- United States

- /

- Transportation

- /

- NYSE:UBER

Uber (UBER): Assessing Valuation After Strong Year‑to‑Date Share Price Run

Reviewed by Simply Wall St

Uber Technologies (UBER) has been grinding higher this week, with shares edging above 92 dollars as investors reassess what its strong year to date run means for future returns at today’s valuation.

See our latest analysis for Uber Technologies.

That latest push above 92 dollars extends a powerful run, with a roughly 47 percent year to date share price return and a more than tripling three year total shareholder return. This suggests momentum is still broadly intact even after recent volatility.

If Uber’s move has you thinking about where growth and innovation might show up next, it is a good time to explore high growth tech and AI stocks for more ideas.

With the stock near record highs, double digit revenue growth, and analysts still seeing upside, the key question is whether Uber remains undervalued on its transformed fundamentals or if the market is already pricing in years of growth.

Most Popular Narrative: 23.4% Overvalued

With Uber closing at 92.57 dollars versus a narrative fair value of 75 dollars, the valuation gap is already front and center for investors.

Methodology: Future Earnings/P-E Projection (growth stock)

• 2030 Revenue Projection: $65-70B

• 2030 EBITDA: $14-15B (22% margin with autonomous vehicle benefits)

• Fair Value Range: $90-135B market cap

• Current Market Cap: $192B (significantly overvalued)

• Target Entry Price: $65-75 per share (vs current ~$95)

According to YasserSakuragi, this narrative leans on aggressive long term revenue scaling, expanding margins and a future earnings multiple that assumes sustained dominance. Curious which precise profit and valuation assumptions are doing the heavy lifting here, and how they connect back to that lower entry range, the full story unpacks every step behind that 75 dollar fair value.

Result: Fair Value of $75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if autonomous adoption lags or competitive pricing pressures margins, Uber’s growth and earnings power could surpass the conservative assumptions in this overvaluation view.

Find out about the key risks to this Uber Technologies narrative.

Another View: Earnings Multiple Signals Value

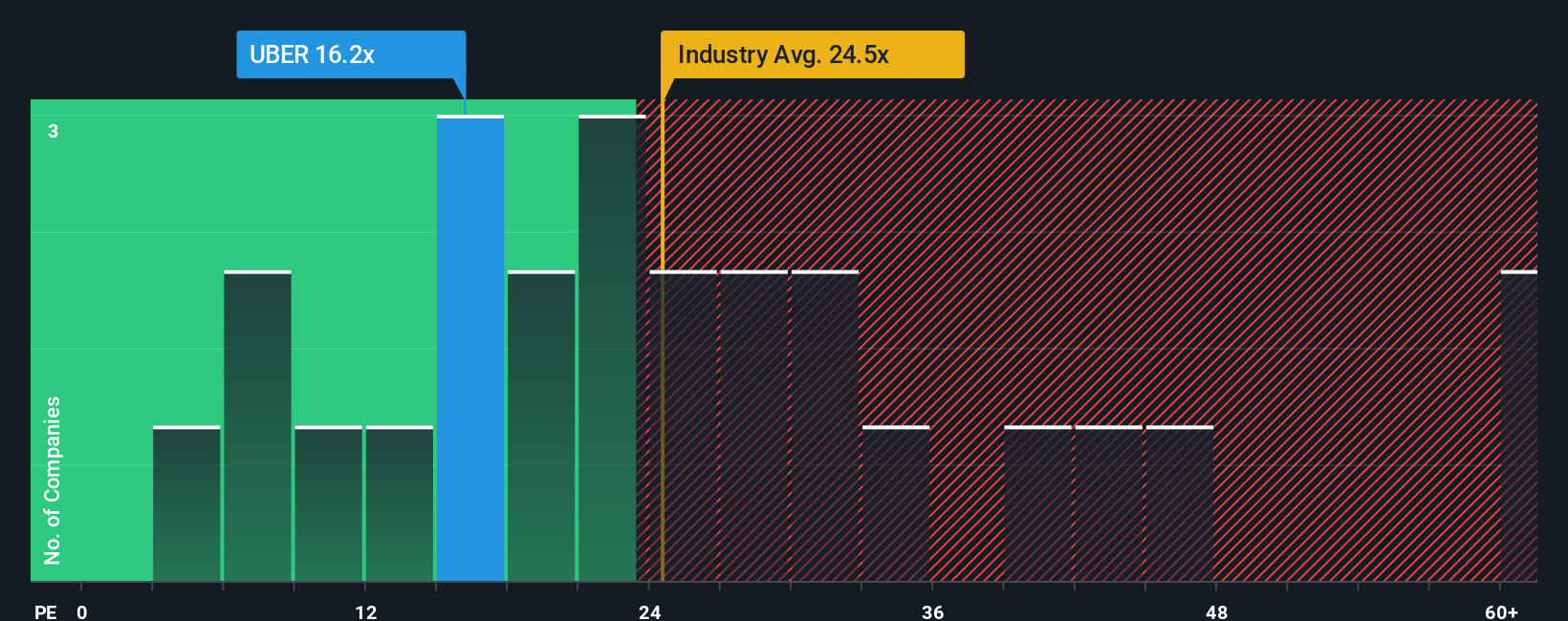

While the narrative fair value flags Uber as overvalued, our valuation using its earnings multiple paints a different picture. At 11.6 times earnings compared with 31.1 times for the US Transportation industry and 68.9 times for peers, plus a fair ratio of 14.4 times, the gap hints at potential upside, not just downside risk. Which story will the market eventually believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Uber Technologies Narrative

If you see Uber’s story differently or want to dig into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Uber Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener now to uncover focused, data driven stock ideas tailored to your exact strategy.

- Capture potential mispricing by targeting companies our models identify as undervalued based on future cash flows, starting with these 907 undervalued stocks based on cash flows.

- Strengthen your passive income plan by focusing on consistent dividend payers through these 15 dividend stocks with yields > 3%.

- Explore structural trends in digital assets by reviewing listed plays linked to blockchain and token adoption via these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026