- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (UBER): Is the Recent Momentum Justified by Its Valuation?

Reviewed by Kshitija Bhandaru

Uber Technologies (UBER) shares have been generating interest as investors look for signs of momentum in the ride-hailing giant’s performance. The stock’s recent moves offer clues about changing market sentiment and broader sector trends.

See our latest analysis for Uber Technologies.

Uber’s latest share price of $96.60 reflects a company that, while not seeing wild short-term swings, has built steady momentum, with a one-year total shareholder return of nearly 30%. Recent gains suggest investors are increasingly optimistic about Uber’s growth potential as it navigates evolving industry dynamics.

If Uber’s trajectory has you thinking bigger, now is a prime moment to widen the search and discover fast growing stocks with high insider ownership

But is Uber's current share price a fair reflection of its future earnings, or are investors overlooking an opportunity before further upside is fully recognized in the stock?

Most Popular Narrative: 28.8% Overvalued

At $96.60 per share, Uber trades well above the fair value range laid out in the most followed narrative. This raises eyebrows over whether the recent surge has overshot the business fundamentals.

*"Achieved sustainable profitability with $1.78B net income vs -$654M loss year ago. Cash Generation: Exceptional FCF of $6.9B in 2024, $2.3B in Q1 2025."*

Curious how bold growth forecasts and shifting margins play into this valuation? The real story includes ambitious profit targets and market assumptions. Find out what unique factors drive the fair value calculation and whether Uber can deliver on the high expectations set by this narrative.

Result: Fair Value of $75.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changing regulatory environments or a slowdown in revenue growth could quickly shift this outlook and challenge the current valuation narrative.

Find out about the key risks to this Uber Technologies narrative.

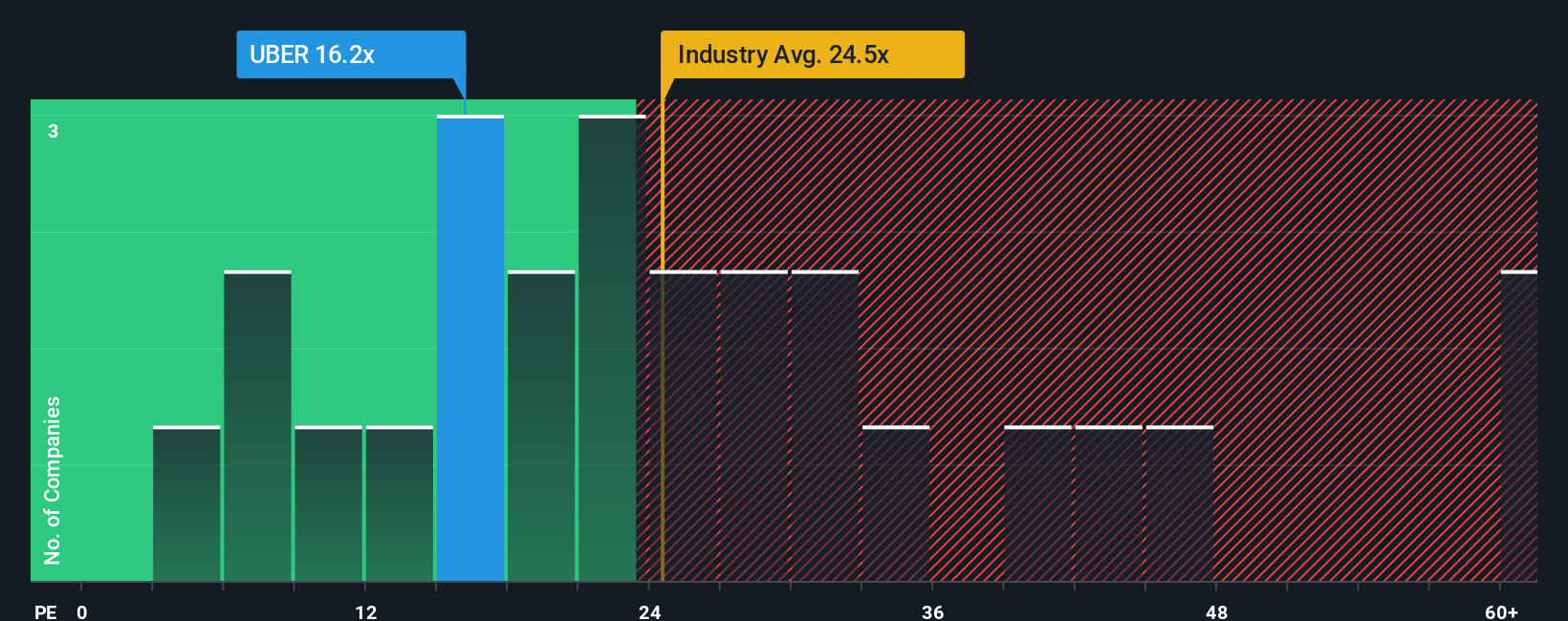

Another View: Strong Value Signals on Earnings Multiple

While the most popular narrative points to Uber being overvalued, a look at its price-to-earnings ratio offers a different perspective. Uber's current ratio of 16x is well below both the US Transportation industry average of 24.1x and the peer average of 39.7x, and is nearly aligned with its fair ratio of 16.8x. This significant gap suggests the market may be underestimating Uber's profitability, potentially leaving room for upside if sentiment shifts or fundamentals outshine expectations. Could investors be under-appreciating the company's earnings strength despite earlier warnings?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Uber Technologies Narrative

If you'd rather form your own conclusions or dig into the numbers yourself, it only takes a few minutes to create your personal narrative and see how your outlook compares. Do it your way

A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on fresh opportunities. Why settle for ordinary returns when you could be ahead of the curve? Don’t let the next breakthrough pass you by; now is the time to find the stocks that set themselves apart.

- Uncover the potential for rapid gains by checking out these 3570 penny stocks with strong financials that are showing exceptional financial resilience and upward momentum.

- Capture tomorrow’s growth now by tapping into these 25 AI penny stocks with standout positions in artificial intelligence, automation, and machine learning.

- Maximize your yield by targeting income-generating companies from these 19 dividend stocks with yields > 3% with dividends above 3% that could strengthen your portfolio’s foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives