despite all the accounting smoke and mirrors, we believe that stock options are compensation and thus an expense for the company – just like Warren Buffett explained 30 years ago.

If you want to dive deeper into Uber Technologies, you'd also look into what risks it is currently facing. At Simply Wall St, we found 2 warning signs for Uber Technologies, and we think they deserve your attention.

If you are no longer interested in Uber Technologies, you can use our free platform to see our list of over 50 other stocks with high growth potential.

If you're looking to trade Uber Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives