- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (NYSE:UBER) Eyes Blu-Smart Mobility Acquisition For EV Expansion In India

Reviewed by Simply Wall St

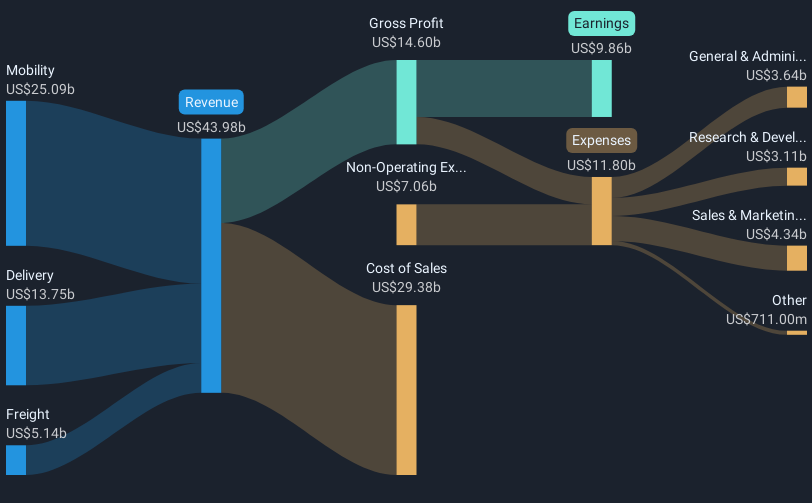

Uber Technologies (NYSE:UBER) has been in the spotlight due to its recent discussions to potentially acquire Blu-Smart Mobility Limited in India, a move that could bolster its presence in the electric vehicle segment. This strategic interest may have contributed to the company's 17% share price increase over the last quarter. In addition to the acquisition talks, Uber's partnerships with companies like HungerRush and FreshDirect, as well as its positive full-year financial results, where revenue and net income saw significant growth, potentially supported investor confidence. Moreover, despite a broadly challenging market, with the Nasdaq and S&P 500 seeing losses, Uber's buyback program and earnings guidance may have also played a role in its performance. The broader market saw tech-related challenges, yet Uber benefited from its industry initiatives which aligned with investor interests in sustainable and innovative services amidst ongoing market fluctuations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past five years, Uber Technologies has delivered a total shareholder return of 219.42%. This robust performance is attributed to factors including impressive profit growth, with earnings increasing significantly each year. In particular, Uber saw a very large boost in earnings this past year, contributing to a healthier net profit margin. Additionally, the company made strategic moves such as the completion of a US$1.25 billion share buyback program, which might have reinforced investor confidence.

Recent partnerships with major clients like FreshDirect and The Home Depot have expanded Uber's service offerings and reinforced its market position. Despite challenges in the broader market, Uber outperformed the US Transportation industry, which saw a 6.6% decline over the past year. This superior relative performance could be indicative of investors' positive outlook on Uber's continued growth and value prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Uber Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives