- United States

- /

- Transportation

- /

- NYSE:UBER

Uber (UBER): Assessing Valuation After First Driverless Robotaxi Launch and Global Autonomous Expansion

Reviewed by Simply Wall St

Uber Technologies (NYSE:UBER) is pushing into new territory this week, rolling out fully driverless Robotaxi operations in Abu Dhabi with WeRide. This milestone marks Uber’s first autonomous service deployment in the Middle East and outside the US.

See our latest analysis for Uber Technologies.

Uber’s push into autonomous mobility comes at a time of notable share price momentum, with a robust year-to-date share price return of 37% and a three-year total shareholder return of 213%. While recent weeks saw some volatility, continued expansion into new markets and categories hints at building growth potential for long-term investors.

If these bold moves in tech-driven delivery got your attention, now is a great time to see the full list of high-growth tech and AI stocks. See the full list for free.

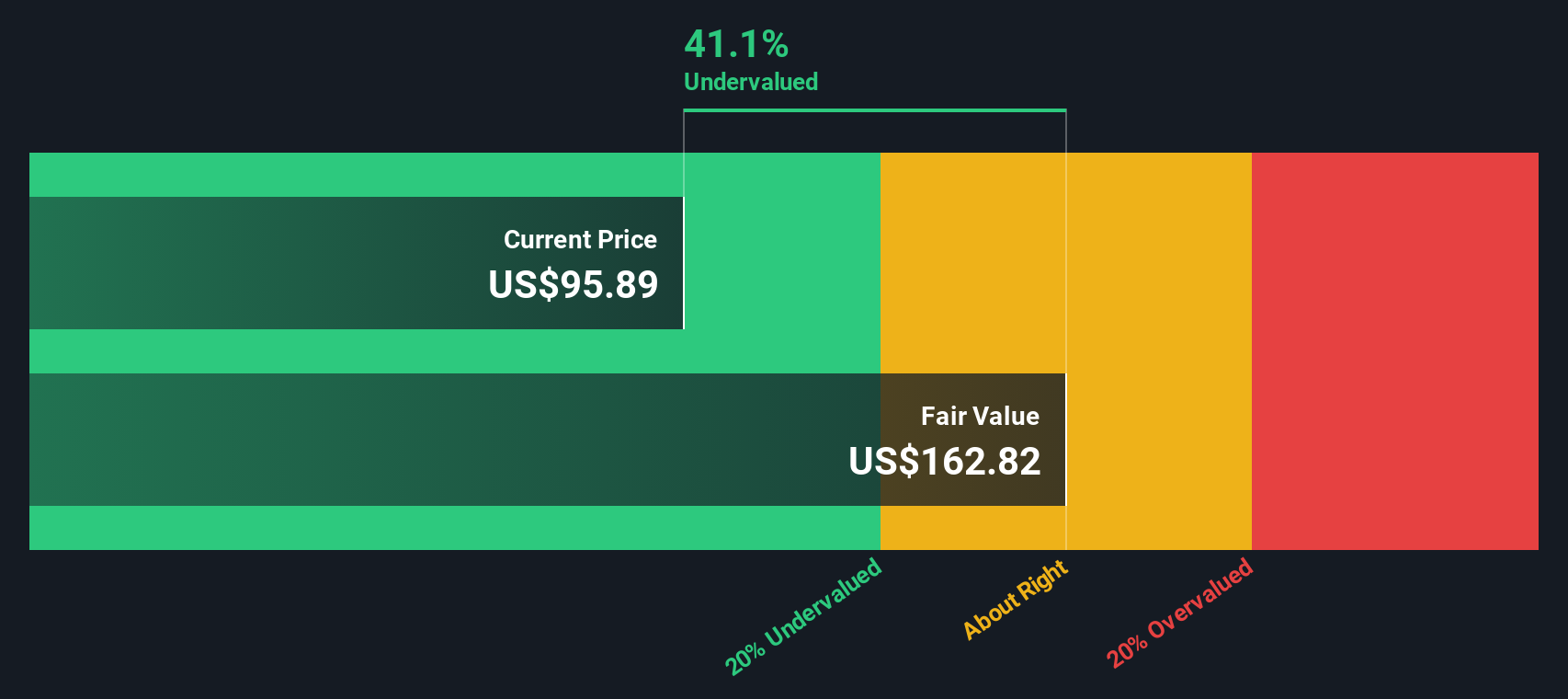

With a share price still trading at around a 28% discount to average analyst price targets, while also showing strong recent gains, the big question is whether Uber remains undervalued or if the market has already priced in the company’s future growth trajectory.

Most Popular Narrative: 15% Overvalued

According to YasserSakuragi, Uber's last close price is running well ahead of what the narrative considers a reasonable entry point, based on calculations that factor in robust near-term momentum and expansion. The narrative values Uber significantly below its current trading range, a stance supported by future projections for revenue and profit growth, plus profit margin expectations over the next several years.

2030 Revenue Projection: $65-70B. 2030 EBITDA: $14-15B (22% margin with autonomous vehicle benefits). Fair Value Range: $90-135B market cap. Current Market Cap: $192B (significantly overvalued).

Curious what assumptions drive this valuation gap? There's a surprising interplay of ambitious revenue growth, operating margins, and the expected impact of autonomous tech. Find out which bold forecasts set this narrative apart, and whether they'd change how you value Uber.

Result: Fair Value of $75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger than expected advances in autonomous technology or a surprising acceleration in profitability could quickly shift the valuation outlook for Uber.

Find out about the key risks to this Uber Technologies narrative.

Another View: SWS DCF Model Signals Undervaluation

While many investors see Uber as significantly overvalued on a near-term growth basis, our SWS DCF model comes to a different conclusion. This approach suggests Uber shares are actually trading well below intrinsic value, with the current price nearly 49% beneath the fair value estimate. Could this sharply different perspective mean the market is discounting Uber’s long-term potential too heavily, or is it missing risks the narrative spots?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Uber Technologies Narrative

If you want to put these numbers and assumptions to the test yourself, you can dive into the data and build your own view in just a few minutes. Do it your way

A great starting point for your Uber Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make the most of emerging opportunities before the crowd by using the Simply Wall Street Screener. You could be missing out on the next breakout stock if you don’t check these out:

- Tap into fast-growing healthcare breakthroughs by examining these 30 healthcare AI stocks, which are transforming patient care with artificial intelligence.

- Boost your portfolio’s earning power by reviewing these 14 dividend stocks with yields > 3%, which deliver higher yields and steady income in any market climate.

- Get ahead in tech’s latest frontier and see these 28 quantum computing stocks, unlocking advancements in computing speed, security, and real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026