- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (UBER): Evaluating Valuation as Serve Robotics Expands Robot Delivery With DoorDash Partnership

Reviewed by Kshitija Bhandaru

Serve Robotics, in which Uber Technologies (UBER) maintains a meaningful stake, has expanded its sidewalk robot delivery rollout by partnering with DoorDash. This move brings fresh competitive energy to the autonomous delivery landscape.

See our latest analysis for Uber Technologies.

Uber Technologies has ridden a wave of momentum this year, with its share price gaining nearly 50% year-to-date as the company doubles down on autonomous delivery and builds strategic partnerships. While the pace of short-term gains has moderated lately, Uber’s multi-year total shareholder return remains exceptional, up over 240% in just three years, underscoring investors' confidence in its growth story as the sector evolves.

Curious about which other companies are innovating at the crossroads of technology and autonomy? You might want to check out our tech and AI stocks screener for more discovery opportunities. See the full list for free.

The question for investors now is whether all this innovation and momentum make Uber undervalued at these levels, or if the market has already priced in years of future growth, leaving little room for upside.

Most Popular Narrative: 25.7% Overvalued

The most popular narrative points to Uber Technologies trading well above its calculated fair value. The last close of $94.25 sits far above the narrative's suggested entry range, flagging a significant disconnect in perceived upside at current levels.

Achieved sustainable profitability with $1.78B net income versus a $654M loss a year ago. Exceptional FCF of $6.9B in 2024 and $2.3B in Q1 2025.

Want to uncover what’s driving this aggressive premium? The key may lie in sky-high margin assumptions and bullish projections that challenge conventional expectations. Curious about the future growth logic that shapes this viewpoint? Find out what sets this narrative apart from the crowd.

Result: Fair Value of $75.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue growth and successful debt management could challenge the overvaluation thesis, potentially pushing investor sentiment in a more optimistic direction.

Find out about the key risks to this Uber Technologies narrative.

Another View: SWS DCF Model Sees a Different Story

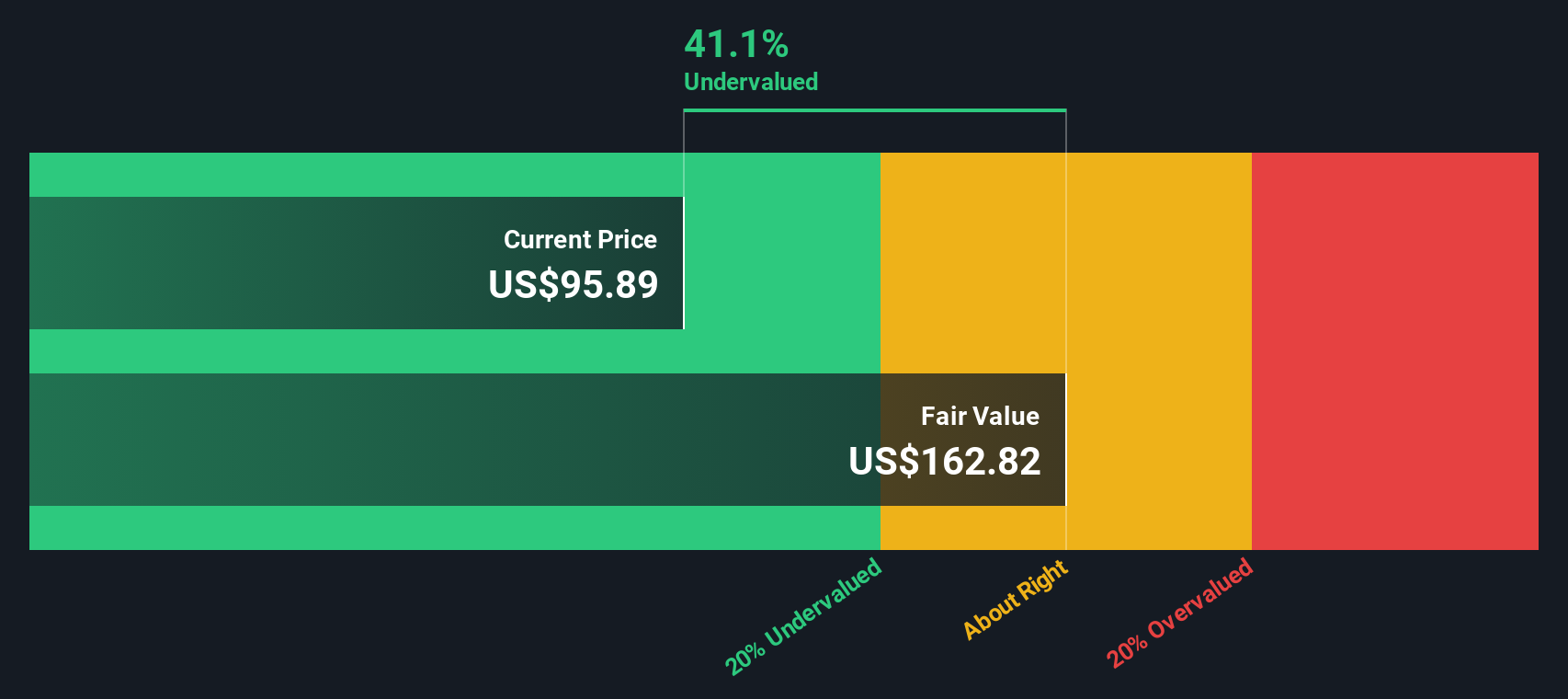

While multiples suggest Uber is trading at a hefty premium, our SWS DCF model paints a dramatically different picture. Uber's shares are 41% below their estimated fair value of $159.93. This sharp contrast raises a new question: are investors missing hidden value, or is the market right to price in caution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Uber Technologies Narrative

If you have your own take or prefer diving into the numbers firsthand, you can craft a personalized view in just a few minutes: Do it your way

A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd by seizing fresh opportunities beyond Uber Technologies. The market is full of untapped potential, and the best plays could be just a click away.

- Capture big yields by scanning for reliable income opportunities among these 18 dividend stocks with yields > 3% paying above 3%.

- Jump into the exciting world of disruptive innovation with top picks among these 25 AI penny stocks that are setting the pace for tomorrow's markets.

- Spot emerging value early by focusing on these 881 undervalued stocks based on cash flows whose fundamentals hint at strong upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

Endeavour Group's Future PE Expected to Climb to 15.51%

A Quality Compounder Marked Down on Overblown Fears

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion